The quantum computing race is heating up. However, unlike other popular domains in the artificial intelligence (AI) landscape, quantum AI isn't dominated by big-tech darlings such as Nvidia or Palantir Technologies.

Instead, investors have taken a keen liking to more speculative businesses promising to revolutionize the computing industry. Among these companies is IonQ (IONQ 7.46%), which leverages exploratory trapped ion systems to develop its quantum technology.

NYSE: IONQ

Key Data Points

Over the past year, shares of IonQ have skyrocketed. One of the main catalysts behind the company's meteoric rise is the stunning pace at which its revenue is growing. Does IonQ hold the keys to the next breakthrough frontier in the AI realm?

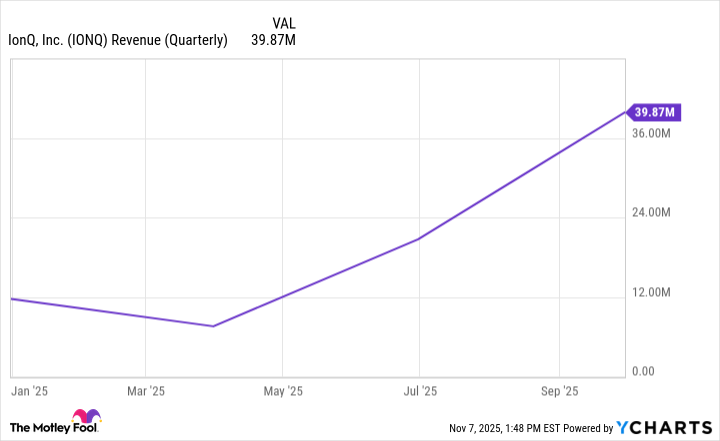

IonQ's revenue is soaring

For the quarter ended Sept. 30, IonQ generated roughly $40 million in revenue. This represented growth of 222% year over year and came in 37% higher than management's previously stated guidance.

IONQ Revenue (Quarterly) data by YCharts.

With so much momentum across the company's top line, investors should be curious about what's fueling this growth. Thankfully, the detailed notes in IonQ's latest 10-Q filing can help uncover the answer.

Image source: Getty Images.

Which companies are IonQ's largest customers?

IonQ doesn't reveal the specific names of its customers, but details in the company's filings still reveal some information. For the nine months ended Sept. 30, three customers accounted for 61% of IonQ's total revenue. Within this cohort, just two of the customers comprised 54% of sales.

Given these figures, it's clear that IonQ is vulnerable to customer concentration risk. Said differently, if any one of these three customers churned, IonQ's revenue could take a nosedive. This leads to another important idea -- how IonQ is trying to diversify its customer base. Over the last year, IonQ completed the following acquisitions:

- Dec. 2024: Acquired Qubitekk for $22 million

- April 2025: Bought a controlling stake (86%) of id Quantique for $116 million

- May 2025: Acquired Lightsynq for $307 million

- Sept. 2025: Acquired Oxford Ionics for $1.6 billion

- July 2025: Acquired Capella Space for $425 million

- Other: In June, IonQ acquired a small marketing intelligence agency for $41 million

Taking this one step further, IonQ reported revenue of $68 million through the first nine months of 2025. In the company's disclosures, management explains that had all of IonQ's acquisitions been closed in January 2024, the pro forma revenue figure would be about $101 million.

This implies that a meaningful portion of IonQ's revenue is coming from the other businesses outlined above -- calling into question the strength of the company's organic-growth profile.

Another way of looking at this picture is to say that IonQ is inheriting the clients of competing quantum businesses, rather than winning over new customers of its own through savvy sales and marketing tactics or competitive technological advantages.

Image source: Getty Images.

Should you buy IonQ stock right now?

From my perspective, IonQ isn't on the verge of a quantum breakthrough, given that its revenue is artificially inflated from all of these deals. While the idea of quantum computing is interesting, the technology itself has yet to deliver commercial application at scale -- yet another reason demand for IonQ's products remains fairly muted.

Moreover, given the prices IonQ is willing to pay in these deals, I'm worried that management could burn through the company's $3.5 billion of cash relatively quickly -- further casting doubt about the company's long-term sustainability. As a result, projecting the company's sales trajectory looks more like an exercise in false precision than anything else.

I see IonQ as a stock primarily influenced by day traders and retail investors chasing what could be a pipe dream. Investors seeking durable opportunities to buy and hold for the long term are likely better off passing on IonQ in favor of more established blue chip companies in the AI realm.