Veeva Systems (VEEV 0.28%) and Spotify Technology (SPOT +1.70%) have been excellent performers this year, delivering above-average returns better than 40%. And while some investors may feel like they missed the boat, the good news is that these niche leaders still have plenty of upside left. Veeva Systems and Spotify are looking at opportunities that could allow them to maintain that momentum -- albeit not necessarily uninterrupted -- for at least the next few years. Here is more on these top growth stocks.

Image source: Getty Images.

1. Veeva Systems

The leaders in the cloud computing market are among the largest and most successful companies in the world. Competing in that industry is challenging, especially for a smaller player. However, Veeva Systems is finding tremendous success thanks to an excellent strategy. Rather than try to go toe-to-toe with giants like Amazon, Veeva Systems built cloud services that match the demands of one industry: life sciences.

Drugmakers and medical device manufacturers must adhere to strict guidelines -- from regulatory compliance to data integrity and patient privacy -- or risk losing business, failing to launch products, undergoing lawsuits, or incurring the wrath of lawmakers. Veeva Systems caters to those needs. As a result, it has become the go-to cloud provider for many of the largest pharmaceutical companies. And this year, the stock has significantly outperformed the market because of solid financial results. Veeva Systems hit its goal of having a $3 billion revenue run rate by 2025.

NYSE: VEEV

Key Data Points

Veeva Systems has made a habit of setting -- and hitting -- such projections, sometimes even ahead of schedule. In a market where some CEOs overpromise and underdeliver, Veeva Systems' ability to hit its projections is noteworthy. Management set a new goal to double the company's revenue by 2030, which would require a compound annual growth rate of almost 15% over that period.

Veeva Systems can pull it off thanks to its leadership in its niche and constant innovations, including a new industry-specific agentic artificial intelligence (AI) platform called Veeva AI, which will help life science companies boost efficiency further by automating certain tasks. Further, Veeva Systems benefits from high switching costs, which should help it maintain its leading market position in this niche.

Veeva Systems is a top growth stock to keep in your portfolio through the next five years (and likely beyond).

2. Spotify

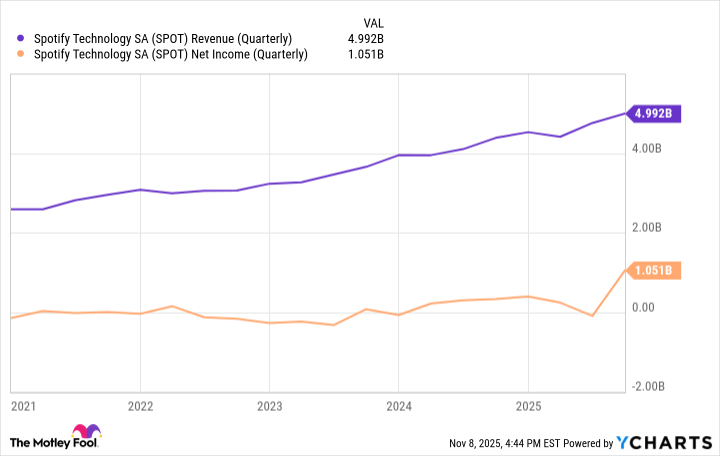

Spotify holds the top share in the competitive music streaming market. The company continues to make progress as it grows its ecosystem, with overall users and paying subscribers still moving in the right direction. Revenue is, too, and although Spotify isn't consistently profitable yet, the company has made significant strides in that department over the past few years.

SPOT Revenue (Quarterly) data by YCharts

Here is why Spotify still may have plenty of upside left. First, it still has tremendous opportunities to convert ad-supported users into paying ones, something it has done at a decent rate over the years. Second, Spotify set a goal to reach 1 billion monthly active users (MAUs) by 2030. The company is not that far from that goal. It ended the third quarter with 713 million MAUs, up 11% year over year. If I were a betting man, I'd put money on Spotify surpassing the 1 billion mark before 2030.

NYSE: SPOT

Key Data Points

Third, the company has built a deep network effect. Artists looking for a vast audience know where to go, since no music streaming platform has more subscribers. On the other side of the equation, customers benefit from having a massive music library thanks to the deals Spotify has signed with record labels. And the more users are on the platform, the more attractive it is to record labels. Lastly, Spotify has made a push to improve the platform through AI initiatives, including an AI-powered DJ that is helping grow engagement and could increase ad revenue.

Spotify has beaten the market in 2025 thanks to excellent financial results and could deliver more outstanding returns well beyond next year.