You can't deny that Target (TGT +2.82%) has been one of the premier retail stores in the U.S. for decades. However, this historical prestige hasn't kept the company's stock from going on a prolonged slump over the past few years.

From March 20, 2020, (the bottom of the COVID-19 bear market) to Aug. 13, 2021, Target's stock surged an impressive 168%, hitting an all-time high. Unfortunately, since then, the stock has plummeted by 65%. Just this year, shares lost more than a third of their value through the beginning of November.

Needless to say, this is less than ideal and has frustrated investors. But with the stock as beaten down as it is, is 2026 shaping up to be the year of the return? Let's take a look.

Image source: Target.

What has been going wrong for Target

There hasn't been one single issue that's caused Target's slump; it's a few issues that happened to hit at the wrong time, causing a domino effect. The three main issues are declining sales and reduced in-store traffic, tightening margins, and community boycotts resulting from some controversial decisions made by leadership.

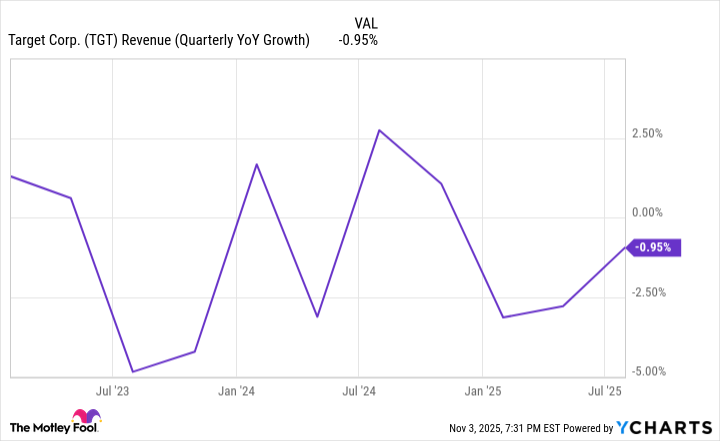

In the second quarter, Target's net sales decreased by nearly 1%, while its in-store sales declined by 3.2%. That continues a trend seen lately from the retailer. In the first quarter, those sales were down 3.8% and 5.7%, respectively.

TGT Revenue (Quarterly YoY Growth) data by YCharts

Aside from the stagnant sales growth (or lack thereof, in many cases), investors are also concerned about the effects new tariffs will have on Target's margins, as its costs are potentially set to increase.

We've seen the tariffs and their various percentages flip-flop, so it's hard to estimate how impactful they will be, but it's worth paying attention to for a retailer that relies heavily on imported goods.

What has been going right for Target

Enough with the negatives. There are still positive things surrounding the business, especially when it comes to its growth beyond just its core retail business. Its membership plan, Target Circle 360, has been gaining traction among frequent shoppers. This is great news for Target's margins because it's recurring revenue coming in without needing to sell additional products.

It also has its marketplace platform, Target Plus, and advertising platform, Roundel. Together, these go hand in hand because more third-party sellers joining the marketplace means Target receives more valuable data, which helps strengthen Roundel's value through more effective targeted ad campaigns.

Although net sales were down in the second quarter, digital sales were up 4.3%. In the first quarter, they were up 4.7%. This is a positive sign that Target is able to capture online demand while its in-store sales remain stagnant.

To compete with companies like Walmart and Amazon, Target will need to double down on convenience and go beyond just standard retail. We've gotten to the point where consumers prioritize convenience and delivery speed, and Target has been making efforts to cement itself as a retailer that can provide that.

A dividend you can count on for the long haul

One thing that remains stable with Target is its dividend. With 54 consecutive years of dividend increases, Target is one of only a couple of dozen Dividend Kings (a company with at least 50 consecutive years of increases).

Its quarterly dividend is $1.14 per share, but given how much its stock price has fallen, its yield is fairly high at just over 4.9%. That's more than four times the S&P 500 (^GSPC +0.19%) average, placing it in ultra-high-yield dividend stock territory.

TGT Dividend Yield data by YCharts

Target's dividend doesn't negate the issues the company is facing, but it's a good incentive for investors to remain patient while the company tries to get back on track.

Nobody can say definitively how Target's stock will perform in 2026, but one thing is certain: With its low valuation, there's much more upside than downside heading into the new year. I wouldn't bank on it turning the corner in 2026, but it's a good value for long-term investors.