Palantir Technologies (PLTR 5.68%) stock got hammered after the company released its third-quarter 2025 results on Nov. 3, losing almost 8% of its value the following day. The stock's sharp pullback can be attributed to concerns about the company's sky-high valuation, as well as the broader stock market drop on Nov. 4, owing to concerns about the sustainability of the recent market rally.

Of course, Palantir does trade at a prohibitively expensive valuation, and there are questions as to whether the massive spending on artificial intelligence (AI) infrastructure is eventually going to pay off. These factors are probably the reasons why the stock market has decided to take a breather, and Palantir investors decided to book profits.

However, the pullback in Palantir stock seems like a buying opportunity. The company is now attracting new customers at a faster pace, and that's one big reason to buy this high-flying stock right now. Let's look at the reasons why.

Image source: Getty Images

Palantir's customer base is growing even more rapidly now, and that's great news for investors

A closer look at the company's latest quarterly report makes it clear that its Artificial Intelligence Platform (AIP) is turning out to be a massive hit. That's not surprising, as this platform connects customers' data with large language models (LLMs), enabling them to integrate generative AI into their operations.

As a result, Palantir customers using AIP can automate workflows, enhance efficiency, and reduce redundancy. All these productivity-enhancing measures are precisely the reason why Palantir is seeing stronger growth in its customer base. The company reported a 45% year-over-year jump in its customer count in Q3, with commercial customers growing at a faster pace of 49%. That's an improvement over the 39% increase in Palantir's customer count in the third quarter of 2024.

Looking ahead, Palantir should be able to sustain such impressive growth, as the AI software platforms market it operates in is expected to jump by more than 12x over the next decade, generating more than $237 billion in annual revenue in 2034. Palantir's customer base is growing at a faster pace than the 29% annual growth that the AI software platforms market is expected to clock, indicating it's primed to win a bigger share of this space.

More importantly, the rapid growth in Palantir's customer base is setting the company up for even stronger growth in the future. That's because the company has shown a knack for winning a bigger share of its customers' wallets once it brings them on board. Palantir's latest earnings call was laced with instances of customers handing out bigger contracts to the company.

NASDAQ: PLTR

Key Data Points

Management said that a "medical device manufacturer signed a multiyear expansion just five months after their initial contract, increasing ACV more than eightfold." This customer started exploring the possibility of adopting more of Palantir's offerings just two weeks after signing the initial contract.

What's worth noting is that the faster increment in Palantir's customer count, along with the expansion of its existing contracts, is leading to a significant jump in its revenue pipeline. Chief revenue officer Ryan Taylor remarked on the earnings call:

As previously mentioned, we closed our highest-ever quarter of TCV bookings at $2.8 billion, up 151% year over year. Net dollar retention was 134%, an increase of 600 basis points from last quarter.

The increase was driven both by expansions of existing customers and new customers acquired in Q3 of last year as we see the effect of the AI revolution.

So, it won't be surprising to see the new customers that Palantir added last quarter spending more on the company's solutions in the future. Additionally, the fact that the growth in the customer base has now accelerated, Palantir's revenue pipeline is likely to grow at a stronger rate.

The company reported $8.6 billion in remaining deal value (the total value of contracts yet to be fulfilled) last quarter, up by 91% from the same quarter last year. That was a major improvement over the 22% growth it reported in this metric in the third quarter of 2024. Palantir's revenue pipeline is more than double the $3.44 billion revenue it has generated in the past 12 months, and it has the potential to become even bigger.

Customer additions and expansion are contributing toward positive unit economics

While Palantir's revenue increased 63% year over year in Q3 to $1.18 billion, its adjusted earnings shot up by a remarkable 110% year over year to $0.21 per share. It is easy to see why that's the case. The customers who are opening their wallets to purchase more of Palantir's offerings, or to extend the application of its solutions to more areas of their business, are driving an improvement in the company's margins.

That's because Palantir doesn't need to spend any extra money to acquire new business from them, contributing toward positive unit economics. Not surprisingly, Palantir CTO Shyam Sankar said on the earnings call that the company achieved the "highest-ever reported adjusted operating margin of 51%, exceeding the high end of our prior guidance by 500 basis points and highlighting the unit economics of our business at scale."

Specifically, Palantir's adjusted operating margin shot up by 13 percentage points from the year-ago period, and this metric has the ability to grow further in the future, considering that it stands at 51% right now. As a result, Palantir is likely to sustain its eye-popping earnings growth rate in the future thanks to its expanding customer base.

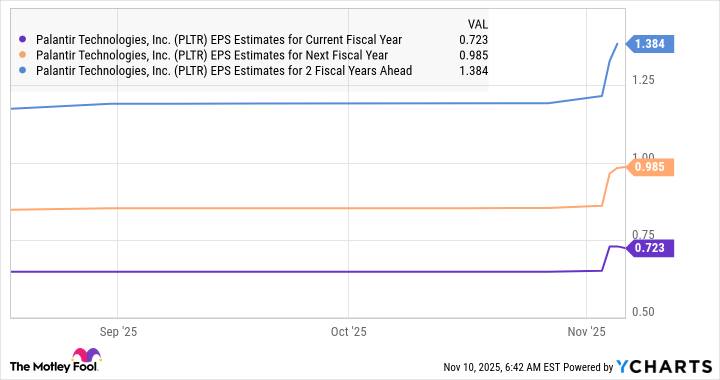

Analysts are forecasting an increase of 36% in its earnings in 2026 following this year's jump of 76%.

Data by YCharts.

However, Palantir has shown that it has the ability to grow at a significantly faster pace, and that could give this AI stock additional fuel to fly higher.