Megacap growth stocks have been pulling back in recent weeks due to valuation concerns. Even so, the S&P 500 is within striking distance of gaining over 20% for the third consecutive year for the first time since the late 1990s. And those gains are largely from stocks like the "Magnificent Seven" and the "Ten Titans," which respectively make up over 35% and 40% of the S&P 500.

The Magnificent Seven includes Nvidia, Microsoft (MSFT 2.86%), Apple, Alphabet, Amazon, Meta Platforms, and Tesla. And the Ten Titans is a group I refer to as the Magnificent Seven plus Broadcom, Oracle, and Netflix. Here's why Microsoft stands out as the best buy for value investors right now.

Image source: Getty Images.

The highest-quality earner among the Ten Titans

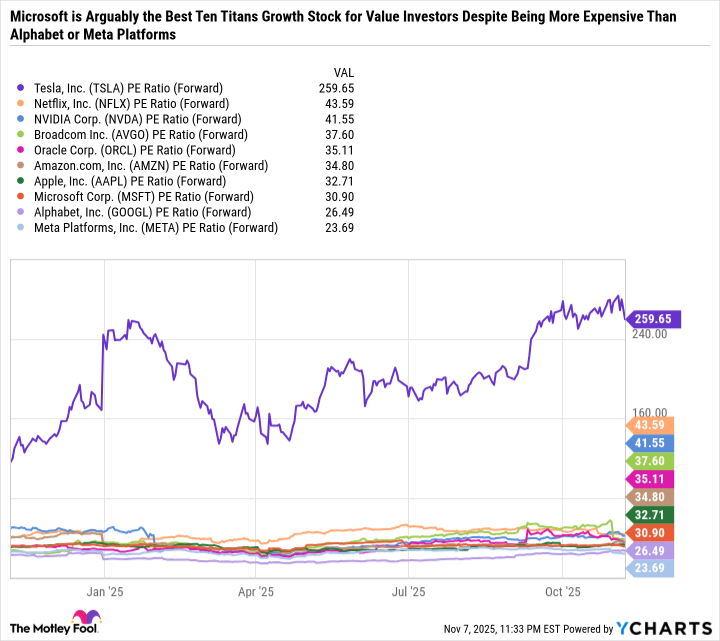

Growth investors are willing to pay up for potential earnings growth, whereas value investors want to buy companies that are reasonably priced. Based on price-to-earnings (P/E) or forward P/E ratios, Microsoft isn't the cheapest of the Ten Titans. That title goes to Meta Platforms, followed by Alphabet. But Microsoft is arguably the best value.

TSLA PE Ratio (Forward) data by YCharts

Microsoft's greatest advantage is that it can afford to ramp up spending on artificial intelligence (AI) without derailing its financial health. This is because Microsoft has a rock-solid balance sheet and a diversified business that includes multiple high-margin segments.

Microsoft is the No. 2 cloud provider behind Amazon Web Services (AWS) and is a leader in enterprise software, gaming, hardware, and more. Microsoft sold off after its latest earnings because it is accelerating its capital expenditures -- which could strain operating margins and cash flow in the near term.

Higher spending also means fewer stock buybacks. So investors will expect earnings growth to accelerate to justify the opportunity cost of lower buybacks. But Microsoft is still buying back more than enough stock to offset stock-based compensation -- protecting its shareholders from dilution.

Microsoft pays a stable and growing dividend, which it has increased for 16 consecutive years. However, it only yields 0.7% because Microsoft's stock price has been rising faster than the dividend growth rate. Still, Microsoft has the highest dividend yield of the Magnificent Seven.

In sum, Microsoft is arguably the most balanced of the megacap tech stocks because it doesn't need everything to go right to grow its earnings and deliver on expectations. By comparison, other companies are betting big on AI or are more heavily dependent on one business segment to justify their AI spending, like AWS for Amazon. Microsoft's business model and balance sheet give it the flexibility needed to endure a recession or a slowdown in the AI investment cycle.

NASDAQ: MSFT

Key Data Points

Microsoft is a good value

Buying stocks near all-time highs is never easy. But the best approach is to find companies that are reasonably valued and have a chance of bridging the gap between expectations and reality. Microsoft isn't terribly overvalued, with a price-to-earnings (P/E) ratio of 35.3 compared to a 10-year median of 33.7.

And there's more certainty that Microsoft can grow earnings because of its diversified business model, industry leadership, exposure to so many different end markets, and combination of enterprise and retail customers.

When buying great companies at pricey valuations, I often like to imagine how many years I'm willing to wait for the stock to go nowhere before it finds a reasonable base to build from. For example, let's say an investor thinks that a 30 P/E is a more reasonable price to pay for Microsoft. But they are confident the company can continue growing earnings at around 10% to 15% per year. In that case, this hypothetical investor could still buy Microsoft now and expect the stock not to go anywhere for a year or two so that the valuation can come down. From there, the stock price should compound at the earnings growth rate over the long term.

The problem is that if you try to time the market, and Microsoft accelerates its earnings growth, the stock price may run up and fetch a higher multiple. So it's better to focus on identifying quality businesses rather than waiting for the perfect moment to strike.

A stable earner among the Ten Titans

Microsoft is a good example of why not all earnings are equal. The reasons Costco Wholesale trades at 50 times earnings and Walmart sports a P/E close to 40 are their earnings reliability and predictability. Costco's highly loyal customer base and Walmart's ability to leverage its supply chain to give customers a great value allow these companies to grow earnings even during recessions.

Microsoft's earnings are about as predictable as you'll find in big tech, probably alongside Apple. But Microsoft is growing faster than Apple and is a better value. Microsoft isn't cheap, but it's arguably the best bet for value investors looking for high-conviction growth stocks to buy in 2026.