Nvidia (NVDA 2.99%) has been a stock market star amid the artificial intelligence (AI) boom, soaring more than 1,000% over the past three years. And the momentum hasn't let up, with the stock advancing 43% since the start of this year. Why has Nvidia been such a winner? The company sells the most sought-after chip to power critical AI tasks -- yes, there are rivals out there, but Nvidia's chip is the fastest, and every minute saved counts for the most ambitious of AI customers.

All of this has resulted in explosive earnings growth for Nvidia in recent years, and considering forecasts that today's billion-dollar AI market may reach into the trillions soon, Nvidia's growth story should keep marching on.

So I'm optimistic about Nvidia's earnings next year and the stock performance too -- but this doesn't mean Nvidia stock will beat all other AI players. In fact, my prediction is the following AI stock will outperform Nvidia in 2026. Let's check it out.

Image source: Getty Images.

An AI stock to watch

This particular company also has established itself as one-to-watch as the AI growth story unfolds as it's made investing in the technology its top priority. And this company is Meta Platforms (META 2.60%), the social media giant that owns Facebook, Messenger, Instagram, and WhatsApp.

About 3.5 billion people use at least one of these apps daily, so it's no surprise that advertisers race to Meta to show us their products and services -- they know that's where they'll find their target audiences. So now you might be asking: How does a focus on AI fit into such a business?

Meta aims to use AI to improve its apps, which ideally would keep us on them longer -- and the more time we spend on them, the more advertisers will want to place ads there. The company also is working to revolutionize the advertising experience through the use of AI, another effort that should please advertisers. Finally, Meta could develop other products and services powered by its large language model, llama, and these could lead to additional revenue opportunities down the road.

Importantly, Meta has the financial strength to see this through, as the company has grown revenue and profit into the billions of dollars over time -- and even pays out a dividend, which isn't always a given with a high-growth tech player.

One element of concern

Meta's stock has advanced over time because of the growth of its social media business, but in recent months, the company's AI aspirations have held some investors back from investing. They've feared that Meta is building out too much capacity, though chief Mark Zuckerberg said in the recent earnings call that the company is seeing "very high demand for additional compute." And, importantly, he said that in the worst scenario, Meta could eventually slow its buildout and grow into existing infrastructure.

All of this should comfort investors regarding the company's plans for infrastructure spending. And this takes me back to my prediction...

The cheapest Magnificent Seven stock

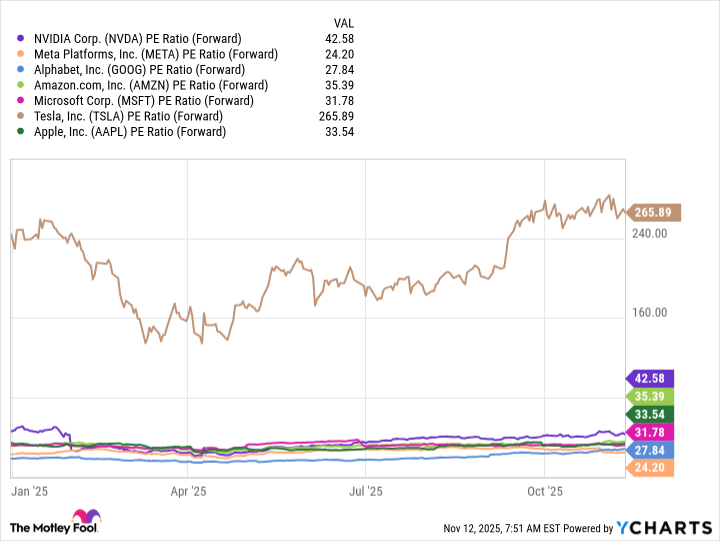

Meta, today, is the cheapest of the Magnificent Seven tech stocks that have led S&P 500 gains over the past few years.

NVDA PE Ratio (Forward) data by YCharts

And the stock has only advanced about 7% this year, underperforming the S&P 500. These points along with the strength of the company's earnings and its emphasis on responsibly investing in AI could attract investors in the quarters to come -- and as a result boost the stock.

NASDAQ: META

Key Data Points

I'm also positive about Nvidia stock moving forward as the company should be one of the biggest winners as infrastructure spending ramps up. But Nvidia, as we can see above, though not expensive considering its market position and earnings prospects, isn't cheap either. Investors looking to get in on a potential AI winner clearly may see more value in buying Meta at current levels than in picking up shares of the chip designer.

All of this leads me to predict that Meta, which has emerged as another major player in the AI revolution, may outperform AI superpower Nvidia in 2026.