The ever-growing demand for Palantir Technologies' artificial intelligence (AI) software solutions has helped the company clock outstanding gains of 156% on the market so far in 2025. However, it looks as if the company's expensive valuation has finally caught up with the stock's rally as it has been witnessing a pullback following its latest quarterly results.

The good part is that there are other AI stocks that investors can consider buying instead of Palantir if they are worried about the latter's valuation. Applied Digital (APLD +3.16%) is one such name. Shares of the data center specialist have shot up an incredible 311% this year (as of this writing), and they aren't likely done soaring yet.

Let's look at the reasons why Applied Digital is primed to deliver more gains in 2026.

Image source: Getty Images.

The catalysts driving Applied Digital's solid surge are set to repeat next year

Applied Digital is in the business of designing, building, and operating data centers meant for high-performance computing (HPC) and AI workloads. The company designs and builds AI-first data centers for clients and focuses on delivering high power and cooling efficiency in a bid to lower operational costs.

The company originally built data centers for bitcoin mining, but it is now benefiting big time from the massive hunger for AI computing power. This is evident from the massive contracts that Applied Digital is receiving for its data center infrastructure.

In late August, Applied Digital announced that it has finalized a lease agreement with neocloud provider CoreWeave (CRWV 1.96%) for an additional 150 megawatts (MW) of data center capacity. This lease contract has increased Applied Digital's potential lease revenue from CoreWeave to $11 billion over the next 15 years. CoreWeave had earlier signed two 15-year leases with Applied Digital for 250 MW of computing power valued at $7 billion.

NASDAQ: APLD

Key Data Points

Applied Digital, therefore, will construct and operate 400 MW of data center capacity for CoreWeave, with the leases set to generate a solid stream of revenue for the former over the next 15 years. An important point worth noting is that Applied Digital has already readied the first 50 MW of data center capacity for CoreWeave in North Dakota.

So, it should soon start recognizing lease revenue from the CoreWeave contract, in addition to the revenue that it is getting from fitting out the data centers for its clients. Even better, Applied Digital recently announced that it has entered into a lease agreement with a U.S.-based hyperscaler to provide 200 MW of AI data center capacity at its second data center complex in North Dakota.

This 15-year lease is projected to generate $5 billion in revenue for Applied Digital. So, the company has already built a solid revenue pipeline of $16 billion for the next decade and a half. For some perspective, its revenue in the trailing 12 months stands at $173 million, which means that its business is likely to take off remarkably in the future.

These sizable multibillion-dollar contracts are the reason why Applied Digital stock has outperformed the likes of Palantir in 2025. That's precisely the reason why it can repeat its sizzling performance in 2026. Applied Digital management pointed out that it had 700 MW of data center capacity under construction at the end of the first quarter.

The company estimates that it has the potential to scale its capacity at the first data center complex in North Dakota to more than 1 gigawatt (GW) between 2028 and 2030. It is expecting something similar at its second data center complex. However, Applied Digital management points out that its potential capacity pipeline is much bigger. As pointed out by CEO Wes Cummins on the latest earnings call:

With four gigawatts in our active development pipeline and more under review, our primary focus has become scaling development and construction.

More importantly, Applied Digital has reduced its data center construction timeline from two years to just 12-14 months. That's quite impressive and suggests that the company has the ability to bring online more capacity at a faster pace. As a result, don't be surprised to see Applied Digital winning more multibillion-dollar contracts for additional capacity next year, while the rapid construction of data centers should help start its lease revenue stream.

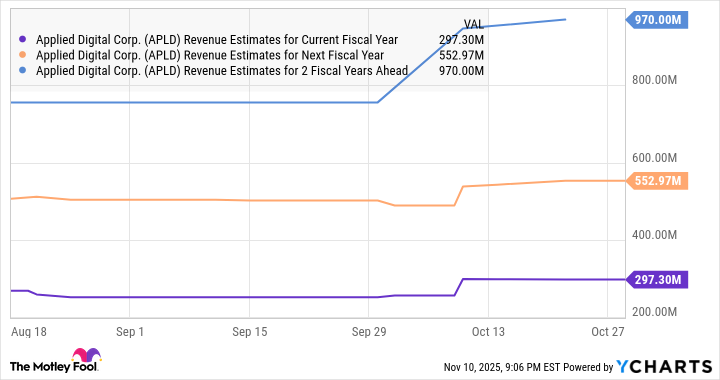

These are precisely the reasons why analysts are expecting Applied Digital's top-line growth to take off.

APLD Revenue Estimates for Current Fiscal Year data by YCharts

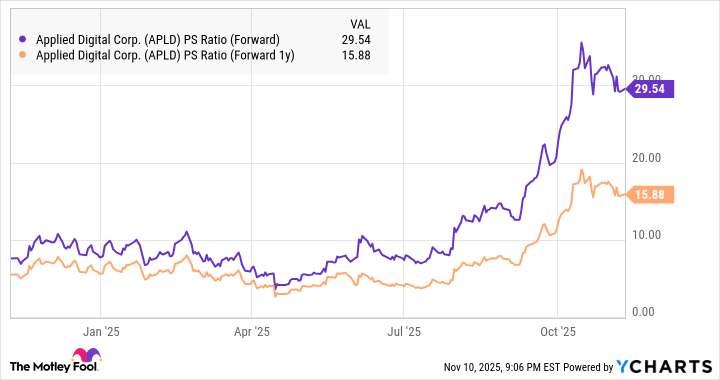

The valuation shouldn't be a concern

Applied Digital stock isn't cheap right now. It is trading at 37 times sales, which is quite expensive when compared to the U.S. tech sector's average sales multiple of 9.2. However, the remarkable growth that the stock is expected to deliver over the next couple of years makes it clear why its forward sales multiples are significantly cheaper.

APLD PS Ratio (Forward) data by YCharts

For some perspective, Palantir shares trade at 137 times sales, so investors can buy Applied Digital at a significantly cheaper valuation and benefit from the outstanding growth that it is likely to deliver in the coming years. What's more, analysts are expecting this AI stock to sustain its momentum in 2026.

Applied Digital's 12-month median price target of $40.50 points toward 29% gains from current levels. All 12 analysts covering the stock rate it as a buy, and it is easy to see why that's the case, as the company seems to be at the beginning of a massive growth curve.