Shares of IonQ (IONQ 0.28%) sank this week as part of a sell-off across tech, finishing down 20.4%. While the Nasdaq-100 finished down just 0.2%, the tech-heavy index was down as much as 2.1% earlier in the week.

Despite reporting 222% year-over-year revenue growth in its Q3 earnings report released last week, recession fears and artificial intelligence (AI) bubble concerns hammered stocks across tech, IonQ included.

NYSE: IONQ

Key Data Points

Investors rethink valuations

Tech stocks have soared for months on massive AI infrastructure deals and promises of incredible returns. This week, investors appeared to be growing wary of tech valuations based on promises of future profits. Shareholders want proof that the massive amounts of capital flooding into AI and quantum computing will see a return. This is coming at a time when fears around the broader economy mount.

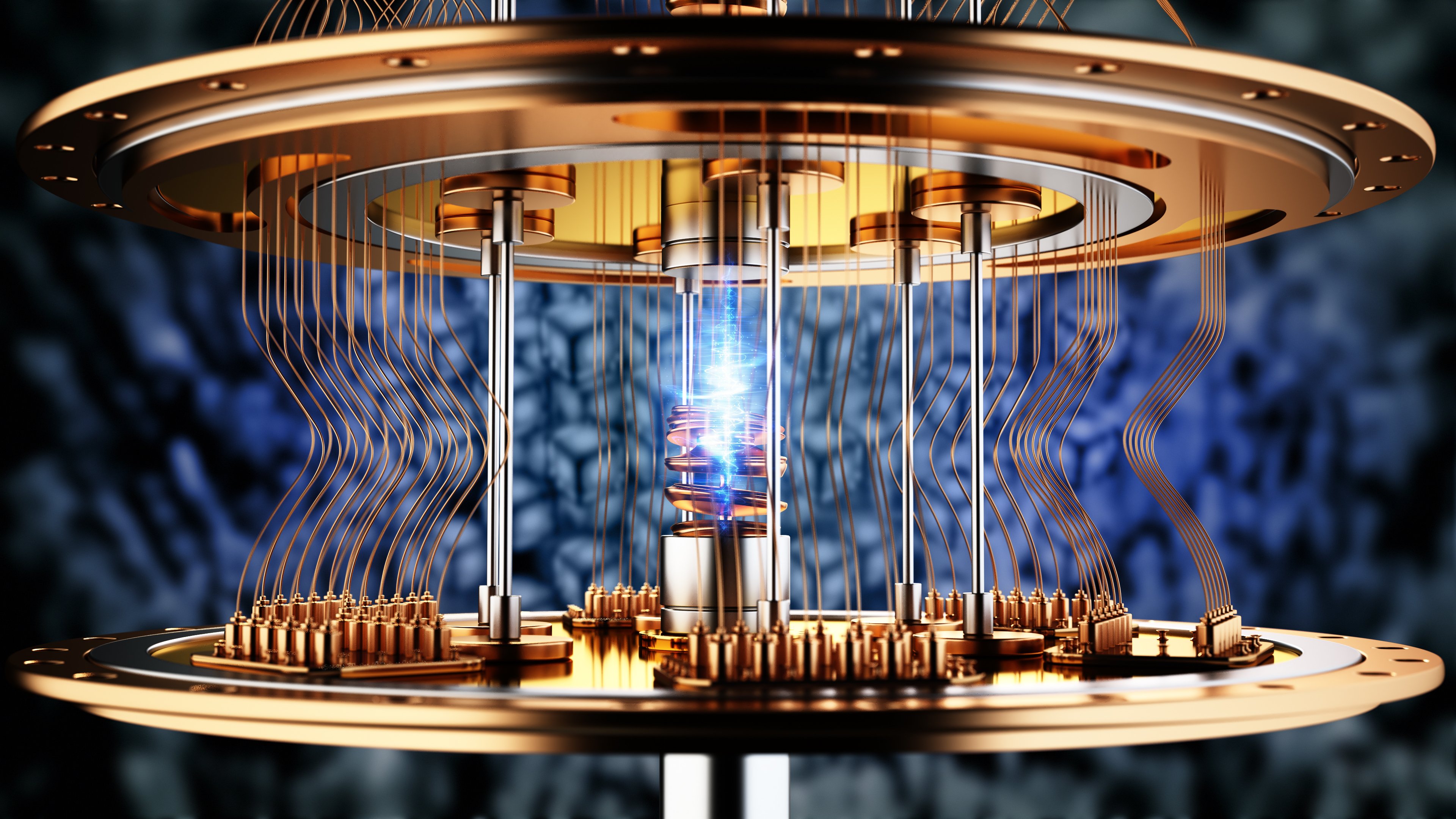

Image source: Getty Images.

IonQ's stock is pricey

While IonQ's latest sales growth looks impressive, it can't justify the incredible premium its stock carries. IonQ shares trade with a price-to-sales ratio (P/S) of 141.

Truly transformative quantum computing could still be decades away, and while IonQ has a substantial cash pile, it could easily burn through that in the next few years, given its current reliance on mergers and acquisitions (M&A). I wouldn't own IonQ stock.