SoundHound AI (SOUN 0.41%) stock has turned out to be a disappointing investment in 2025. Shares of the voice artificial intelligence (AI) solutions provider are down 27% this year, a far cry from the stellar returns it delivered in 2024.

A big reason for SoundHound's pullback this year is the stock's expensive valuation. It is trading at 38 times sales right now, which is significantly higher than the tech-focused Nasdaq Composite index's price-to-sales ratio of 5.5. However, SoundHound AI's recent quarterly results and guidance suggest that it has the potential to justify its expensive valuation.

Does this mean that investors should consider accumulating SoundHound AI stock in anticipation of healthy gains over the next three years? Let's find out.

Image source: Getty Images.

SoundHound AI's incredible growth is here to stay

SoundHound AI released its third-quarter results on Nov. 6. The company reported a 68% year-over-year spike in revenue to $42 million, exceeding the $40.5 million consensus estimate. SoundHound's non-GAAP net loss of $0.03 per share was also lower than the $0.09 per share loss that analysts were expecting.

NASDAQ: SOUN

Key Data Points

The company's guidance was the icing on the cake. SoundHound is now expecting $172.5 million in revenue in 2025 at the midpoint of its guidance range, which is slightly higher than the earlier estimate of $169 million. What's worth noting is that SoundHound has consistently increased its guidance throughout the year.

Its latest outlook suggests that its top line will more than double from the 2024 figure of $84.7 million. The strong growth trajectory that SoundHound is enjoying can be credited to the company's rapidly expanding customer base across multiple industries. SoundHound won several deals last quarter to deploy its voice AI solutions across automotive, healthcare, apparel, restaurant, insurance, cybersecurity, and other industries.

SoundHound management is confident of sustaining its momentum thanks to the impressive traction that it is witnessing in the voice AI market, and the adoption of voice-based agentic AI solutions and voice commerce. Management remarked on the latest earnings call that SoundHound is "at the very beginning of addressing the massive market opportunity in front of us."

That is indeed the case. The conversational AI market is expected to grow at an annual growth rate of almost 24% through 2030, generating over $41 billion in annual revenue by the end of the decade. SoundHound is growing at a significantly faster pace than the end market. Notably, the company's consistently improving customer base suggests that it can maintain that momentum.

Another important point worth noting is that SoundHound has already built a solid revenue pipeline. Its cumulative subscriptions and bookings backlog stood at almost $1.2 billion at the end of 2024, with the metric growing by 75% from the year-ago period. SoundHound will update this metric when it releases its fourth-quarter results. It wouldn't be surprising to see the company report a bigger backlog, considering the impressive pace at which it has been acquiring new customers.

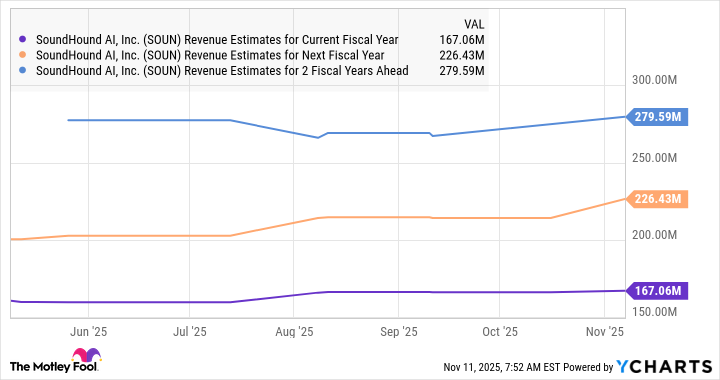

Not surprisingly, analysts have increased their revenue expectations from SoundHound for the next couple of years.

SOUN Revenue Estimates for Current Fiscal Year data by YCharts.

However, the company is well-placed to exceed those expectations.

Can strong growth translate into more upside over the next three years?

The chart above tells us that analysts are expecting SoundHound's top line to grow by around 30% in 2026 and 23% in 2027. But the strength of its backlog and the healthy growth of the conversational AI market suggest that it could do better than that.

Assuming SoundHound's revenue increases at an annual rate of 50% over the next three years, its top line could hit $582 million at the end of 2028 (using the company's estimated 2025 revenue of $172.5 million as the base). Of course, assuming a 50% growth rate is quite generous, but it is well below the 100%-plus growth rate that the company is set to clock this year.

We have already seen that SoundHound is trading at 38 times sales. Even if it trades at a significantly discounted 20 times sales after three years, its market cap could hit $11.6 billion based on the projected sales figure calculated for 2028. That would represent a significant increase over its current market cap of around $6 billion.

However, SoundHound has the potential to increase its annual revenue by more than 50% in the long run. The company sees a total addressable market (TAM) of over $140 billion, indicating that it has only scratched the surface of a massive opportunity. So, investors looking to buy a growth stock and willing to accept the risks that come with investing in an expensively valued stock can consider taking a closer look at SoundHound. It could regain its mojo, thanks to the reasons discussed above.