Warren Buffett, arguably the greatest investor of all time, is on record saying that his favorite holding period is forever. These aren't just words from the Oracle of Omaha: Many of the stocks in his conglomerate's portfolio have been there for quite some time. A great example of that is Visa (V 1.80%), a stock Berkshire Hathaway first bought in 2011. The financial services giant has performed extremely well since, and it could continue doing so for a long time. Here are four reasons investors should load up on Visa.

1. An (almost) inflation-proof stock

Some investors worry that President Donald Trump's tariff policies will cause inflation to rise. But the fear of rising prices isn't a thing that started this year. Inflation can erode purchasing power over the long run, so it's important to invest in assets that can handily outpace it. Stocks have historically done that. And some corporations can do even better than broader equities because they have businesses that perform well even when prices rise, giving them an advantage over most companies.

Image source: Getty Images.

That's what we have with Visa. The payment network leader makes money through the fees it charges on transactions it facilitates. Since these fees are calculated as a percentage of the transaction amount, higher prices mean the company pockets more money per transaction, helping offset the decrease in consumer spending that occurs when prices rise significantly. As former Chief Executive Officer Al Kelly once said, "Historically, inflation has been positive for us."

There's another way Visa can serve as an inflation hedge. The company pays a regular dividend that has grown by 379% during the past decade, yet it still boasts a conservative cash payout ratio of 21.5%. That means it still has miles of room to hike its payout even more. Reinvesting a steadily growing dividend can boost real returns over the long run and help investors outpace inflation.

2. Outstanding margins

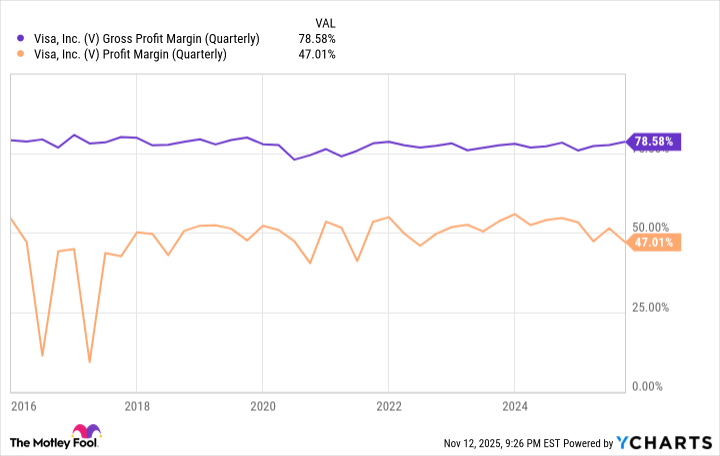

Visa's business is famously high-margin. The company's gross margin usually hovers at more than 70%, while it nets about $0.50 for every dollar it earns.

V Gross Profit Margin (Quarterly) data by YCharts

You will struggle to find many corporations of Visa's size with margins this high anywhere. One key reason behind Visa's high margins is the front-loaded nature of its payment network. It required a heavy upfront investment to build. Now that it is up and running, though, handling 200 billion or 300 billion transactions makes little difference to Visa's marginal costs. Obviously, higher margins mean the company can return more to shareholders and reinvest in the business to pursue lucrative growth opportunities.

NYSE: V

Key Data Points

3. Visa avoids credit risk

Visa does not issue credit and debit cards to customers; that's done by banks. Visa merely helps facilitate card transactions. This fact has important implications for Visa's business. One is that the company does not extend credit to customers and does not take a cut out of the banks' interest payments. On the flip side, though, Visa is not subject to credit risk, a problem that plagues banks, especially during recessions.

4. A large remaining opportunity

Visa has billions of cards in circulation and processes trillions of dollars in transaction volume each year. Digital payment methods are now ubiquitous, partly thanks to the company's efforts. However, there is still a huge opportunity for Visa over the long run. Here are two reasons. First, there are still trillions of dollars in cash and check transactions that could be converted to digital transactions and brought into the company's ecosystem.

Second, the growth of the e-commerce industry will provide another major long-term tailwind, since cash generally can't be used in online transactions. Visa should be able to profit from these long-term growth avenues thanks to its leadership in its niche and a deep network effect that grants it a wide competitive moat. That's one more reason to buy the stock and hold it for a long time.