Of all the stocks on the market, the one that may be generating some of the most heated disagreements among investors is semiconductor specialist Nvidia (NVDA 0.46%). The first company to reach a $5 trillion market cap, Nvidia is undeniably in rarefied air, and many pundits posit that the artificial intelligence (AI) leader has the ability to soar even higher. Plenty of others, however, suspect that the more prudent move for its shareholders would be to click the sell button.

But where does that debate leave the average retail investor? And what do Nvidia's fundamentals suggest about what to do with the stock now?

Image source: Nvidia.

What's buttressing the bull case?

Even though shares of Nvidia are up by about 1,350% over the past three years, there are plenty of reasons to suspect that the stock will soar even higher. The company's high-end Blackwell and Blackwell Ultra graphics processing units (GPUs) are in extraordinarily high demand as AI companies continue to make massive investments in data center infrastructure to support AI workloads. Quantifying the sizable opportunity that lies before it, Nvidia estimates investments in AI infrastructure will total $3 trillion to $4 trillion by 2030.

NASDAQ: NVDA

Key Data Points

The leader in designing GPU architectures, Nvidia is hardly resting on its laurels, having already unveiled its Vera Rubin architecture, the successor to the massively popular Blackwell architectures. CEO Jensen Huang characterizes the Rubin chips as "another leap in the frontier of AI computing." Nvidia projects the Rubin CPX will be available before the end of 2026.

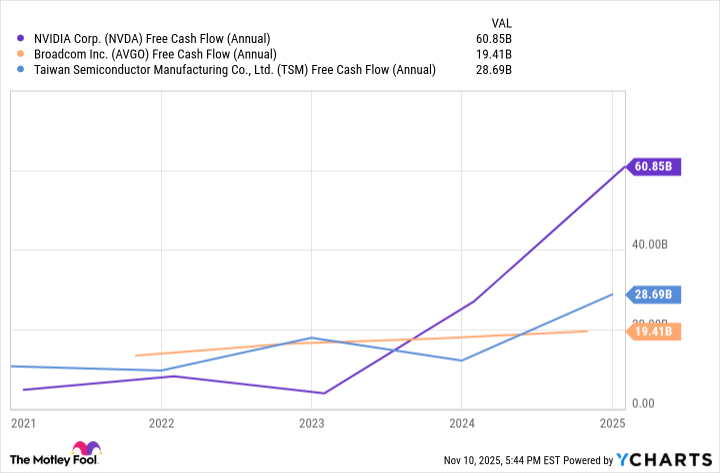

Of course, it's not only the company's formidable intellectual property that warrants attention. Nvidia's staggering ability to generate cash also makes the stock an attractive investment -- especially its growth in free cash flow over the past few years. Compared to its fellow semiconductor powerhouse Broadcom (AVGO 1.07%) and chip foundry leader Taiwan Semiconductor Manufacturing (TSM +1.44%), Nvidia's robust free cash flow advantage is clear.

NVDA Free Cash Flow (Annual) data by YCharts.

Yet another reason why bulls are outspoken about Nvidia now is the stock's price tag. Currently, shares of Nvidia are changing hands at about 52.7 times operating cash flow. Admittedly, this hardly seems cheap, but it's actually a discount to the stock's five-year average cash flow multiple of 54.5, suggesting that today's valuation is hardly unreasonable. Further illustrating the point, Broadcom and Taiwan Semiconductor Manufacturing both trade today at premiums to their five-year average cash flow multiples.

What underpins the sell case?

Although there are plenty of Nvidia stock advocates, there are those who have their concerns. Talk that the market may be in an AI bubble analogous to the dot-com bubble of the late 1990s has many investors scared that a steep sell-off in AI stocks is looming. While AI chatbots like ChatGPT and Perplexity AI have gained in popularity, skeptics question whether the promise of AI has been overblown, or if the use cases for the technology may be less impactful than AI companies would have the market believe.

A special consideration for those who have been Nvidia shareholders for a while is whether its sharp growth has given it a disproportionate weighting in their portfolios. This is not necessarily a bad problem to have -- to have a holding perform so well that one has to question whether to rebalance or let their winners run. For some long-term shareholders, trimming their Nvidia positions right now may be a wise move in order to regain their portfolio diversification.

A great time for most people (though not all) to load up on Nvidia

The merits of an Nvidia investment right now are clear -- and certainly ample. Those who might lose sleep worrying about how Nvidia stock could sink if the AI bubble (assuming there is one) pops may want to think twice about buying, though. Although Nvidia may suffer temporarily from a dip if the entire AI sector goes through a correction, it should recover, as its fundamentals are incredibly strong. Moreover, those who are looking at their portfolios and finding that Nvidia stock has become a dominant position should consider trimming it and reallocating some capital to get back to their preferred level of diversification.