If you've got $1,000 sitting on the sidelines ready to invest, I can think of a few great stocks to buy right now. We're at the doorstep of 2026, and fund managers are going to start moving investments into what they think could be the best-performing stocks for next year. Although there are growing fears about the artificial intelligence (AI) buildout, I think guidance for 2026 will calm investors' fears and make AI the best place to invest again.

I believe these stocks are excellent picks right now and are primed to soar throughout 2026.

Image source: Getty Images.

Nvidia

Nvidia (NVDA 0.46%) has been at the top of nearly every AI investing list for a reason. Its graphics processing units (GPUs) have built a large chunk of the AI infrastructure we experience today, and that doesn't look to be changing anytime soon. Nvidia is selling AI hyperscalers loads of its GPUs, and is primed to benefit as data center capital expenditures reach new all-time highs in 2026. But that's just the start.

NASDAQ: NVDA

Key Data Points

Nvidia expects data center capital expenditures to rise to $3 trillion to $4 trillion by 2030, and if that occurs, Nvidia will be a must-own investment. Even if the actual projection falls short of this lofty figure, the general direction is likely correct. Nvidia has more information about upcoming demand than the average investor because AI hyperscalers are placing orders for chips years in advance to secure computing power.

I think this makes Nvidia an excellent stock to buy now and hold for a few more years, as the AI build-out is far from over.

Taiwan Semiconductor Manufacturing

Taiwan Semiconductor Manufacturing (TSM +1.44%) is in a similar boat as Nvidia, although it's less specialized. Nvidia and its competitors are known as fabless chip companies, which means they design the chip, but don't produce it. Instead of everyone having their own chip factory, they farm out that work to the industry leader, Taiwan Semiconductor. This places Taiwan Semi in a neutral position where it's providing chips to all of the AI computing suppliers. As long as there's growing AI spending, it will continue to grow its revenue.

Furthermore, Taiwan Semiconductor's stock is quite cheap. When analyzed using the price/earnings-to-growth (PEG) ratio (which factors in earnings growth and valuation), Taiwan Semi trades at a dirt cheap level.

TSM PEG Ratio data by YCharts

Anything under 1 is considered undervalued, which means Taiwan Semiconductor is one of the cheapest stocks in the AI arena. I think this makes it an excellent buy right now; investors should scoop up shares before 2026.

Meta Platforms

Meta Platforms (META 0.85%) is one of the AI hyperscalers that's spending a ton of money on the AI megatrend. However, investors recently dumped the stock because of its plans to spend a massive amount of money on data centers in 2026. Yet they completely ignored the fact that its AI endeavors are boosting its ad sales, with revenue rising 26% year over year to $51.2 billion during Q3.

Investors have been burned by Mark Zuckerberg overinvesting in a hot trend before, and they don't want to see it again. Furthermore, Zuckerberg doesn't care how much they build, as he stated in its conference call that he isn't worried about overbuilding AI computing capacity. This concerned many investors, which is why the stock sold off.

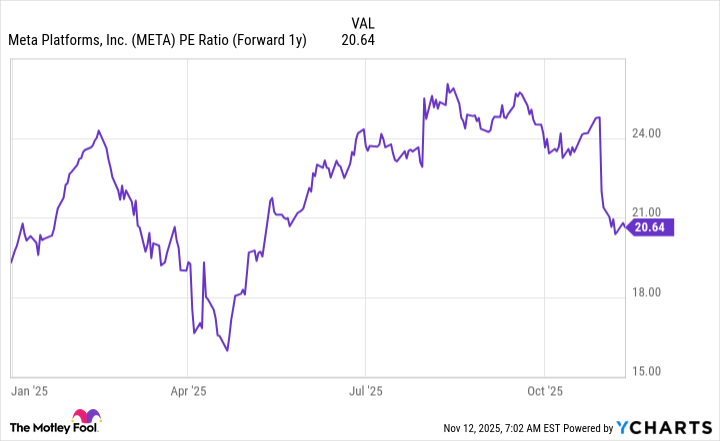

However, it's now one of the cheapest big tech stocks available on the market, trading for 20.6 times 2026's earnings.

META PE Ratio (Forward 1y) data by YCharts

That's a great price to pay for Meta's stock, and I think it makes it a great long-term investment pick.