There's arguably no other company that has benefited from the artificial intelligence (AI) revolution as much as Nvidia (NVDA 2.81%).

The company's graphics processing units (GPUs) are the biggest keys igniting AI development -- putting the company firmly at the center of hardware, software, and data center construction. In just the last three years, shares of Nvidia have risen by 1,000% -- propelling the company's market cap to $4.6 trillion, and making Nvidia the most valuable company in the world.

Following gains of this magnitude, growth investors are surely beginning to look for adjacent opportunities that could follow Nvidia's path as infrastructure becomes the newest chapter in the broader AI narrative.

I'll break down how a rising star called Nebius Group (NBIS +5.30%) is beginning to make waves in the AI landscape, and assess if the company could emerge as the next Nvidia.

Image source: Getty Images.

Are investors overlooking Nebius Group?

Over the last few years, big tech has spent hundreds of billions of dollars building data centers and outfitting these facilities with clusters of Nvidia's GPUs. Demand for chips remains so intense that procurement can become compromised if Nvidia is not able to meet supply, or if customers are not able to meet the ever-rising costs this hardware commands.

This is where Nebius is able to lend a hand. The company's core business is providing neocloud services. The value proposition of a neocloud is that these businesses provide customers access to GPU clusters through cloud-based infrastructure.

In essence, Nebius already has a number of data centers with Nvidia chips installed. If a company is not able to purchase Nvidia's hardware directly from the source, they can rent capacity through Nebius -- saving time and hefty capital outlays that would otherwise be geared toward constructing new data centers or buying additional networking equipment.

While Nebius and peers such as CoreWeave and Oracle are beginning to gain traction in the world of AI infrastructure services, many investors still look toward traditional semiconductor stocks when considering which company could become the next Nvidia.

NASDAQ: NBIS

Key Data Points

Nebius is on a supercharged growth trajectory

At the end of September, Nebius' annualized run-rate revenue (ARR) was $551 million. On the surface, this figure may look a bit pedestrian.

However, some recent business updates highlight just how important neoclouds are becoming. Over the last couple of months, Nebius struck transformational deals with two hyperscalers.

Back in September, Microsoft signed a five-year, $17.4 billion infrastructure services contract with Nebius. More recently, Nebiius also won a five-year, $3 billion contract with Meta Platforms.

Against this backdrop, Nebius' management is now guiding between a $7 billion and $9 billion in run-rate ARR by the end of 2026.

Is Nebius the next Nvidia?

While Nebius has demonstrated that its neocloud platform can serve AI's most influential developers, the company's growth has a trade-off that shouldn't be overlooked: Building its own data centers and securing clusters of Nvidia's next-generation GB300 chips is not cheap.

Through the first nine months of 2025, Nebius reported a net loss of $508 million. While the company's balance sheet holds $2.4 billion of cash, the runway won't last very long if Nebius continues to rack up operating losses. To hedge against any liquidity crunches, the company has resorted to an at-the-market offering to fund its near-term expansion.

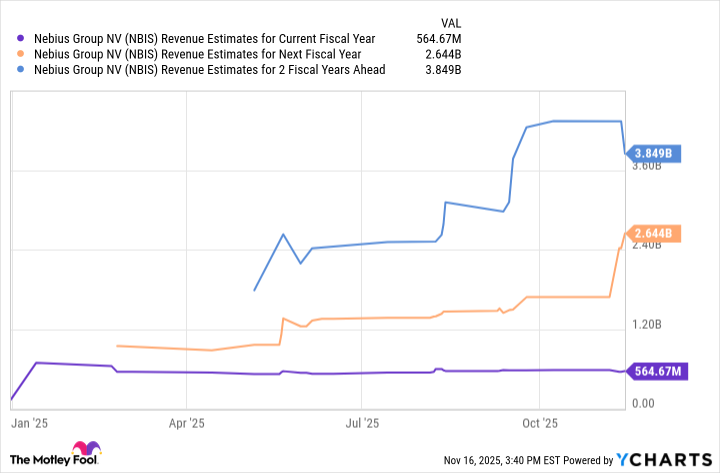

Should the company meet its 2026 ARR forecast, Nebius stock trades at an implied forward ARR multiple of about 2.6. Since ARR is a non-GAAP figure (generally accepted accounting principles), a more conservative approach to valuation would be to look at consensus financial models from Wall Street analysts.

Given the company currently boasts a market cap of $21 billion, Nebius trades at an implied forward price-to-sales (P/S) ratio of about 5.5, based on 2027 GAAP revenue. This seems reasonable given the company's roadmap. The caveat, of course, is whether Nebius can offset its losses and begin generating positive unit economics.

NBIS Revenue Estimates for Current Fiscal Year data by YCharts

For now, I'm not too worried about Nebius' ability to allocate capital wisely and secure enough funding to execute on the Microsoft and Meta opportunities. That said, I think labeling Nebius as the next Nvidia might be a little overzealous at the moment. Nevertheless, I see Nebius as a compelling stock to own in the AI infrastructure era.