The semiconductor industry has won big from the rapid growth of artificial intelligence (AI), as evident from the 153% jump in the PHLX Semiconductor Sector index in the past three years -- significantly higher than the 70% rise in the S&P 500 in that period.

Nvidia has been one of the leading lights of the semiconductor industry during the ongoing AI boom, with shares up 1,100% in the past three years. The company's graphics processing units (GPUs) have played a central role in training large language models and in AI inference.

However, Nvidia's incredible rise in the past three years wouldn't have been possible without its foundry partner, Taiwan Semiconductor Manufacturing (TSM +5.17%). Within the semiconductor industry, it's even more influential than Nvidia -- and a better buy than Nvidia or any other AI chip designer right now. Let's look at the reasons.

TSMC logo in front of a company building.

TSMC is the real kingpin of the semiconductor industry

TSMC (as the company is known for short) is a foundry partner for several chipmakers that don't fabricate their own chips. Nvidia designs its chips but uses TSMC to get its chips made. And those same factories don't just churn out chips for Nvidia.

Other AI chip designers -- such as Broadcom, Marvell Technology, and Advanced Micro Devices -- also use TSMC's foundry services. Apple is one of its biggest customers, while other smartphone chip designers such as Qualcomm and MediaTek also use it.

TSMC says that it made chips for 522 customers last year, manufacturing almost 12,000 types for deployment in data centers, smartphones, automobiles, and consumer electronics applications.

And it doesn't just manufacture chips for other companies. It now offers advanced chip packaging services as well, a market that's been growing at a terrific pace from AI. That's because advanced manufacturing enables semiconductor companies to integrate multiple chips, known as chiplets, into a single package. As a result, the packaged chip platform delivers more performance, reduces power consumption, and helps lower costs.

NYSE: TSM

Key Data Points

Bloomberg estimates that the advanced chip packaging market could jump eightfold by 2033, with annual revenue of $80.5 billion. This is in addition to the 29% annual growth that the AI chip market alone is expected to register through the end of the decade.

Because TSMC serves all the major AI chip designers as well as consumer electronics providers that put chips into smartphones, personal computers, gaming consoles, and other applications, it's in an outstanding position to capitalize on this terrific opportunity.

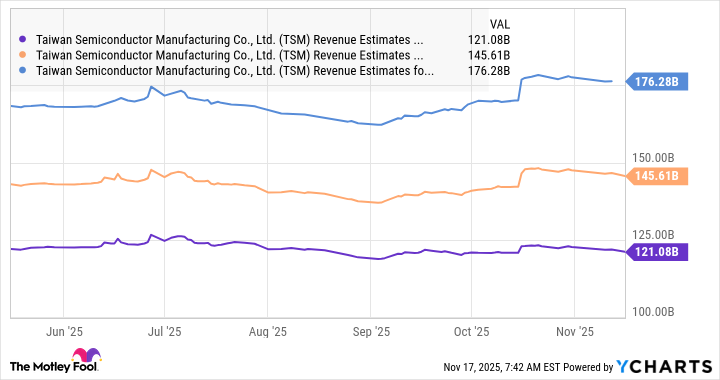

Revenue in the first 10 months of 2025 increased by almost 34%, up from the 30% gain last year. And analysts are expecting TSMC to register 20% annual growth for the next couple of years as well.

TSM Revenue Estimates for current fiscal year; data by YCharts.

The stock is on track to deliver healthy gains

The company could easily exceed the growth that analysts are expecting. Market researcher IDC estimates that the Foundry 2.0 market that TSMC is targeting will hit $298 billion in revenue this year. Its share of this space is expected to grow to 37% this year, though the 2025 revenue that the company is expected to generate suggests that its share could be higher than that.

IDC projects the Foundry 2.0 market to show annual growth of 10% through 2029, which would bring its total size to $436 billion. There's a good chance that TSMC could easily corner at least half of this market since it is growing much faster than the industry it serves. If that's indeed the case, revenue could hit $218 billion in 2029.

Multiplying that by the U.S. technology sector's price-to-sales ratio of 9 would send its market cap to almost $2 trillion. That would be a 36% increase from current levels. But TSMC could carry a premium sales multiple at that time on the back of its outstanding growth (the stock currently trades at 12.5 times sales).

So, investors would do well to buy this semiconductor stock right now as there is a strong possibility that it could deliver substantial gains in the long run considering its position as the largest player in the foundry market.