Right now, there are 10 public companies with a market capitalization of $1 trillion or more. In order from largest to smallest, the trillion-dollar club includes the following companies:

- Nvidia: $4.6 trillion

- Apple: $4.0 trillion

- Microsoft: $3.8 trillion

- Alphabet: $3.3 trillion

- Amazon: $2.5 trillion

- Broadcom: $1.6 trillion

- Meta Platforms: $1.5 trillion

- Taiwan Semiconductor Manufacturing: $1.5 trillion

- Tesla: $1.3 trillion

- Berkshire Hathaway: $1.1 trillion

Outside of this list, the next largest technology companies include Oracle, Netflix, and Chinese conglomerate, Tencent.

If you're wondering which artificial intelligence (AI) company will be next to reach the trillion-dollar milestone, however, data analytics specialist Palantir Technologies (PLTR +6.85%) stands out.

Let's see what it will take for Palantir to achieve a trillion-dollar valuation before assessing whether now is a good time to buy the stock.

Image source: Getty Images.

Understanding Palantir: What does the company actually do?

Palantir develops a suite of AI-powered software platforms -- dubbed Foundry, Gotham, and Apollo.

Foundry helps commercial businesses make sense of messy data. By better structuring critical information across disparate systems into a unified platform, corporations can use data-driven insights to improve their operations.

Gotham is primarily marketed toward government agencies and defense contractors -- helping national security personnel across mission-critical workflows.

Whether a company is using Foundry or Gotham, it's also important to leverage Apollo. Apollo is the infrastructure that distributes Palantir's software suite -- from the cloud, on-premise, or even in high-security networks.

By developing application-specific data analytics capabilities in combination with its own in-house distribution system, Palantir is swiftly becoming the backbone of enterprise AI software protocols in the commercial and public sectors. Its success in both areas has allowed the company to report truly impressive growth and profitability as you can see in the third-quarter highlights from Palantir's investor presentation:

- US revenue grew +77% Y/Y and +20% Q/Q to $883 million

- US commercial revenue grew +121% Y/Y and +29% Q/Q to $397 million

- US government revenue grew +52% Y/Y and +14% Q/Q to $486 million

- Revenue grew +63% Y/Y and +18% Q/Q to $1.18 billion; +65% Y/Y and +18% Q/Q excluding Strategic Commercial Contracts

- Rule of 40 score of 114%

- Closed 204 deals of at least $1 million, 91 deals of at least $5 million, and 53 deals of at least $10 million

- Adjusted free cash flow of $540 million; 46% margin, and TTM adjusted free cash flow of $2.0 billion; 51% margin

- Adjusted operating income of $601 million; 51% margin

- US commercial remaining deal value (“RDV”) grew +199% Y/Y and +30% Q/Q to $3.6 billion

- Highest-ever quarter of US commercial total contract value (“TCV”) of $1.3 billion; +342% Y/Y

- Highest-ever quarter of TCV of $2.8 billion; +151% Y/Y

- Adjusted EPS of $0.21

Valuation: What would it take for Palantir to reach a $1 trillion market cap?

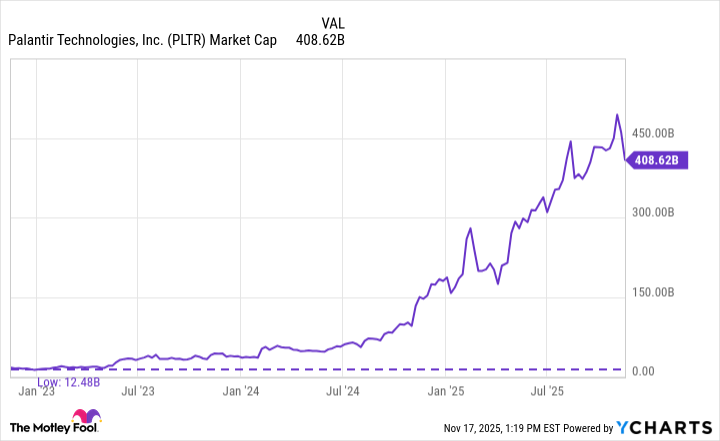

As of this writing (Nov. 17), Palantir's market cap is $408 billion. Simple math tells us that to achieve a $1 trillion valuation, Palantir stock would need to climb another 145%.

This is a tall order, especially when you account for the incredible rally Palantir has already seen over the last few years. Given this backdrop, a trillion-dollar market value becomes even more suspect.

Prior to the release of ChatGPT, Palantir's market cap was $12 billion. Shares of Palantir have since skyrocketed approximately 2,000% thanks to the AI market boom.

Data by YCharts.

To drive home just how historic Palantir's momentum has been, consider that the company trades at a price-to-sales (P/S) ratio of 112 and a forward price-to-earnings (P/E) multiple of 237. Even for a high-growth software business, these multiples are historically pricey.

Keep your expectations reasonable

The level of demand for Palantir's products, in combination with an estimated addressable market of $13 trillion for AI software, suggests the company is well-positioned for further growth. At a high level, I agree with that view.

Where I begin to grow skeptical is the likelihood of Palantir continuing to generate market-beating returns. The magnitude of the stock's valuation expansion over the last few years is becoming increasingly hard to justify.

Moreover, given its massive rally, I would not be surprised to see institutional investors begin to trim their exposure and rotate profits elsewhere.

With investor expectations sky-high, the stock runs the risk of selling off if the company begins to show the slightest signs of decelerating growth. Given the valuation multiples mentioned above, it's fair to say that Palantir stock is priced to perfection.

While Palantir may one day become a member of the trillion-dollar club, believing that it will become the next AI stock to do so is overly optimistic. Ultimately, I remain bullish on Palantir's long-term prospects but view the stock as overbought right now.