The fast-growing demand for artificial intelligence (AI) software solutions has been a tailwind for both Palantir Technologies and BigBear.ai in 2025.

Palantir stock has shot up by a remarkable 126% year to date as of this writing, while BigBear.ai has delivered gains of 25% despite bouts of volatility. However, both generative AI software companies are facing a few headwinds.

Palantir's lofty valuation has created doubts among investors about the company's ability to sustain its rally. That's why its shares have been under pressure of late, even though it delivered impressive third-quarter results. BigBear.ai, meanwhile, has been unable to capitalize on the huge opportunity in AI software thus far, and its revenues have declined sharply lately.

Snowflake (SNOW 9.15%), however, is having no such problems. The cloud-based data platform provider's growth has taken off in recent quarters thanks to AI. Let's see why that has been the case.

Image source: Snowflake.

Snowflake's AI solutions are helping its customers do more with their data

Snowflake's data cloud platform is used for storing, processing, and analyzing huge amounts of data. Customers can securely store their data with Snowflake, and then use it for developing applications, gaining business insights, and for analytics purposes. The advent of AI has unlocked a new opportunity for Snowflake, as it now offers AI tools that customers can apply to their data.

NYSE: SNOW

Key Data Points

The company's Cortex AI platform helps customers build AI agents; analyze text, images, and audio; search documents using natural language prompts, and access popular large language models (LLMs) from the likes of Anthropic, Mistral, and Meta Platforms, among other things. Snowflake customers can translate documents from multiple languages, summarize customer reviews, derive customer sentiment information, and perform other functions.

It also offers a serverless platform through which customers can rent hardware such as graphics processing units (GPUs) to train and deploy custom AI applications with the help of LLMs. So, Snowflake offers full-stack hardware and software solutions, and that's a smart strategy. It not only can upsell its AI software tools to its existing customers, but also attract new customers through the serverless GPU model.

That's because customers looking to integrate generative AI with their data won't need to invest in expensive hardware and incur the related overhead costs. They can simply rent the capacity they require from Snowflake. So, it is not surprising to see Snowflake witnessing healthy growth in both its customer base and spending by established customers.

As of July 31, the end of its fiscal 2026 second quarter, Snowflake's customer count was up 19% year over year. What's more, its net revenue retention rate stood at 125%. This metric is calculated by taking Snowflake's quarterly product revenue from customers who have been with the company for a year or more, and dividing it by the total product revenue from that same customer cohort in the prior-year period. A result of more than 100% means that its established customers have been increasing their spending on its solutions.

This combination of higher customer spending and an improvement in the customer count led to a 33% increase in Snowflake's remaining performance obligations (RPO) to $6.9 billion. Also, more business from existing customers positively impacted the company's bottom line, doubling its earnings year over year.

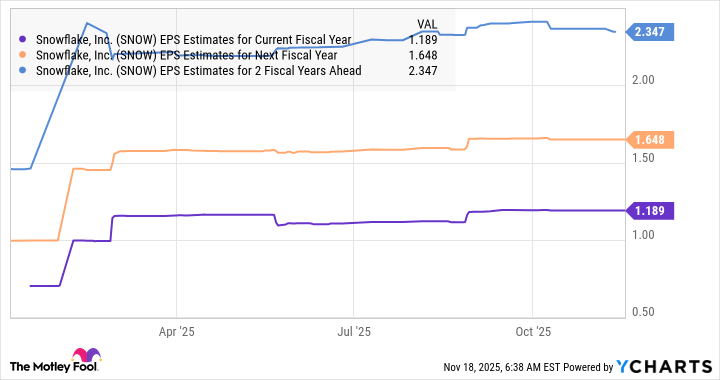

What's more, Snowflake is primed for stronger earnings growth.

SNOW EPS Estimates for Current Fiscal Year data by YCharts.

Snowflake estimates that by 2029, its total addressable market (TAM) will be worth $355 billion. That suggests that it has so far only scratched the surface of a massive opportunity.

Why Snowflake could outperform both Palantir and BigBear.ai next year

Snowflake trades today at 22 times sales. While that's expensive when compared to the U.S. technology index's average price-to-sales ratio of 9, it is significantly lower than Palantir's P/S multiple of 125. BigBear.ai, meanwhile, trades at almost 16 times sales, but it witnessed a 20% year-over-year decline in revenue last quarter.

So, Snowflake looks more likely to maintain its valuation owing to a potential acceleration in its earnings growth. Meanwhile, both Palantir and BigBear.ai's valuations are likely to weigh on their stock prices next year. That's why there is a good chance of Snowflake stock delivering bigger gains in 2026 than its AI software peers, even after its 64% gain so far in 2025.