Carnival (CCL +0.42%) has drawn investor interest for many reasons. Travel stocks remain popular, and the company's market lead in the cruise line industry and the continued strength in bookings undoubtedly contribute to its popularity.

Nonetheless, amid the focus on the large cruise stocks, Viking (VIK +1.68%) launched its IPO. The company's immense success and advantages in the cruise industry could ultimately deliver higher returns for investors. Here's why.

Image source: Getty Images.

The advantages of Carnival stock

In many respects, Carnival looks like the cruise line stock of choice. It claims nearly 42% of the passenger load in the industry. Even though its budget-friendly approach means that it earns about 36% of industry revenue, it remains a leader in that respect as well.

Moreover, for all the talk about the uncertain economy, Carnival reports record bookings, all-time highs in net income, and occupancy rates reaching 112% in its most recent quarter (the industry defines 100% occupancy as two passengers in every cabin).

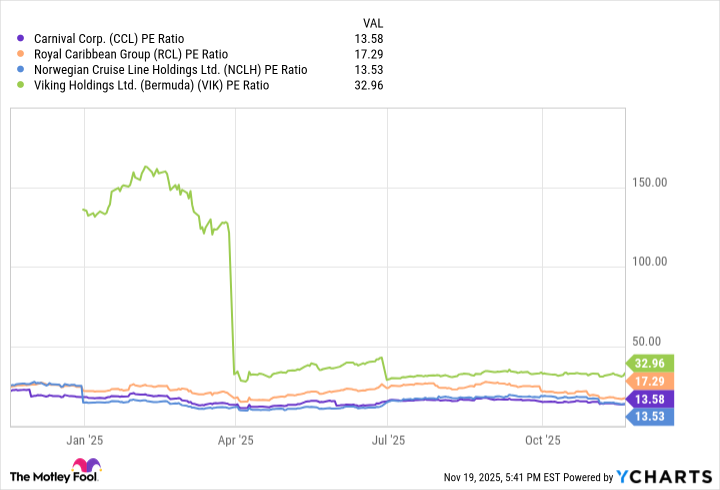

Furthermore, the stock is cheap. At a price-to-earnings (P/E) ratio of 14, Carnival's valuation is in line with Norwegian Cruise Line. It is also significantly cheaper than its largest competitor, Royal Caribbean, at 17 times earnings, and Viking, whose P/E ratio is 31. Amid such conditions, Carnival stock should appeal to investors on the surface.

CCL PE Ratio data by YCharts.

Why Viking is different

However, since launching its IPO in May 2024, Viking has stood out by dismissing Carnival's amenities.

Since Viking strictly limits cabins to two passengers per room, occupancy is 96% in the most recent quarter. Furthermore, instead of building bigger ships with greater offerings, Viking focuses on experiences that are culturally enriching, all-adult, and all-inclusive in pricing.

To make this experience possible, it sails significantly smaller ships. That allows the company to offer river cruises in waterways that will not accommodate large cruise ships. It also means that passengers deal with smaller crowds.

Not surprisingly, this makes its cruises somewhat more expensive on balance. Nonetheless, that factor is less meaningful, since Viking targets the upper end of the market and its approach seems to resonate with passengers. Despite accounting for less than 1% of the industry's total passenger count, Viking is the fifth-largest cruise line as measured by revenue.

Viking's financials

Additionally, Viking's approach means it tends to be less sensitive to economic cycles, making revenues more likely to stay steady. Its revenue for the first nine months of the year was more than $4.4 billion, increasing by 20% compared to the same period in 2024.

Moreover, Viking kept its expense growth in check. That allowed operating income to rise 35% in the first three quarters of 2025. Also, even with a spike in currency losses, it was able to earn $848 million in net income during that period, far above the $49 million profit over the same year-ago timeframe. Amid such increases, the rise in Viking stock should not come as a surprise.

NYSE: VIK

Key Data Points

Despite that improvement, one financial issue hangs over Viking as it does its industry peers -- debt. All cruise lines had to borrow heavily to stay in business during the pandemic shutdowns, when they could not earn revenue.

Viking's total debt stands at just under $5.6 billion, a heavy load considering the $804 million in book value. That actually worsened from the $5.2 billion in debt in the year-ago quarter. Fortunately, the interest to be paid fell from more than $1.4 billion one year ago to slightly above $1 billion as the company refinanced some of its debt in the third quarter.

That has also allowed shipbuilding obligations to rise from $2.8 billion to $4.5 billion over the same timeframe, translating into more fleet expansion. That frees Viking to better capitalize on the heavy demand for cruise vacations, making the revenue and net income increases likely to continue.

Buying Viking stock

Under current circumstances, investors should consider Viking stock instead of Carnival.

Indeed, Carnival is the industry leader, and strong bookings and a low P/E ratio make it appealing on the surface.

However, Viking stock turns Carnival's supposed advantage on its head and offers benefits that provide a compelling incentive to overlook a somewhat higher P/E ratio.

The stock's focus on higher-income consumers should make it more recession-resistant. A rapid growth rate and a turn to profitability place it in a significantly stronger financial position. Amid its strength in revenue generation and rapid growth, Viking looks well-positioned to drive higher returns over time.