Artificial intelligence (AI) stocks, as a group, aren't cheap. AI companies have been investing hundreds of billions of dollars in development, and many of them are already growing quickly. AI is a tremendous long-term opportunity with serious implications in so many arenas, which is why the market gives its stocks a premium. Another reason is that many AI stocks are extremely profitable, which could be a justification for a higher valuation.

But while some AI stocks sport wild valuations (think Palantir Technologies) or aren't profitable (think CoreWeave), some of the largest and most stable companies in the world are also top AI stocks, and some of them could be undervalued. The most undervalued AI stock today looks to me like Meta Platforms (META +0.87%).

Image source: Meta Platforms.

Ads, family, and Llama

What ties these together is that they form the basis of Meta's business today. Meta is the umbrella name for the company's flagship social media app, Facebook, but it also owns several others, like WhatsApp, Instagram, and Messenger, which it calls its family of apps, in addition to some other businesses. These apps are the core of the company's business model.

These platforms serve an astounding 3.45 billion people on average every day as of the end of the third quarter. That's access to almost half of the entire world, including their time and their data. And those numbers keep on growing; they were up 8% year over year in the quarter.

The operating model is to monetize this base through advertisements. It's really that simple. Who wouldn't want exposure to that many people? Of course, most advertisers don't need exposure to billions of people -- just their target customers. That's where AI comes in. Meta's large language model (LLM), Llama, does a lot of the heavy lifting to make this work.

NASDAQ: META

Key Data Points

Meta uses AI for several important purposes. The more accurately it can pinpoint the right target for a marketing campaign, the more it's likely to result in sales conversions, and the more likely advertisers are going to stick with Meta and raise their budgets.

Another way it uses AI is to feed users content they're interested in. The better it knows its customers, which improves through machine learning and AI, the more it can provide targeted content, and the more time users will spend on the app and see ads. The results are strong. Ad impressions increased 14% year over year in the third quarter. That makes the ads more valuable, and the average price per ad increased 10% in the quarter. Total revenue increased 26% over last year in Q3.

Management raised its outlook for AI spending in 2025, and said it was going to increase in 2026. It's investing in devices and in superintelligence, and CEO Mark Zuckerberg said he's expecting a "paradigm shift" over the next five to seven years. "If we deliver even a fraction of the opportunity ahead," he said "then the next few years will be the most exciting period in our history."

All this for a bargain price

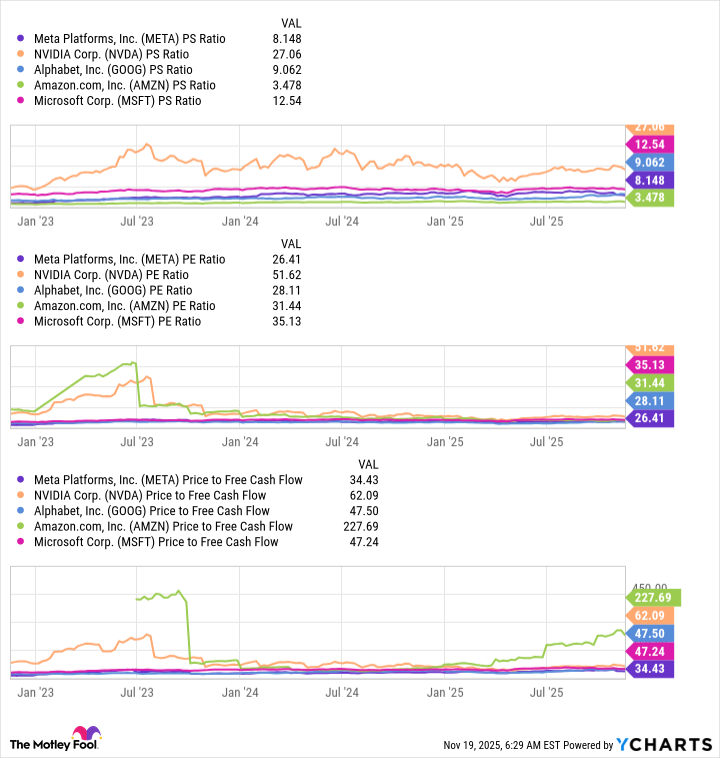

Meta is delivering fine performance and has an exciting future ahead, but its stock looks cheap today, especially as compared with other large AI companies like Nvidia, Alphabet, Amazon, and Microsoft.

META PS Ratio data by YCharts.

The market has been falling over the past few days, and the notion that there's an AI bubble and that it's going to burst could come to be in the weeks and months ahead. But Meta's business is backed up by its billions of users and a robust advertising business. Whatever happens in the near term, it's well-positioned to succeed in the long term. Plus, at this price, even if the market does pull back, Meta should feel the impact less intensely than overvalued AI stocks.