Given Nvidia's prominence in the market's biggest megatrend -- the artificial intelligence (AI) revolution -- it's nearly unthinkable to consider that large cap stocks in other industries could be outperforming the semiconductor giant.

So far this year, shares of industrials specialist Caterpillar (CAT 3.36%) have gained 52% -- making it the top-performing stock in the Dow Jones Industrial Average (^DJI 0.58%). Moreover, Caterpillar's performance handily outpaces Nvidia's 2025 gains of roughly 40%.

Let's examine what is fueling Caterpillar's rally and assess whether the stock still remains a compelling buy.

Image source: Getty Images.

What is fueling Caterpillar stock this year?

Caterpillar's business is split into three categories: construction, resource industries, and energy and transportation.

NYSE: CAT

Key Data Points

Through the first nine months of 2025, Caterpillar generated $48.5 billion in revenue -- essentially flat year over year. In addition, the company's operating profit of $8.5 billion is roughly 16% lower compared to 2024 levels.

This isn't exactly the most robust financial profile. This raises the question: Why are investors cheering on Caterpillar stock? I see a couple of reasons for the rally.

First, the company's expense profile has taken a toll due to the new tariff policies that went into effect earlier this year. On some level, investors are likely accounting for this headwind and assuming that ongoing trade negotiations will lead to a more stabilized cost structure in the long-run -- thereby improving profit margins.

In addition, investors are paying close attention to where Caterpillar is deriving its growth from. Specifically, the company's energy and transportation business has started to capture a lot of attention thanks to accelerating investment in AI infrastructure.

Is Caterpillar a stealth AI stock?

Buried deep inside of Caterpillar's latest 10Q filing, the company breaks out its segment revenue in great detail. The table below summarizes the company's revenue for the energy and transportation segment.

| Category | Nine Months Ended 9/30/2025 | Nine Months Ended 9/30/2024 | % Change |

|---|---|---|---|

| Oil and gas | $5.1 billion | $5.0 billion | 1% |

| Power generation | $7.0 billion | $5.5 billion | 28% |

| Industrial | $3.1 billion | $3.1 billion | 1% |

| Transportation | $3.8 billion | $3.9 billion | (4%) |

| Total energy & transportation | $19.0 billion | $17.6 billion | 8% |

Data Source: Caterpillar Q3 2025 10Q

The clear outlier in the table above is Caterpillar's power generation business. This is by far the fastest growing segment within the overall energy and transportation operation.

During the earnings call, management attributed the growth from power generation to ongoing data center construction from cloud infrastructure providers.

Moreover, Caterpillar's backlog of $39.8 billion is at an all-time high -- fueled by continued orders in the energy and transportation business.

To me, growth investors are becoming increasingly aware of Caterpillar's role in the AI infrastructure era. While hyperscalers will continue to make the headlines, companies like Caterpillar represent compelling adjacent opportunities that are also positioned to benefit greatly from secular tailwinds of rising AI capital expenditures (capex) over the coming years.

Image source: Getty Images.

Is Caterpillar stock still a buy?

While Caterpillar stock has generated market-beating returns this year, that performance alone doesn't reveal much about the company's valuation.

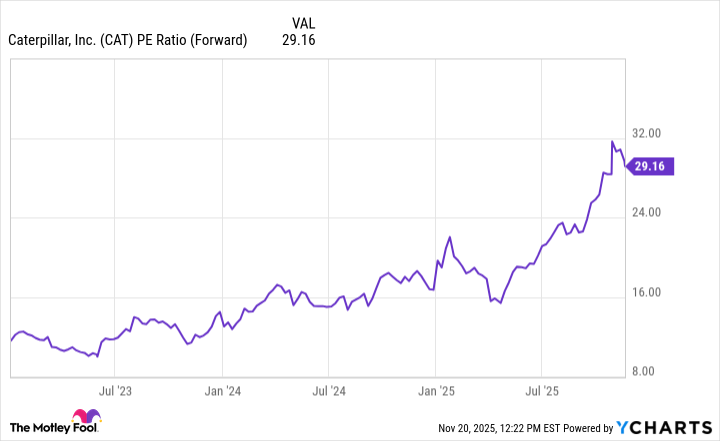

CAT PE Ratio (Forward) data by YCharts

The chart above illustrates Caterpillar's forward price-to-earnings (P/E) trends throughout the AI revolution. What is interesting is that the company's earnings multiple was expanding steadily throughout 2023 and 2024, but appears to have kicked into an entirely new gear this year. Now, the company's forward P/E multiple of 29 is at its highest level in three years.

In my eyes, there's quite of a bit of momentum fueling Caterpillar stock right now. Investor sentiment appears to be significantly improving as the company is increasingly viewed as complementary exposure to big tech in the AI infrastructure movement.

While Caterpillar stock is not dirt cheap, I still find the company compelling for investors with long-term time horizons. In the long run, the company's margin profile should improve as the tariff policies are more of a near-term fluid situation.

Furthermore, with trillions of dollars expected to pour into AI infrastructure over the next several years, Caterpillar is uniquely positioned to benefit from both rising demand in construction machinery and energy resources.

Against this backdrop, I think Caterpillar stock is deserving of a premium and worth consideration in a diversified portfolio.