If you know anything about Amazon (AMZN 1.79%) at all, then you know it tends to dominate whatever business it's operating in. It remains North America's e-commerce market leader, for instance, as well as the planet's biggest cloud computing service provider. This persistent leadership is arguably at least part of the reason the market's willing to keep Amazon shares priced at a premium.

Investors are starting to see something they're not accustomed to seeing, though. It's something that might cause them to question Amazon's ability to hold on to its lead within the cloud computing industry.

The crazy part? The competitors chipping away at its cloud market share aren't the ones you might expect.

Image source: Getty Images.

One simple picture tells the undeniable story

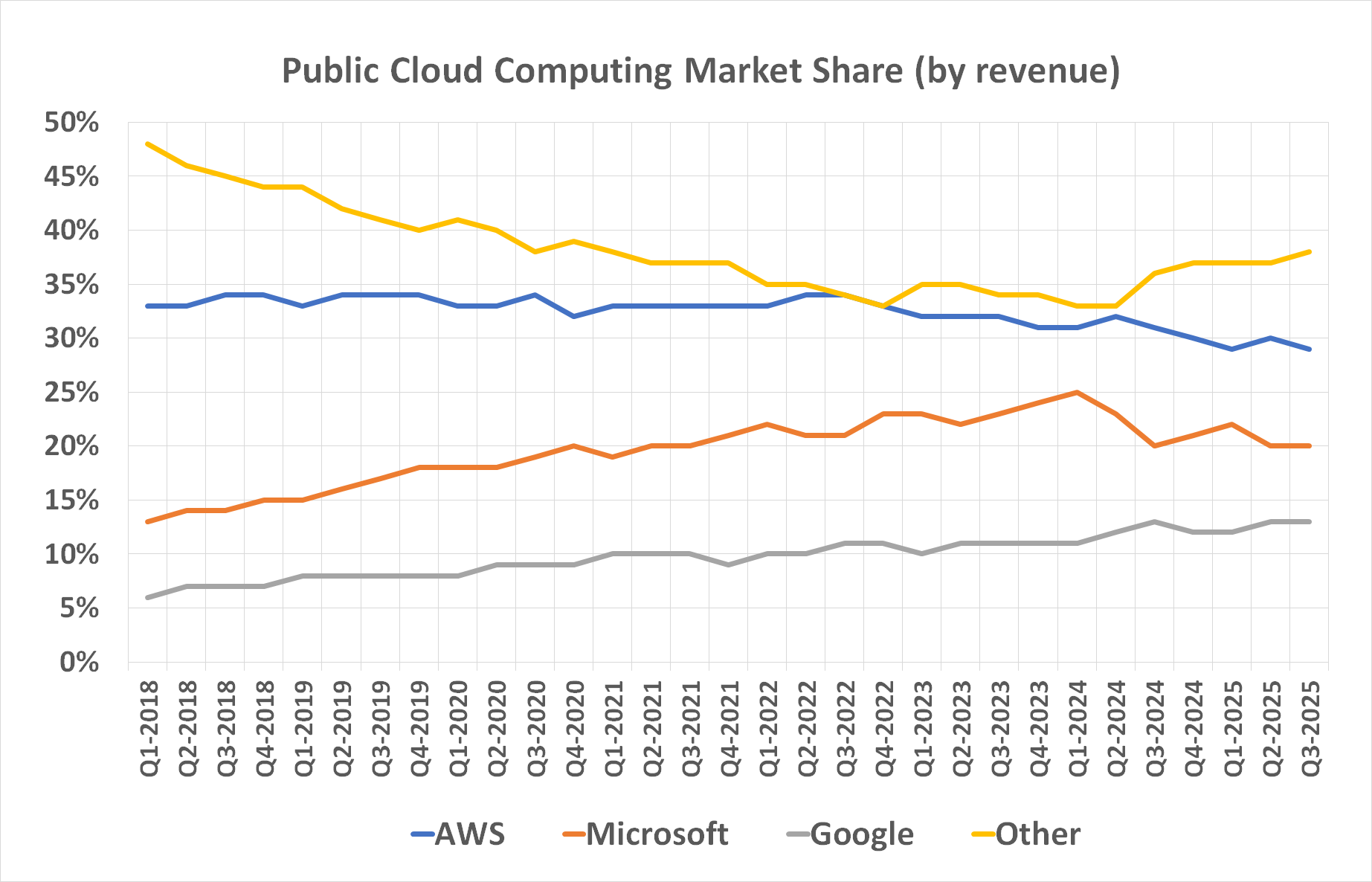

The relevant data comes from research and analysis outfit Synergy Research Group. The group compiles the quarterly cloud revenue figures reported by all the main cloud service providers, then compares each company's number to all the others.

The image below illustrates these comparisons going all the way back to the beginning of 2018. Amazon Web Services' seemingly shrinking market share could have just been chalked up to pricing volatility ... until last quarter. With its market share now back down to a multiyear low of only 29% from 2019's peak of nearly 35%, it's difficult to suggest anything other than that Amazon is losing ground on the cloud computing front.

Data source: Synergy Research Group. Chart by author.

That's not the most interesting part of this story, though. Far more curious is what Amazon is losing market share to. It's not really Alphabet's (GOOG 1.22%) (GOOGL 1.12%) Google, and certainly not Microsoft (MSFT 2.87%), which has been losing share as well since early last year. This ground is being lost to "other" providers, which are too small and too numerous to even explicitly name on the chart.

There are names, though.

The neoclouds

It's time to put a new word in your lexicon: neocloud. These are just smaller and more specialized cloud service providers, mostly catering to the needs of artificial intelligence (AI) data center operators. Roughly half of the recent market share growth of the world's "other" cloud computing service providers came from neoclouds. That makes sense, given the ongoing evolution of AI -- the next generation of technology needs to perform better than the current generation. Smaller and more specialized outfits are often better positioned to deliver this superior tech.

And you may recognize more neocloud names than you'd expect. Synergy Research Group has specifically named CoreWeave (CRWV +1.26%) more than once, as well as Nebius (NBIS +2.03%). You can also add DigitalOcean (DOCN 2.49%) to this list, even if Synergy didn't. DigitalOcean is particularly proficient with AI-powered customer service agents, and it turned its technological know-how into $230 million worth of revenue during the three-month stretch ending in September. That's a 16% year-over-year growth pace for DigitalOcean that's expected not only to persist, but to accelerate at least through the end of 2027.

The chief takeaway for investors is simply that -- despite its deeper pockets -- Amazon isn't keeping the smaller specialists from tiptoeing onto its turf.

NYSE: DOCN

Key Data Points

Worth taking action

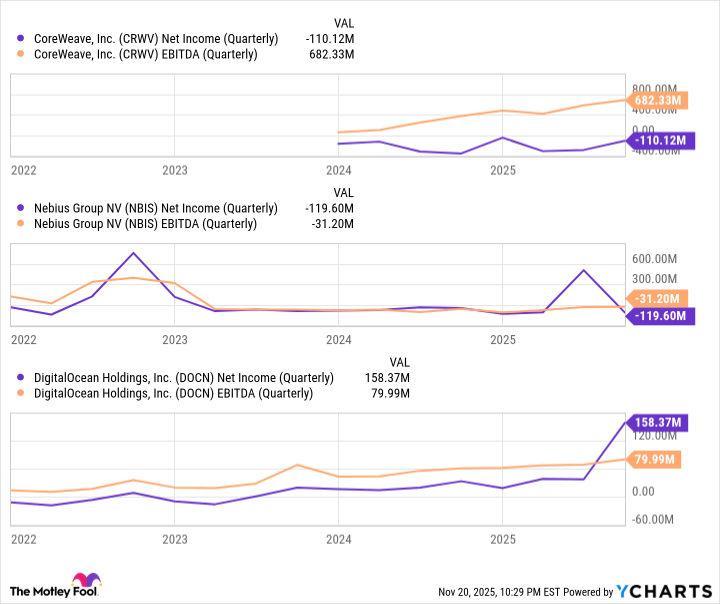

Don't overrespond! Revenue is one thing, profits are another. Amazon Web Services is still operationally profitable, even if it's losing share. Not all the neocloud names are. Nebius and CoreWeave, for instance, remain in the red.

DigitalOcean is decidedly and increasingly in the black, though, and CoreWeave is clearly moving in that direction.

Data by YCharts.

This matters in part because the one thing smaller players need to compete with the likes of deeper-pocketed Amazon is strong technology, which is primarily a function of how much they can invest in research and development.

Don't be surprised to see Amazon continue losing market share to these relatively unknown names, as well as others not mentioned here.

NASDAQ: AMZN

Key Data Points

This gives investors a great deal to think about, particularly given that AWS's profit margins are now shrinking just a bit. It could be a sign that Amazon is being forced to lower prices for its most lucrative profit center. If so, Amazon's stock usual premium valuation could be in jeopardy.

Aggressive growth seekers would be wise to find a neocloud name (or two) for their portfolios.

This might help convince you: Synergy Research Group believes the neocloud sliver of the global cloud computing industry is poised to grow from only $23 billion in revenue this year to nearly $180 billion in annual revenue by 2030. Even half this growth in twice the time would make this a fantastic opportunity.