There have been few hotter investments in 2025 than quantum computing stocks. However, that ship seems to have sailed. As the market becomes a bit more risk-averse, the first holdings to be sold are quantum computing stocks. Anyone who started investing in these companies at the beginning of 2025 is up big-time, so taking some gains off the table isn't a bad idea.

However, the question that long-term investors are now asking is if now is a good time to buy the dip or if they should be patient. Consider IonQ (IONQ 0.28%), a leader in the quantum computing space. It's my top pure-play pick in this space and is down around 40% from its all-time high.

Is that enough of a sale price to warrant picking up shares? Or does this quantum computing leader still have a ways to tumble? Let's find out.

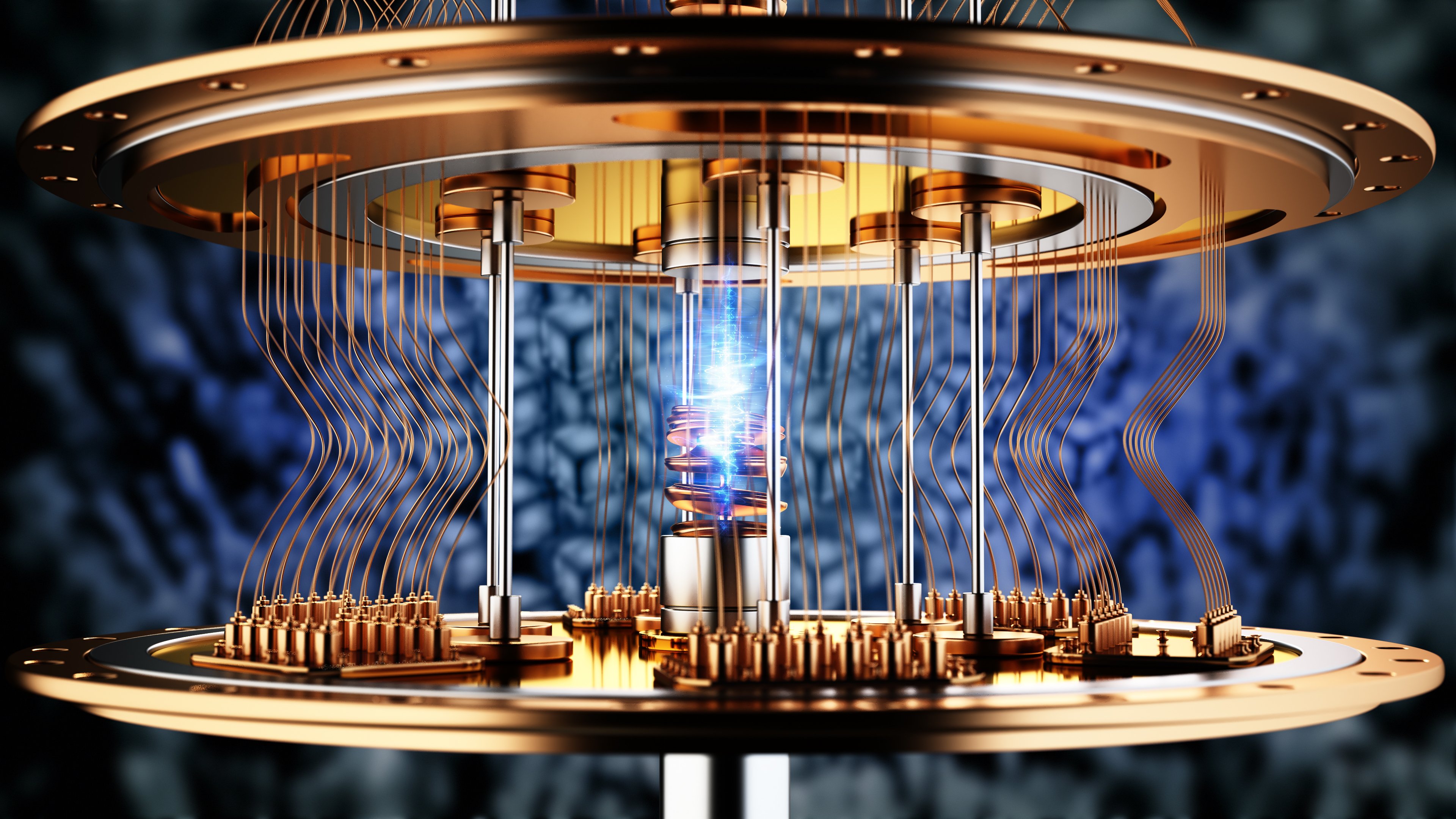

Image source: Getty Images.

IonQ has the industry's most accurate solution

Quantum computing has several benefits over traditional computing methods. but it will never be able to replace traditional computing completely. And there is one factor holding it back from more widespread usage right now: accuracy. Quantum computers make a lot of mistakes. Most have about 99.9% two-qubit gate fidelity accuracy -- meaning the computer makes an error once for every 1,000 calculations that pass through two processing gates -- or worse.

IonQ's technology is best-in-class and boasts 99.99% two-qubit gate fidelity, which means it makes one error about every 10,000 calculations. That's a huge improvement -- and it's because of the computing technique that IonQ uses.

NYSE: IONQ

Key Data Points

Most quantum computing companies use the superconducting technique, which requires cooling a particle down to near absolute zero. This is both expensive and less accurate than the trapped ion approach that IonQ uses, which can be done at room temperature.

The primary downside of the trapped ion approach is processing speed. Superconducting computers are much faster, and if a quantum computing competitor develops a superconducting platform that matches IonQ's accuracy, IonQ's products wouldn't be as attractive.

IonQ reached the 99.9% two-qubit gate fidelity threshold in September 2024 and the 99.99% threshold in October 2025. So, IonQ has about a one-year head start on the competition. However, useful quantum computing is still a few years out, which could leave plenty of time for competitors to catch up to IonQ.

2030 is the date most companies point to for implementation

IonQ and most of its competitors have commonly stated that commercially viable quantum computing won't be available until about 2030. That's still five years away, and a lot can happen in five years. It could be enough time for IonQ to establish itself at the top of the quantum computing hierarchy or have the stock sink to $0.

This makes IonQ a high-risk, high-reward stock, as there's no guarantee that its product will be the winning one in the end. While I like what I see in IonQ's technological development, it's going up against some well-funded competitors.

With the market likely to hold off on high-risk stocks until we get clarity on job markets and inflation, this sell-off may continue. If we get bad news, that rates will stay higher for a while, then this sell-off could drag on.

As a result, I think investors are better off staying patient. There will likely be multiple sell-offs between now and 2030, so this won't be your only chance to buy IonQ at a discount. Unless something dramatic changes in the market, IonQ could be headed lower, and being patient may reward investors over the long term.