Any concerns about the health of the artificial intelligence (AI) industry were put to rest on Nov. 19 when Nvidia (NVDA +1.42%) released its fiscal 2026 third-quarter results (for the three months that ended Oct. 26).

Nvidia is an AI bellwether as its graphics processing units (GPUs) and other products are critical parts of the data center infrastructure that's needed to run AI workloads. So, the company's better-than-expected results were just what the AI sector needed at a time when concerns have been growing that AI stocks are in a bubble.

Here's why Nvidia's latest quarterly report suggests that the AI market's growth isn't going to cool down any time soon.

Image source: Nvidia

AI computing demand continues to outpace supply

Nvidia sells GPUs and rack-scale systems that integrate multiple GPUs, central processing units (CPUs), memory chips, and cooling systems onto a single platform. These chips and systems go into data centers where they are deployed in massive volumes by hyperscalers, cloud computing companies, and AI companies to run AI models and inference applications.

Nvidia is the leading player in the AI chip market by quite some distance. So the terrific 66% year-over-year increase in its data center revenue last quarter to a record $51.2 billion is proof that the demand for AI chips is robust. What's more, CEO Jensen Huang pointed out that all its cloud GPUs are sold out, suggesting that the AI chip market isn't going to cool down any time soon.

The growth in the company's data center business boosted Nvidia revenue by 62% to a record $57 billion. The company's non-GAAP earnings surged by 60% year over year to $1.30 per share. The results exceeded analysts' consensus expectations of $1.26 per share in earnings on $55 billion in revenue.

NASDAQ: NVDA

Key Data Points

Given that it is selling hardware as fast as it can be fabricated, Nvidia's performance could possibly have been better had it not been held back by supply constraints. And the company is taking steps to bolster its supply chain by "ordering to secure long lead-time components, meet the demand for Blackwell, and support future architecture ramps."

Another important thing to note here is that Nvidia's guidance supports the idea that its growth isn't going to slow down. The company forecast $65 billion in revenue in the current quarter, which would be an increase of 65% from the year-ago period. Additionally, its guidance for a gross margin of 75% would be an improvement of 150 basis points (1.5 percentage points) from last year. That should translate into stronger earnings growth.

All this suggests that Nvidia is on track to maintain outstanding growth levels despite its enormous revenue base. What's more, management's commentary on the latest conference call suggests that Nvidia is on track to keep doing so at least into the medium term.

During the earnings conference call, Nvidia CFO Colette Kress acknowledged that the company has received $500 billion in orders for 2025 and 2026 for its current generation of Blackwell processors and the Rubin processors that it will launch next year. Nvidia has already shipped $150 billion worth of these orders.

So, it is still sitting on $350 billion of orders for the next five quarters. That translates into a quarterly data center revenue run rate of $70 billion. However, Kress pointed out that the company is still receiving more orders, citing the example of its deal with Saudi Arabia for 400,000 to 600,000 GPUs. That's why Kress said that "there's definitely an opportunity for us to have more on top of the $500 billion that we announced."

This means that Nvidia's data center business is on track to become even bigger over the next year or so, positioning it to pull further ahead of its rivals. And that's precisely the reason why the company is likely to remain the best bet in AI chips.

Here's why buying this chip bellwether is a no-brainer after its latest results

Assuming Nvidia indeed hits the $70 billion quarterly revenue run rate in its data center business implied by its backlog, it will remain way ahead of Advanced Micro Devices and Broadcom, two of its closest competitors in this space.

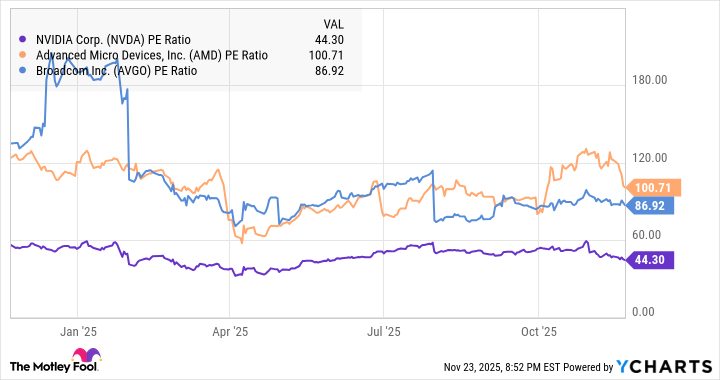

While both AMD and Broadcom are expecting remarkable growth in their own data center businesses, which are gaining traction thanks to improving sales of their AI chips, they are nowhere near the scale that Nvidia has achieved. What's more, Nvidia stock is trading at a cheaper price-to-earnings ratio than either AMD or Broadcom, while clocking much faster growth.

NVDA PE Ratio data by YCharts.

All this makes it clear that Nvidia remains the best AI stock you can buy right now, as its dominance in the fast-growing AI chip market is likely to translate into more upside for investors.