If you're familiar with the stock market, you're probably aware of the S&P 500. It's one of the best-known stock market indexes, and is what people typically refer to when discussing the U.S. stock market as a whole. For those who don't know, the S&P 500 index is a market-cap-weighted index of 500 prominent U.S. companies.

You can invest in the S&P 500 via an index fund, such as the Vanguard S&P 500 ETF (VOO +0.55%). The Vanguard fund is very popular and has traded since 2010. For many, it's a no-brainer investment, and you can buy a share of the index fund for under $1,000.

You often hear people talk about buying low and selling high. So why then should investors buy when the S&P 500 is already near all-time highs?

Here is what history says about that.

Image source: Getty Images.

It often pays to be an optimist

Look, I get it. Nobody wants to feel like a sucker, overpaying for something only to have its value quickly drop like a rock after you've invested.

But the reality is that isn't typically how it works. While stock prices fluctuate over time, they usually rise more often than they fall. Historically, the average bull market lasts six years and 10 months, while the average bear market lasts one year and three months.

There's a saying that the stock market tends to take the stairs on the way up, and the elevator on the way down. That's why bear markets can seem so scary, even though they don't typically last long. Yet, if you sit around holding your money, you're more likely to miss out on a lot of gains.

NYSEMKT: VOO

Key Data Points

But what if you're wrong?

The S&P 500 has soared in recent years, primarily due to the "Magnificent Seven" stocks and the massive sums of money flowing into artificial intelligence (AI). Yes, if the AI trend falls off, the market could decline, and yes, the S&P 500 is very expensive right now compared to its historical norms.

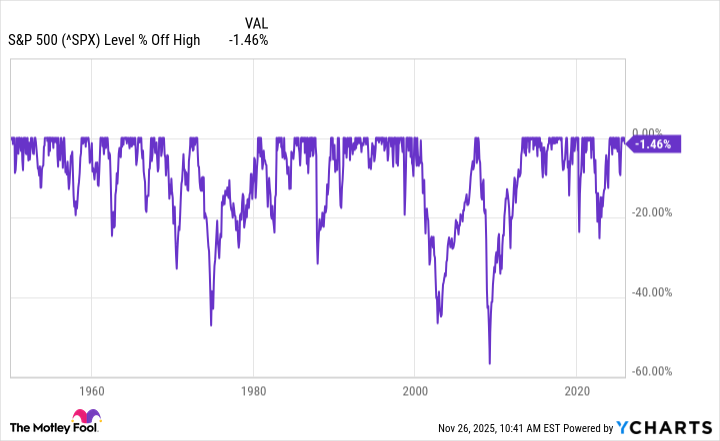

But nobody can predict declines, or, at the very least, the timing. The more important takeaway is recognizing that this is simply the latest edition of a movie the stock market has seen before. In fact, the S&P 500 declines quite often when you zoom out -- sometimes by quite a lot.

Data by YCharts.

So, what if the optimism is misplaced and the market does plunge in the near future?

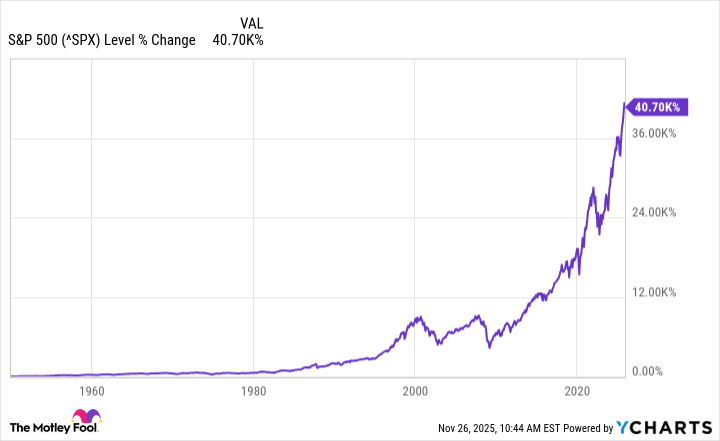

Consider that the United States, its economy, and its stock market have experienced periods of growth and contraction throughout its history. Yet the country and the stock market have repeatedly recovered and reached new heights.

If you look at the same chart above in a different light, you'll see that even the most dramatic declines look minor decades later.

Data by YCharts.

That's the superpower of long-term investing. As long as America's best businesses, often found in the S&P 500, continue to thrive, the stock market will eventually follow.

Here is the smartest way to invest

Ultimately, it's wise to take a measured approach to investing, since we don't have that elusive crystal ball to predict what might happen tomorrow, next week, or next year.

Consider dollar-cost averaging into your investments. That's where you invest smaller amounts on a schedule, slowly building your positions over time. That way, you'll help ensure you don't jump in with both feet at the wrong time.

You can buy a share of the Vanguard S&P 500 ETF for under $1,000, but don't worry if that's not feasible for you. The index fund has a minimum investment of only $1, so it works for any budget. You can invest a dollar amount that suits you into fractional shares.

It's another reason why investors hold the Vanguard S&P 500 ETF in such high regard.