A company's market cap is found by multiplying its stock price by its number of outstanding shares. Typically, stocks fall into the following three categories: small-cap, mid-cap, or large-cap. However, some stocks' valuations have increased so much that a new category has emerged: mega-cap.

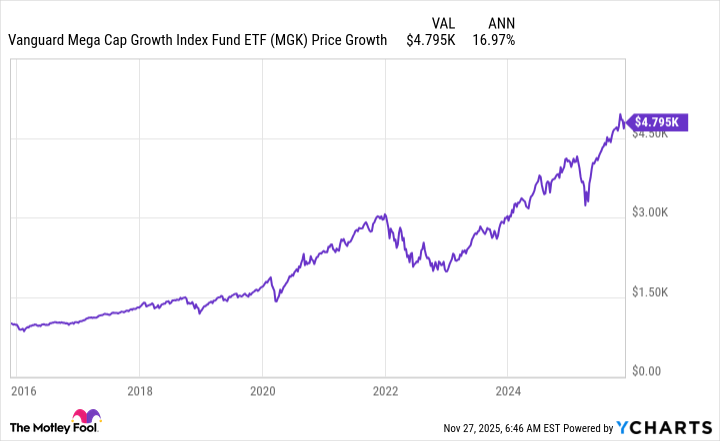

The Vanguard Mega Cap Growth ETF (MGK +0.08%) holds 66 of the largest American companies and has been one of the best-performing ETFs over the past decade. In that time, it's up close to 380%, meaning a $1,000 investment made 10 years ago would be worth around $4,800 today.

Although MGK contains 66 stocks, a few mega-cap tech stocks have been doing the heavy lifting, especially over the past few years, with the artificial intelligence (AI) boom. MGK's top 10 holdings account for 65% of the ETF, with its top three holdings -- Nvidia, Apple, and Microsoft -- accounting for over 38% by themselves.

This high concentration of tech stocks has worked wonders for MGK, as they have been among the best-performing stocks over the past decade. The three stocks mentioned above are up above 23,000%, 840%, and 804%, respectively, in that time span (through Nov. 27).

NYSEMKT: MGK

Key Data Points

I'd caution against making MGK a large portion of your portfolio because of its concentration and overlap with other major indexes like the S&P 500 and the Nasdaq Composite. However, it can be a good complementary piece for people wanting exposure to mega-cap growth stocks.