Cameco (CCJ +4.17%) is the largest publicly traded producer of uranium, the fuel that is used by nuclear power plants. It has a long and largely successful history behind it. Cameco is a solid "picks and shovels" play for those interested in investing in nuclear power. But is it worth buying the stock now that it has pulled back from its 52-week high of $110 per share? It depends.

What does Cameco do?

For the most part, Cameco is a uranium miner and processor. It produces the fuel used by the nuclear power industry. Given that the vast majority of its operations are in politically and economically stable regions, it is an attractive partner for the industry. However, uranium is a commodity, and mining is still a challenging and costly endeavor.

Image source: Getty Images.

Potential investors need to keep these facts in mind. Uranium prices have a history of being volatile, particularly following nuclear reactor meltdowns. The last meltdown to occur was Fukushima in 2011. That accident captivated the world and led to countries reevaluating their investment in nuclear power. The price of uranium plunged and remained low for a decade.

It isn't even unrealistic to believe that such an accident could happen again at some point, even as the technology behind nuclear power safety improves. While nuclear power is generally safe, accidents can and do still occur.

Beyond the uranium component of the equation, investors need to consider the mining aspect. Building and operating a mine is expensive and time-consuming. Once again, accidents can happen, which could disrupt Cameco's business. While it has a history of operational success, no company is perfect.

Cameco has attempted to diversify slightly by acquiring half of Westinghouse, which provides services to the nuclear power industry. That should help to smooth out the company's income stream. However, there are still inherent risks to Cameco's business that investors need to keep in mind at all times.

NYSE: CCJ

Key Data Points

The opportunity ahead looks attractive right now

Cameco's 52-week high also happens to be its all-time high. Even after a roughly 15% pullback from that peak, however, the stock is still up 50% over the past 12 months. This is largely because investors have become enamored of the nuclear power industry again, thanks to increasing electricity demand from things like data centers, artificial intelligence, and electric vehicles.

That said, there's a quandary in the uranium industry. Investment in the industry was curtailed after the Fukushima disaster. Given the current supply projections, strong future demand is expected to lead to a material supply/demand imbalance starting around 2030. When a commodity's supply falls short of demand, prices tend to rise. Higher uranium prices would lead to higher revenue for Cameco. The business is leveraged to the increasing demand for nuclear power.

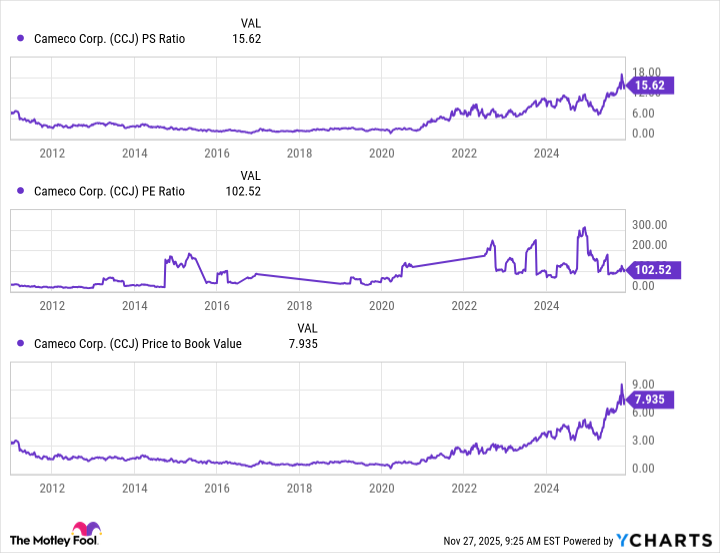

CCJ PS Ratio data by YCharts

The problem is that Wall Street seems to be well aware of the opportunity ahead. Cameco's price-to-sales, price-to-earnings, and price-to-book value ratios are all significantly above their levels prior to the Fukushima disaster. This suggests that a lot of good news has already been factored into the stock. Any misstep by the company or setback for the industry could prompt investors to dump the shares.

Probably best left on the wish list for now

Cameco is a well-run company. In fact, its ability to survive the uranium pullback following the Fukushima disaster is clear evidence that it knows how to handle adversity. If you do buy it, you are acquiring a good business. However, it also appears that you will be paying a premium price.

Unless you believe strongly in the nuclear power story, you will probably want to hold off on buying Cameco, despite the 15% pullback from its 52-week high of $110 or so.