For nearly a decade, Apple (AAPL 0.13%) has been a mainstay in Berkshire Hathaway's (BRK.A +1.47%)(BRK.B +1.27%) portfolio.

In 2016, Warren Buffett first approved of adding Apple shares, initiating a $1 billion purchase. In the years that followed, Berkshire continued to add more and more Apple stock. At one point, the company's position was valued at more than $100 billion -- its biggest bet ever.

Apparently, Buffett and his lieutenants are quickly souring on the stock. In six of the last eight quarters, Berkshire has sold down its stake. And while it remains Berkshire's biggest holding, Apple investors are left wondering: Why is Buffett seemingly selling his Apple stake as quickly as possible?

There are two likely reasons, one of which may surprise you.

1. Buffett seems nervous about the stock market

It isn't just Apple stock that Buffett is selling. Many of his key positions have been trimmed in 2025. And right now, Berkshire Hathaway is holding on to more cash than it ever has in its history. Roughly one-third of its entire market cap is now tied up in cash.

It's hard not to conclude that Buffett isn't a huge fan of market valuations right now. That's because he has long warned against holding cash. "Cash is always a bad investment," he said in 2009. "When people say 'cash is king,' that's crazy ... It was sure to go down in value over time." He went on to say that he actively avoids holding too much cash:

You don't need to have excessive amounts of it around. Anytime we have surplus cash around, I'm unhappy. I would much rather have good businesses than cash.

NASDAQ: AAPL

Key Data Points

So why is Buffett holding so much cash at Berkshire? There is only one reasonable conclusion: He is having a tough time finding enough deals to absorb Berkshire's growing cash hoard. Right now, stock market valuations are near historic highs. The S&P 500, for instance, trades above 30 times earnings, something it has done only a few times over the past three decades.

So although Apple has been on the chopping block, the selling may deal with more than the company's valuation. But on that front, Buffett may have worries as well.

Image source: Berkshire Hathaway.

2. Apple stock isn't the value it used to be

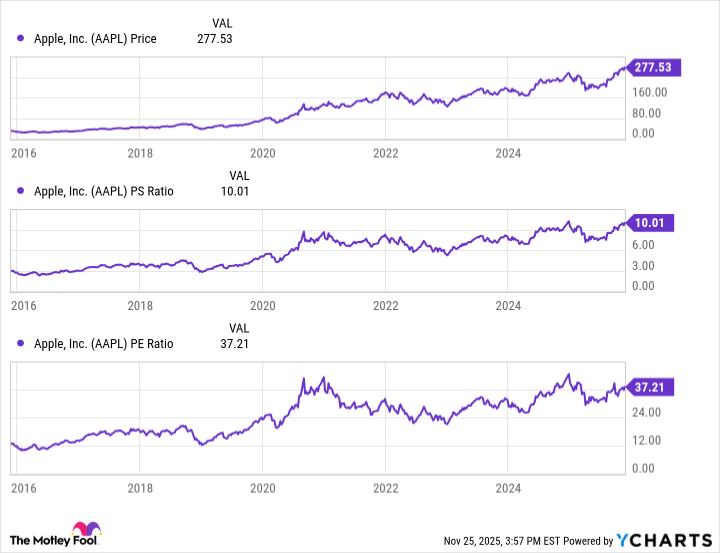

When Buffett started buying Apple stock, shares traded with a price-to-sales (P/S) ratio below 3. On a price-to-earnings (P/E) basis, shares traded below a ratio of 12. Today, Apple trades above 10 times sales, with a P/E of nearly 40. All of this occurred as Apple's market cap soared from well under $1 trillion to more than $4 trillion, a reality that would theoretically make future growth harder to come by.

There's just one problem with this high valuation: The company's growth has slowed dramatically compared to the past. While revenue increases have varied over time, they regularly reached 10% or more from 2012 to 2022. In 2023 and 2024, however, Apple's revenue growth briefly dipped into the negatives. This year, sales gains are expected to be just 8.8%, with estimates calling for only 6.2% next year.

To be sure, Apple is still a high quality business with a strong moat and cash flow profile. Sales are still rising, too, just not as quickly as in the past. But that valuation looks to have become a bit out of control, a view that Buffett seemingly agrees with now.