If you have ever lived through a prolonged blackout, you know that the modern world comes to a screeching halt without electricity. Supplying the world with electricity is a significantly larger task than simply installing a few power plants. A comprehensive infrastructure is required to manage the flow and use of electricity effectively, which is the primary focus of Eaton (ETN +2.28%), one of the world's largest industrial companies.

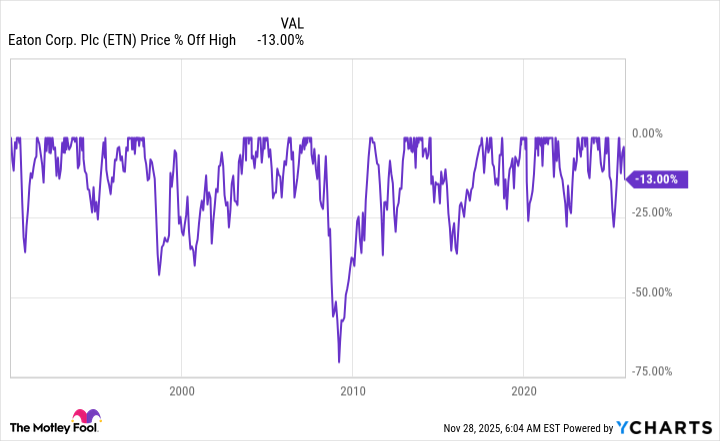

With Eaton's shares currently trading down around 13% from their 52-week highs, is now the time to buy the stock? Here's what you need to know.

Image source: Getty Images.

Eaton is positioned for success

Eaton's big makeover occurred in 2012 when the company acquired Cooper Industries for around $13 billion. The CEO at the time described the acquisition as transformational, explaining: "Cooper adds proven capabilities in utility power distribution, smart grid, lighting, lighting controls, wiring devices, and safety solutions to Eaton's strengths in power quality, power distribution, and energy services. These complementary technologies further accelerate Eaton's growth as a global integrated power management company focused on one of the most challenging megatrends of our time: the rising costs and increasing environmental impact of the world's growing energy use."

The first big step was to integrate Cooper into Eaton. Then the company began to streamline its operations, exiting businesses that were less profitable and more cyclical in nature, such as hydraulics. This was a multiyear effort that involved the company pausing dividend growth for a few years. Investors soured on the shares for a while, even though the company, in hindsight, was setting itself up for success.

The key figure to note here is that electricity demand increased by a total of 9% between 2000 and 2020. However, between 2020 and 2040, electricity demand is expected to grow by 55%. The Cooper deal was a little early, but that gave Eaton time to prepare for the demand spike that was coming. Electricity demand is already rising, driven by material needs from data centers, artificial intelligence, and electric vehicles.

The future looks bright, but what about Eaton's price?

Eaton is exactly where it wants to be at this point. The industrial giant has a globally diversified business focused on key power management trends that are likely to support decades of growth. The problem is that Wall Street is aware of this fact and has priced the stock accordingly. For example, the stock's price-to-sales, price-to-earnings, and price-to-book ratios are all above their five-year averages.

Not only do traditional valuation metrics hint at a lofty price, but the stock's recent 13% decline is from the 52-week high, which also happens to be the stock's all-time high. As the chart below highlights, however, 13% isn't that big a decline for Eaton, which has a history of fairly frequent drawdowns that exceed 25%. In fact, there was just such a drawdown earlier in 2025.

Data by YCharts.

Eaton is a well-run company that has positioned itself to benefit from a multidecade industrial trend. The problem is that it is an expensive stock, and the 13% decline from recent highs just isn't large enough to bring the valuation back to an attractive level. Most investors should keep this stock on their wish list for now.

Be patient with Eaton

That said, you should prepare to buy Eaton when other investors are downbeat on the stock. If the current decline deepens to 25% or more, you may want to revisit this well-positioned industrial giant. The problem at that point, however, is likely to be emotional, since it requires a contrarian streak to buy when others are selling. If you steel yourself now, you may have the fortitude to go against the crowd when Eaton's valuation is more compelling.