Shares of Remitly Global (RELY 1.49%) were pulling back last month due to a post-earnings sell-off in the digital remittance specialist, in spite of generally solid results.

The report was overshadowed by its forecast calling for slowing growth and concerns about rising credit risk, in part due to a weakening economy in the U.S.

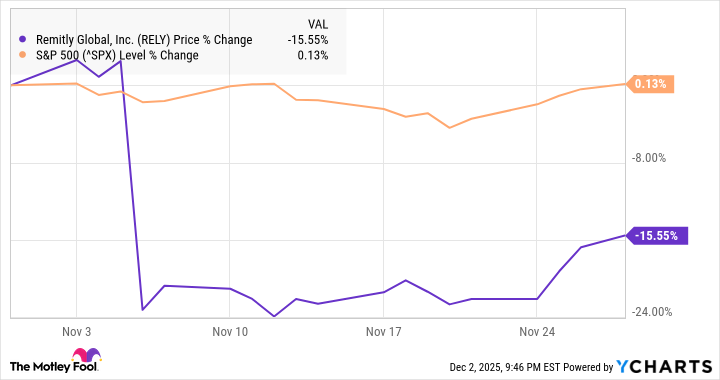

The stock hit a 52-week low during the month and finished down 16%, according to data from S&P Global Market Intelligence. As you can see from the chart below, Remitly plunged early in the month following its earnings report, but recouped some of those losses in the last few days of November.

What's ailing Remitly

Remitly is a disruptive fintech stock, growing rapidly and taking market share from traditional leaders like Western Union and MoneyGram.

However, the stock has mostly been a disappointment to investors, and that pattern was on display again last month.

Remitly's overall third-quarter results were strong. Active customers increased by 21% to 8.9 million, and send volume rose 35% $19.5 billion, which translated to a 25% increase in revenue to $419.5 million, beating the consensus at $413.7 million.

On the bottom line, adjusted earnings before interest, depreciation, and amortization (EBITDA) rose 29% to $61.2 million.

The company's take rate, or the percentage of send volume it converts into revenue, fell as it expanded its platform with new products like Remitly Business, its Remitly One membership program, which offers features like "send now, pay later," and stablecoins that allow for transfers of tokenized U.S. dollars.

Still, the exposure to credit risk in an uncertain macro environment and disappointing fourth-quarter guidance led to the sell-off.

Looking ahead to the fourth quarter, management called for revenue of $426 million-$428 million, or 21% growth, which was below the consensus at $430.5 million.

Image source: Getty Images.

Can Remitly bounce back?

Remitly's revenue growth is slowing, a sign that the core business may be starting to mature, and the company called for high teens revenue growth in 2026, a moderation from the fourth quarter.

However, at its current price, Remitly looks like a bargain, trading at a price-to-sales ratio of less than 2, and just 12 times its expected EBITDA for the full year. The company also expects to be profitable on a generally accepted accounting principles (GAAP) basis for the full year.

With its recent product expansions and targeting of high-value senders, the stock still has a lot of upside potential. The discount price may not stick around for long.