Is Starbucks (SBUX 2.15%) stock on the dreaded investor naughty list this holiday season?

Its recent share price performance suggests that it is. A string of uninspiring earnings reports has really dampened sentiment on the once-mighty coffee king. If we look back a few months and years, however, the situation might appear a little different.

A fallen Starbucks

No, it doesn't.

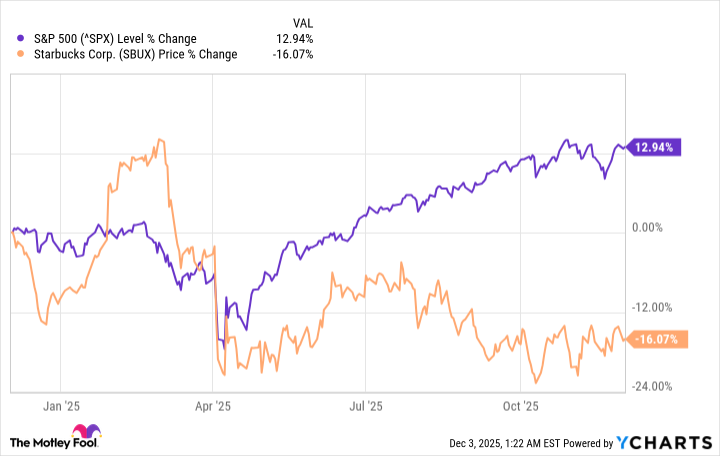

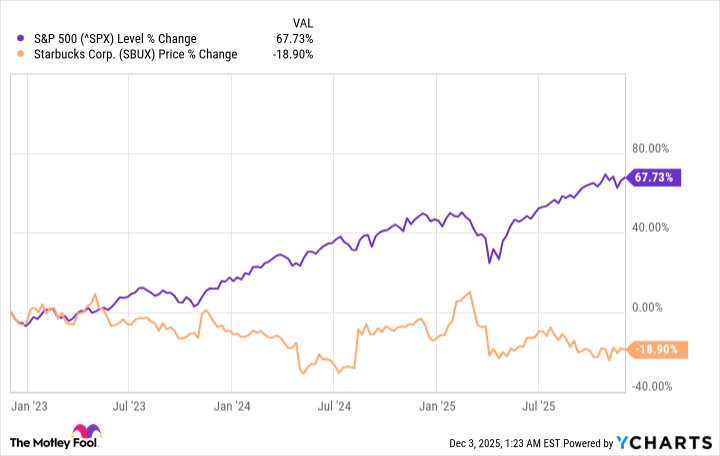

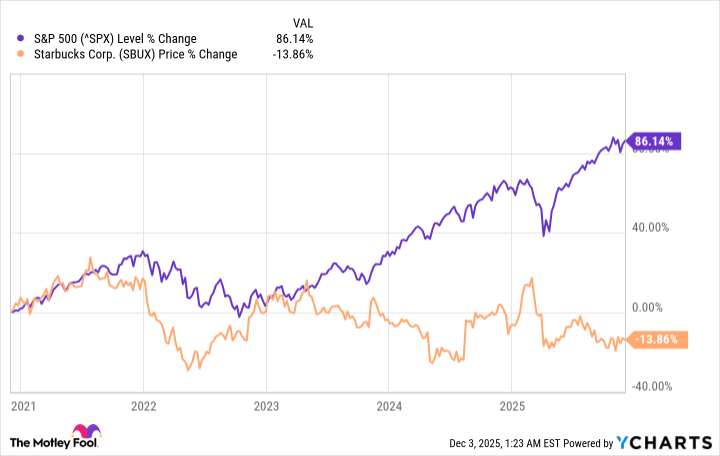

Over the past one, three, and five years, Starbucks has notably underperformed the bellwether S&P 500 index. In all three spans, it has not only been beaten by the index but has also fallen in price at double-digit percentage rates. Take a look:

Why has this once-hot, fresh cup of coffee gone cold? Much of this is because of good, old-fashioned fundamentals.

In each of the four quarters of fiscal 2025 (which ended Sept. 28), Starbucks not only posted a decline in net income according to generally accepted accounting principles (GAAP), but a steep one. Add them all up, and for the full year, the company's GAAP bottom line was $1.86 billion. That's a scary 51% down from the fiscal 2024 result.

There has been top-line growth, yes, but it's skinny. Again for the entirety of fiscal 2025, net revenue inched up by less than 3% to almost $32.2 billion. In retail, though, more emphasis is placed on comparable sales, and on this basis, Starbucks hasn't excelled. Its full-year global "comps" fell by 1%, with its two major markets (the U.S. and China) both suffering declines.

Back to the past

Shortly after Starbucks hired onetime Chipotle Mexican Grill CEO Brian Niccol to lead the company in mid-2024, it launched a turnaround strategy. The "Back to Starbucks" priority initiative was designed to bring more traffic into the stores, hopefully returning the company to its hearty growth days.

NASDAQ: SBUX

Key Data Points

In the words of Starbucks, this would center on "enhancing the in-store experience with the return of the condiment bar, writing on cups, more ceramic mugs and a revised code of conduct," plus other measures, including a goal to close customer orders within four minutes.

None of these, it has to be said, felt like business-shaking changes to me at the time. And these days, in my semi-regular visits to Starbucks cafes, the experience feels pretty much the same as it has for years (not counting the unusual disruptions of the COVID-19 pandemic, of course).

Image source: Starbucks.

I don't feel particularly welcome at these outlets, which continue to emit a palpable "get your stuff and go" vibe, despite the typically friendly employees. For the most part, these places are not cozy, and I have little desire to sit down and relax with my hot beverage and snack. If they were, I'd probably be inclined to spend a bit more money, given the increased time spent there.

Starbucks has been reducing its heavy store footprint lately, mainly in its native U.S. Like the ceramic cups and the four-minute maximum, though, I don't think this is solving the problem. Management needs to find ways of inspiring its customers, rather than tweaking the same old, same old. Until there's some indication it can do that, I'd stay away from the stock for now.