Shares of Strategy (MSTR 6.73%) tumbled 34.3% in November 2025, according to data from S&P Global Market Intelligence. The crash resulted from Bitcoin (BTC +0.89%) losing value in November.

Image source: Getty Images.

Strategy is a Bitcoin amplifier on steroids

The data analytics software company formerly known as MicroStrategy now refers to itself as "the world's first Bitcoin Treasury Company." Co-founder and executive chairman Michael Saylor takes every opportunity to double down on Strategy's Bitcoin holdings, taking out loans and selling more stock on the open market to pursue that idea.

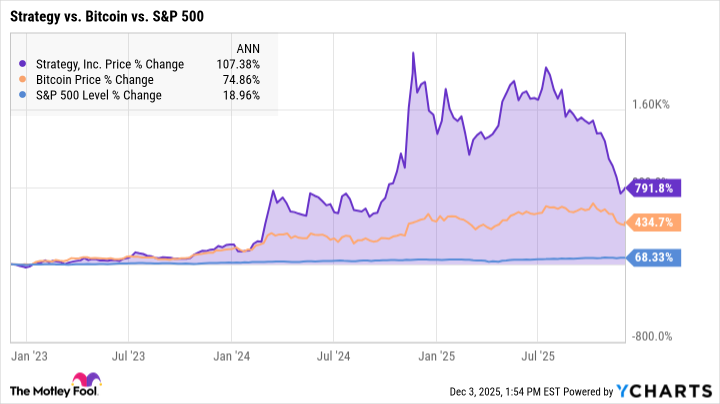

The stock tends to amplify Bitcoin's price chart moves, which makes sense because Strategy is making cash investments to grow its Bitcoin stakes. For example, Strategy shares have nearly doubled Bitcoin's total gains over the last three years. Both investments left the surging S&P 500 (^GSPC +0.54%) index far behind:

Strategy's stock isn't trying to be a spot Bitcoin exchange-traded fund (ETF), like the iShares Bitcoin Trust ETF (IBIT 6.89%) or the Fidelity Wise Origin Bitcoin Fund (FBTC 7.03%). Those funds simply reflect the underlying Bitcoin price moves, based on direct cryptocurrency holdings matching their shareholders' ETF share purchases. There's no effort going on to boost the amount of Bitcoin per ETF share there.

Strategy takes that next step and attempts to increase each shareholder's exposure to Bitcoin over time. Saylor looks like a genius when Bitcoin is moving up. But Bitcoin and many other high-risk investments posted steep price cuts in November 2025, as investors shied away from market risk amid the government shutdown and slowing Federal interest rate cuts. Strategy doesn't look so good in that type of market scenario.

NASDAQ: MSTR

Key Data Points

The Bitcoin treasury strategy is a double-edged sword

Bitcoin fell 16.1% in November, while Strategy's stock approximately doubled the pain. If Bitcoin is poised for a rebound in 2026, Strategy investors will benefit from that recovery. This dip just might be the start of another crypto winter, though. In that cold and dark scenario, Strategy's stock could fall to deeply uncomfortable levels.

Traditional valuation metrics like price to earnings and price to sales don't make a lot of sense for this stock, since Saylor isn't trying very hard to generate dollar-based revenues and profits. As a committed Bitcoin buyer, he'd rather take another loan and sink the proceeds into even more Bitcoin holdings than sell even a fraction of a coin to generate dollar-based revenues. The software business has become an afterthought. Strategy issues more stock as needed to pay the operating bills and debt interest.

So when risk-averse investors are driving Bitcoin prices down, you should expect Strategy's stock to post a much deeper dive. That's what happened in November, and it will almost certainly happen again. Owning Bitcoin isn't for the faint of heart, and Strategy's price swings are even wilder.