Semiconductor stocks have been one of the biggest beneficiaries of the artificial intelligence (AI) boom in the past three years. That's not surprising, as chips are the basic building blocks of AI infrastructure. It wouldn't be possible to train large language models (LLMs) and run inference applications without chips.

As a result, chipmakers such as Nvidia, Broadcom, AMD, and others delivered substantial gains to investors. However, those 2025 returns are being overshadowed by a software specialist that helps customers integrate generative AI tools into their operations.

Palantir Technologies (PLTR +1.31%) stock is up 122% in 2025. That's well above the 41% jump in the PHLX Semiconductor Sector index this year. The signs point to Palantir delivering bigger returns than chip stocks in 2026 as well. Let's see why that may be the case.

Image source: Getty Images.

Palantir's AI software platform is setting it up for phenomenal growth in 2026

While there is no doubt that chipmakers are a key cog of the AI ecosystem, it is the software companies that will eventually help end users unlock the benefits of this technology. This is precisely what Palantir is doing with its Artificial Intelligence Platform (AIP), a set of software tools that helps enterprises connect their data and operations with LLMs to boost operational efficiency, unlock productivity gains, automate processes, and reduce redundancy.

The effectiveness of AIP is encouraging the rapid adoption of the platform. Palantir management pointed out on the company's November earnings call that enterprises tend to scale up AIP deployment across their entire business following the initial deployment. That's in addition to the new customers that AIP is helping Palantir attract.

This explains why Palantir is winning larger contracts, reporting exceptional margin growth, and posting triple-digit growth in earnings. Its revenue growth accelerated to 63% in the third quarter of 2025, while the jump in earnings was even bigger at 110% to $0.21 per share. Even better, Palantir scored new contracts worth $2.76 billion last quarter, up by 151% from the year-ago period.

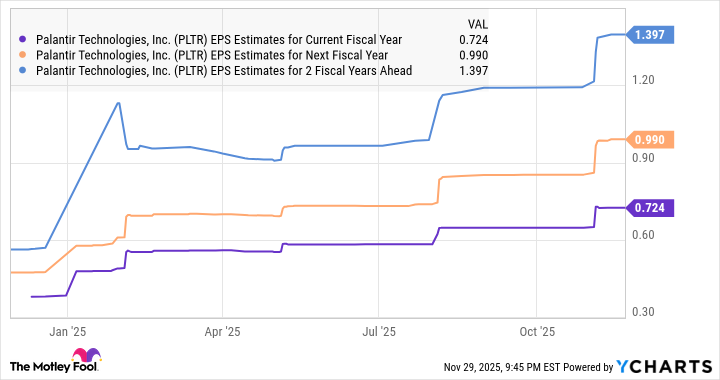

The value of its new contracts was double its revenue, indicating that it is now on track to deliver even faster top- and bottom-line growth going forward. As a result, Palantir's earnings estimates for the current and the next two years have moved up significantly.

Data by YCharts.

There is a good chance of Palantir beating those estimates. After all, the total value of the company's unfulfilled contracts stood at $8.6 billion last quarter, up by 91% from the year-ago period. That number is more than double the $3.9 billion revenue that Palantir generated in the past year. Also, Palantir's customer count jumped by 45% year over year in Q3.

If these new customers continue the trend of expanding their usage of Palantir's AI software platform, then there is a solid chance that its phenomenal earnings growth will continue in 2026. That's precisely the reason why the possibility of the stock sustaining its outstanding momentum cannot be ruled out.

Addressing the elephant in the room

Palantir stock hit a 52-week high on Nov. 3 after releasing its third-quarter results. However, it has dropped 19% since then owing to valuation concerns. Even analysts aren't expecting much upside in the coming year, with the median 12-month price target pointing toward a 14% jump from current levels.

NASDAQ: PLTR

Key Data Points

With the stock trading at 166 times forward earnings and 107 times sales, you may be wondering how Palantir can outperform chip stocks in 2026. After all, its valuation is too rich right now, and that may weigh on the stock in the coming year. But then, don't forget that Palantir delivered triple-digit earnings growth last quarter.

What's more, its earnings growth has been picking up this year. Palantir reported a 77% jump in earnings in the second quarter, preceded by a 62% increase in Q1. That trend is likely to continue next year as well, considering its expanding customer base and massive revenue backlog. Palantir's earnings, therefore, could increase at a much faster pace than consensus expectations of 37% in 2026.

As such, Palantir is capable of justifying its expensive valuation by comprehensively crushing Wall Street's expectations next year. That should ideally pave the way for more upside in this AI stock, potentially enabling it to perform better than AI chip stocks in 2026 as well.