I've bought shares of short-term rental platform Airbnb (ABNB 1.46%) since 2021. And I doubt I'll ever sell them.

Others may criticize my fanaticism about Airbnb stock, and the criticism is fair. I've paid an average of $160 per share of Airbnb, whereas it trades at just $120 as of this writing. I've patiently held, and I've lost money. In other words, my never-sell mentality isn't paying off yet.

Image source: Getty Images.

My enthusiasm for owning Airbnb stock stems from my love of the platform as an avid longtime user. As a traveler, I've stayed in unique places, met interesting people, enjoyed extra privacy, and saved money with the platform. In short, I always prefer to use Airbnb when possible.

Granted, it's not necessarily a good idea to invest in something just because I like the product. After all, a good product can still suffer from a company's poor financials. However, being such a big fan of the brand, I can't imagine moving on from the stock.

NASDAQ: ABNB

Key Data Points

That said, there's more to this than just being a fan. Airbnb does have incredible long-term potential from an investment perspective, allowing me to continue holding calmly and patiently. Here are just a few of my favorite aspects of the business that support my investment thesis.

What I love about Airbnb's business

Airbnb doesn't own properties. Property owners voluntarily list spaces on the platform. But why choose Airbnb? It's simple: It has the user base. Consider that many properties are listed on multiple platforms. But according to short-term rental analytics firm Airdna, only 19% of properties list exclusively on Expedia's Vrbo. By comparison, 51% of properties list exclusively on Airbnb.

Simply put, property owners might turn to other platforms to help fill their calendar. But they almost never turn away from Airbnb. It's the platform that properties need to be listed on, giving Airbnb a brand moat.

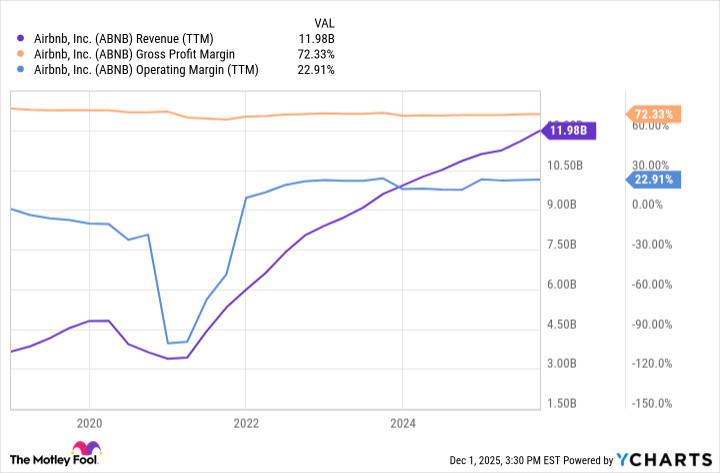

Facilitating the transaction is far more lucrative than renting the property directly. This is why Airbnb enjoys wonderful profit margins. As the chart below shows, the gross margin is consistently above 70%, and the operating margin is usually higher than 20%.

ABNB Revenue (TTM) data by YCharts

I love Airbnb's brand moat and profit margins. But I also love that co-founder and CEO Brian Chesky maintains an entrepreneurial spirit. Management intends to try out several new ideas every year, in hopes that at least one develops into a multibillion-dollar business in time.

Recently, Airbnb added some hotels to its platform. The idea is that if Airbnb sells out its rental supply, it can send travelers to a local hotel and earn a commission. This might not prove to be a big idea. But it represents just one way that Airbnb is striving to leverage its large user base into higher profits.

Even though it's down, I can happily hold Airbnb stock because I'm such a big fan of the platform. I also love the business fundamentals and can patiently wait for one of its newer ideas to pay off. I know not everyone is as big a fan as I am. But these are just a few reasons I don't plan on ever selling Airbnb stock.