Companies involved in artificial intelligence (AI) have proven to be big winners for investors over the past few years -- in many cases delivering double- or triple-digit gains in a short period of time. And chip stocks, particularly AI chip leader Nvidia, have emerged as the perfect vehicle to bet on the AI boom. That's because AI chips are the key tool needed to power the training of AI models and the application of AI to real-world situations.

But chip stocks also come with a certain degree of risk. If AI investment slows or takes a pause, these companies may see a significant drop in revenue and their stock prices.

So, what should you do if you want to invest in AI, but you aim to minimize your exposure to risk? Could the following be the safest way to invest in AI without touching chip stocks? Let's find out.

Image source: Getty Images.

AI and risk

First, let's talk about AI risk. Any new technology comes with risk since it's not yet clear if the technology will be widely adopted or accepted, or if it will result in major earnings gains for its developers. There is also the possibility of outside factors -- like economic problems -- producing stumbling blocks along the way. Finally, as we've seen in recent times, investors may worry that shares of these innovators have climbed too far too fast -- and that valuations have become too high.

All of this means investors who are uncomfortable with risk may think twice before piling into stocks that rely heavily on a new game-changing technology.

Now, let's consider the AI picture. Though chips are the key element powering AI, they aren't the only way to gain exposure to this game-changing technology. Ideally, if you aim to keep risk low, you'll invest in a company that sells AI products and services but doesn't depend heavily or uniquely on AI for revenue. And a player that fits the bill is a company you may know very well: Amazon (AMZN +0.54%).

I probably don't have to tell you that Amazon is an e-commerce giant globally, and that business helped it reach $638 billion in sales in the latest full year. The company's Prime membership program keeps that leadership going, offering customers fast delivery and special deals that spur them to come back. And here, Amazon uses AI to help it gain in efficiency and even help customers as they shop -- this is positive as it lowers the company's costs and pleases shoppers.

AI products and services

But Amazon truly shines as an AI company thanks to its cloud computing business, Amazon Web Services (AWS). Through AWS, Amazon offers customers access to an enormous variety of AI products and services -- from the basics, like chips, to entire platforms like Amazon Bedrock that can help them accomplish their AI goals. AWS also aims to serve every budget, offering its own in-house designed AI chips at lower price points as well as the more costly high-end graphics processing units (GPUs) designed by Nvidia.

NASDAQ: AMZN

Key Data Points

All of this has helped AWS' revenue soar in recent quarters, and in the latest period, the unit reached a $132 billion annualized revenue run rate.

This is great news for investors looking for a potential AI winner -- but what's even better news is that Amazon doesn't depend on AI customer spending. Customers of the e-commerce business are individuals like you or me, or companies and organizations looking for essentials or mass merchandise. And momentum here isn't linked to AI spending.

A successful business model over time

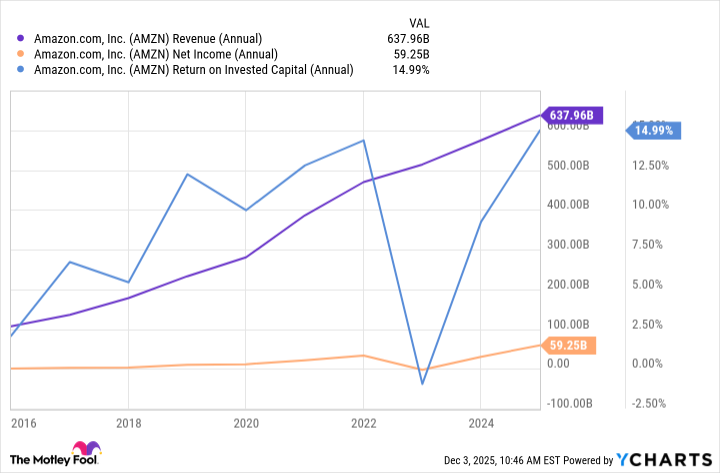

Though AI certainly is supercharging growth at AWS, the cloud business doesn't only serve AI customers. AWS offers a broad range of non-AI cloud services to customers as it's done in the past. And Amazon has demonstrated the success of its business model over time, with earnings and return on invested capital advancing.

AMZN Revenue (Annual) data by YCharts

So, even if general AI development faces headwinds, Amazon has what it takes to continue growing -- both in the e-commerce and cloud businesses.

On top of this, investors who have worried about the valuations of AI players may be happy to learn that Amazon, trading for 32x forward earnings estimates, is very reasonably priced right now.

All of this means that Amazon may be the safest way of investing in AI today without even touching a chip stock.