The first thing you need to know about Enterprise Products Partners (EPD +0.86%) if you are a dividend investor is that its yield is juicy 6.7%. The second thing is that this midstream master limited partnership (MLP) has increased its distribution annually for 27 consecutive years. Given the simple math of dividend yield, these two facts are tightly related and help explain why the unit price is in a three-year uptrend.

The math behind dividend yield

Dividend yield is simply the current annualized dividend payment a company offers divided by the current price. If the dividend payment goes up, the only way for the yield to stay the same is for the stock price to rise, too. Conversely, if the dividend falls, the yield will remain the same only if the stock price also falls. This may sound like stating the obvious, but it is important to keep in mind.

Image source: Getty Images.

Income investments often trade within yield ranges. Sometimes the range can shift up or down, but the more common theme is that a dividend increase (or cut) leads to an increase (or decrease) in the share price of a dividend stock. Steady dividend increases tend to lead to steady share price appreciation. This is why investors are so fond of companies like Dividend Kings, which have an incredible 50+ years of annual dividend increases behind them.

Enterprise Products Partners is not a Dividend King, but its streak of 27 consecutive annual increases remains impressive. Moreover, that streak is basically as long as the midstream MLP has existed. So the pipeline and energy infrastructure operator has a strong distribution history. Not surprisingly, the stock price has trended upward over time, in line with the dividend.

NYSE: EPD

Key Data Points

The trends are back to normal

To be fair, there was a period in the early teens when investors looked at the midstream sector as a growth industry. Higher multiples were assigned to the sector, leading to lower yields. When the view shifted around 2015, Enterprise's unit price fell along with the rest of the industry. That made it more difficult to fund growth via issuing new units to tap the capital markets for cash.

The unit price moved generally sideways for a while as Enterprise adjusted its business model to self-fund more of its own growth. And then the pandemic struck, resulting in a significant drop in unit prices during the bear market that occurred at the time. However, Enterprise not only survived all that turbulence but also managed to continue increasing its distribution throughout the difficult times. Now, around five years after the pandemic-induced price drop, Enterprise's unit price has been heading higher.

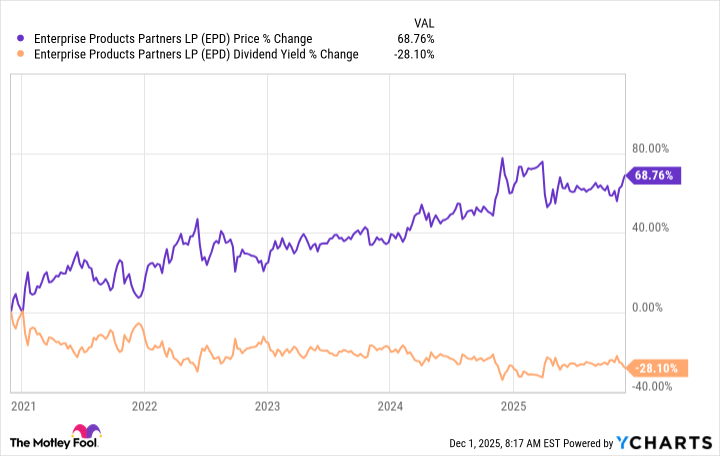

Here's the interesting thing: The yield is down around 30% over the past five years, but Enterprise's unit price is up nearly 70%. Yes, there was some recovery from the pandemic-induced drop in the mix, but by and large, the stock has risen in tandem with the distribution, keeping Enterprise's yield fairly stable over time. Note that the average yield over the MLP's history is roughly 6.2%, which is just a bit lower than the current yield of roughly 6.7%.

Enterprise is a slow and steady tortoise, so it won't be an exciting income stock to own. The yield will likely make up the lion's share of your return over time. However, if you are looking to generate a reliable income stream, the lofty yield should be attractive. And so should the history of regular distribution increases.

You'll also get the price kicker, too

Enterprise has proven itself to be a solid income generator. However, let's revisit the distribution history and the math behind dividend yield. The steady distribution increases have also set investors up for steady capital appreciation. Given that the current yield appears fairly attractive historically, now may be a good time to buy Enterprise Products Partners for long-term dividend investors. You get income, income growth, and, if the yield range holds, price increases, too.