It's not often that a stock that skyrockets by nearly 1,100% over just six months, but that's exactly what shares of Zepp Health (ZEPP 2.37%) have done. That meteoric rise, however, may seem a bit less impressive after one notices that the stock is still down by about 37% from where it debuted on public markets in February 2018, and off more than 60% from its peak.

Let's take a closer look to see what has driven the market to bid this maker of health wearables higher in 2025, and what investors should do now.

Image source: Getty Images.

The market has been sold on Zepp's success in growing sales

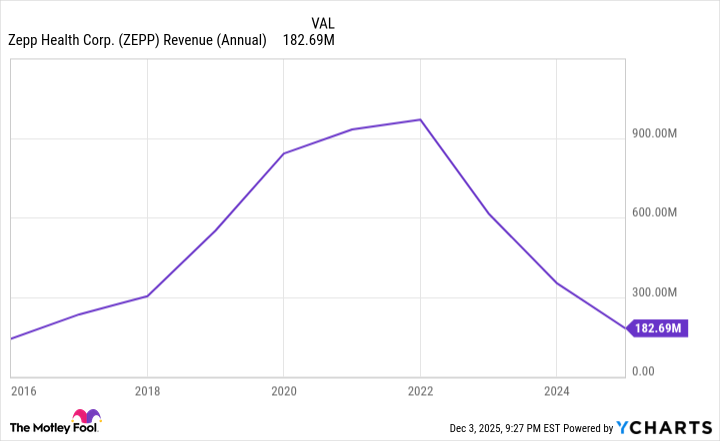

Zepp Health experienced numerous ups and downs in the years following its initial public offering, when it was known as Huami. Beginning in 2022, however, the stock swung sharply lower and stayed down as, after years of growth, the company's revenue reversed course and plummeted.

ZEPP Revenue (Annual) data by YCharts.

More recently, however, Zepp delighted investors in August with second-quarter results that featured notable top-line growth, driven by strong sales of its Amazfit wearables. Zepp reported Q2 revenue of $59.4 million, a year-over-year increase of 46.2%. That exceeded the higher end of the range of $50 million to $55 million that management had forecast three months earlier.

NYSE: ZEPP

Key Data Points

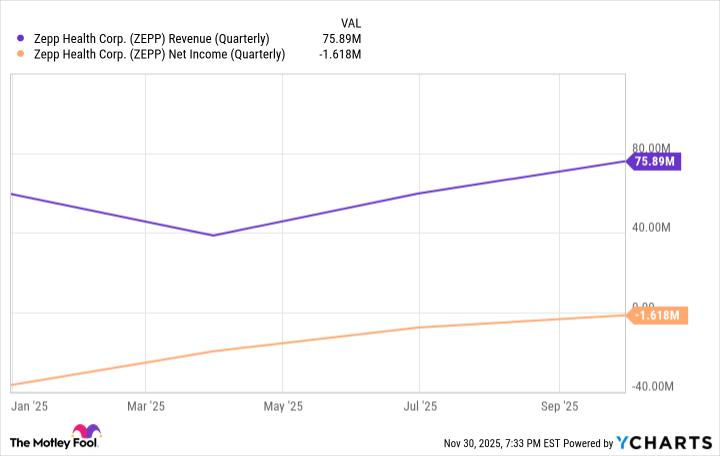

The company also projected that robust sales growth would continue, forecasting Q3 revenue in the range of $72 million to $76 million. And it did report Q3 revenue of $75.8 million -- up 78.5% year over year.

Still a good time to click the buy button on Zepp

The company is also making progress toward achieving profitability.

ZEPP Revenue (Quarterly) data by YCharts.

Granted, there's still some risk with Zepp stock as the company continues to incur losses, but the tech stock's 54% pullback from an intraday high of $61.85 on Oct. 9 and the fact that it's currently valued at only 1.2 times forward earnings suggest that now's a good time to consider opening a position.