Meta Platforms (META +1.72%) stock is nearly in bear market territory. After pledging massive amounts of spending on capital expenditures (capex) to compete in artificial intelligence (AI), the stock has pulled back by almost 20% since the summer.

The drop likely comes as investors grow more nervous about the staggering capex expenses. Does this mean Meta will become the first major AI casualty? Let's take a closer look.

Image source: Getty Images.

Meta's turning point

Indeed, it's difficult to ignore the fact that the Facebook parent has reached a major turning point in its history. Its social media dominance means that more than 3.5 billion people log on to at least one of its social media platforms.

Unfortunately, that amounts to 43% of the world's population, naturally leading to questions on where it can drive significant growth. To address that issue, it plans to leverage its treasure trove of personal data to develop a competitive advantage by training AI models.

Competing in AI comes at a considerable cost. Meta said it will spend between $70 billion and $72 billion in 2025 alone on capex, primarily for that purpose.

One also has to assume that the spending level will continue into 2026 and perhaps beyond. Its AI competitor, Google parent Alphabet, pledged to spend $91 billion to $93 billion over the same period, and this was after spending almost $53 billion in 2024.

Meta by the numbers

Even for a Magnificent Seven company like Meta, this is a considerable expense, and for now, its original business, advertising, primarily funds these investments. Advertising made up $138 billion of its $141 billion in revenue in the first nine months of 2025, with overall revenue growing 22% compared to year-ago levels.

Also, it was the primary driver of the company's nearly $38 billion in net income during that period. Looking forward, analysts project 21% revenue growth this year, with it falling to 18% in 2026. While still respectable, it infers that advertising revenue growth is on track to slow, and an AI-driven transformation is likely needed. That may also explain why the stock is up by only about 12% over the last year.

NASDAQ: META

Key Data Points

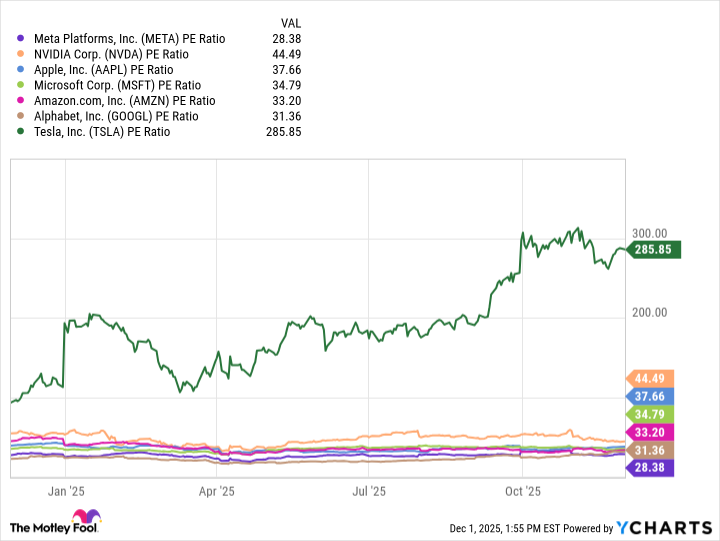

Also, at a price-to-earnings (P/E) ratio of 28, it's the cheapest Magnificent Seven stock. Still, such trends indicate that success in AI will be critical to the company's ability to command premium valuations.

META PE Ratio data by YCharts.

Strategic risks

Furthermore, investors should remember that Meta subtracts capex spending to determine its free cash flow. Considering the competitive conditions it faces, the fact that it generated almost $30 billion in free cash flow in the first three quarters of 2025 should boost confidence in the company.

Still, it's down from $39 billion in the same year-ago period, showing it has taken a toll on the company. Also, advertising still makes up 98% of the company's revenue. That means Meta is spending heavily on capex with little revenue to show for it so far.

Additionally, after virtual reality failed to draw investor interest with its earlier move in the metaverse, it's hoped that AI can bolster this segment's success. If its AI push does not meet expectations, it could again mean struggles for Meta Platforms' stock.

Will Meta Platforms be the first major AI casualty?

As conditions stand now, it's too early to call Meta an AI casualty.

Admittedly, 98% of the company's revenue still comes from advertising, and it will probably fund Meta's AI investments for the foreseeable future.

Still, since it will have to look beyond advertising to continue growing at double-digit levels, it has invested heavily to compete in AI without much of a significant near-term return.

Consequently, investors are in a position where they have to wait and hope for a successful transformation. Nonetheless, this means Meta's future is more uncertain than it is bleak. Unless such results turn negative, investors should not write off the social media giant as an AI casualty.