Domino's Pizza (DPZ 2.46%) is the largest pizza chain in the world, and it recently achieved the status of being a Warren Buffett stock. If you're also considering adding it to your portfolio, here's what you need to know.

Domino's business model

Domino's has 21,700 stores in 90 global markets, making it the leader in pizza stores. Pizza is a resilient category, since it's cheap to buy and quick to order. As a business model, it's easy to set up pizza stores, which have a fairly small menu with minimal ingredients and work for most developed markets.

99% of Domino's global store fleet is franchised, so Domino's makes the vast majority of its sales from franchise fees and not from selling pizza. Despite its large size, Domino's opens more stores frequently, with 214 new stores in the 2025 fiscal third quarter (ended Sept. 7). Most of those were international.

Image source: Domino's.

How has Domino's been doing?

Unlike many fast-casual chains that are struggling in the high-inflation environment, Domino's continues to thrive. It provides quarterly updates for global retail sales and comparable sales (comps), which measure how much food is being sold, as well as company sales, which is how much money Domino's is making from selling all of that pizza.

NASDAQ: DPZ

Key Data Points

In the third quarter, global retail sales increased 6.3% year over year, and U.S. comps were up 5.3%. Company sales increased 6.2%, and operating income was up 12.2%. Much of the increase was due to higher pricing in food delivery orders from franchising partners and higher franchising fees.

The company is performing much better in the U.S., where comps were up 5.2%. International comps were up only 1.7%, but total international sales increased 5.7%, lifted by the new stores.

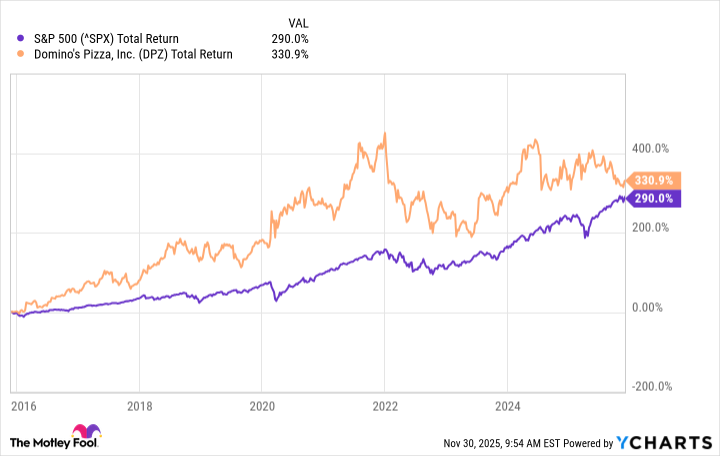

How has its stock performed?

Domino's has underperformed the market this year and over recent periods. However, it has outperformed the market over the past 10 years.

It pays a growing dividend that yields 1.6% at the current price. That's high for Domino's dividend, and that's in line with its stock being roughly flat this year, since stock price and dividend yield move conversely.

Buffett is likely interested in Domino's as a stable market leader that will always have a place in the economy and can weather market storms. It's a solid and reliable stock, and it could be a strong anchor stock for a diversified portfolio.