For the last three years, one piece of hardware has continually earned credit for the rise of generative artificial intelligence (AI) applications: the semiconductor. Naturally, investors sought growth in the companies that design AI chips and the accompanying networking gear that powers them inside of data centers.

Against this backdrop, names like Nvidia, Advanced Micro Devices, and Broadcom have become synonymous with the AI revolution. In recent months, however, investors are beginning to look beyond the usual suspects in the chip realm.

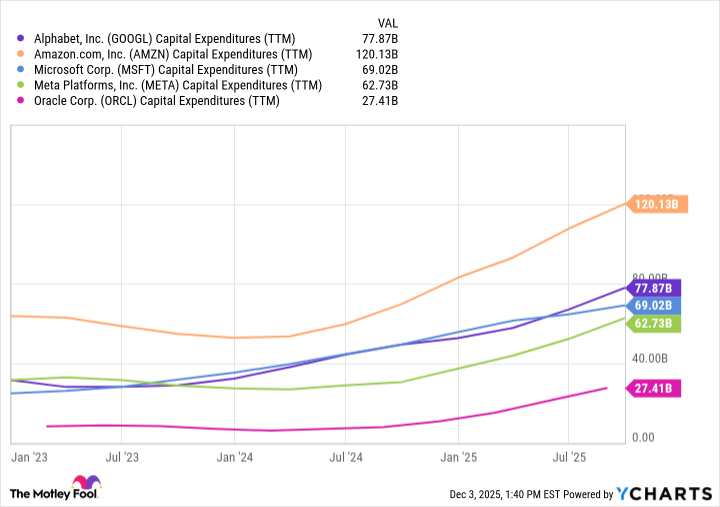

Perhaps the biggest reason for this is rising investment from hyperscalers in AI infrastructure. As big tech pours hundreds of billions of dollars into data center upgrades, investors are starting to ask which companies truly benefit the most from accelerated infrastructure buildout.

GOOGL Capital Expenditures (TTM) data by YCharts

In my eyes, Taiwan Semiconductor Manufacturing (TSM +1.77%) could be the best choice. Let's explore Taiwan Semi's critical role in the AI landscape and assess why the stock could be poised for an Nvidia-style breakout in 2026.

Why is Taiwan Semiconductor important for AI?

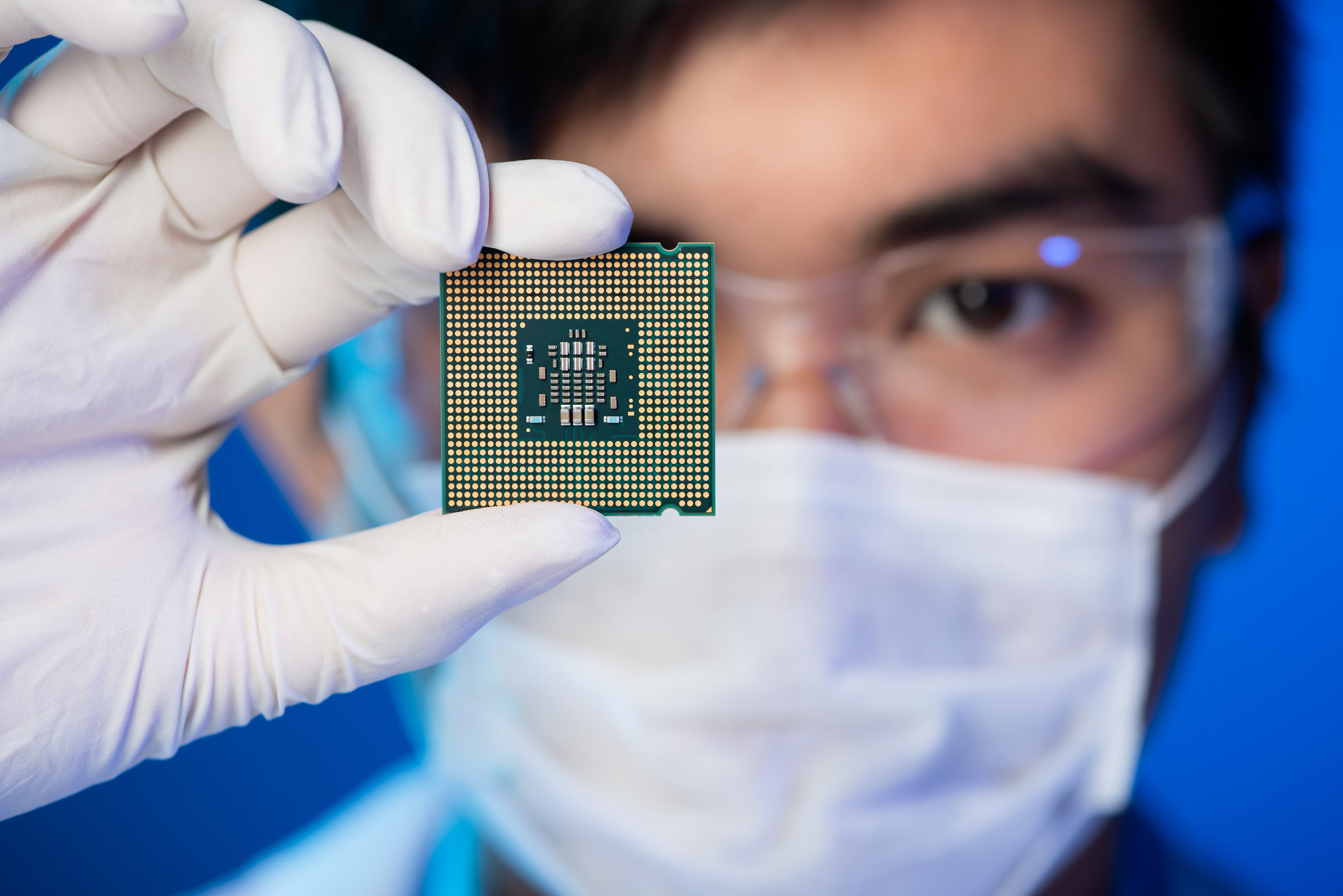

Taiwan Semiconductor (or TMSC) specializes in foundry services. The company's fabrication facilities serve as the manufacturing output for sophisticated chip designs from Nvidia, AMD, Qualcomm, Apple, and many others. With roughly 68% market share, TSMC is the largest chip foundry in the world as measured by revenue.

What makes Taiwan Semi so unique is that its business stands to benefit from the broader secular trend of rising chip demand. In other words, the company's diverse customer base makes it less exposed or vulnerable to a particular chip design. Given these dynamics, TSMC acts more as a pick-and-shovel opportunity in the semiconductor industry.

Image source: Taiwan Semiconductor Manufacturing.

Why 2026 could be a breakout year for TSMC

Analysts at Goldman Sachs recently reported that AI capex among the hyperscalers could reach nearly $500 billion next year. While this figure surely captures the imagination, Beth Kindig of the I/O Fund not only sees capex accelerating next year, but she's calling for the infrastructure chapter of the AI narrative to be a multi-year opportunity worth several trillion dollars.

I am personally in Kindig's camp on this one. In just the last few months, a number of large-scale deals have been announced:

- Nvidia is investing up to $100 billion in OpenAI for a 10-gigawatt data center buildout.

- In addition, Nvidia is investing up to $10 billion into Anthropic in a deal that features the company's upcoming Vera Rubin chip architecture.

- Advanced Micro Devices has a separate 6-gigawatt deal with OpenAI, and also inked a partnership with Oracle's cloud infrastructure division.

- Neocloud provider Nebius Group signed a $17.4 billion dollar chip deal with Microsoft which was followed up with a $3 billion deal with Meta Platforms.

- Iren, another infrastructure-as-a-service (IaaS) specialist, signed a separate $9.7 billion dollar contract with Microsoft.

NYSE: TSM

Key Data Points

The common thread stitching these deals together is that demand for GPUs remains strong. Taking this one step further, many of these partnerships are planned to last several years -- suggesting that chip procurement will remain a critical need for AI developers well into the future.

This is music to TSMC's ears. While Nvidia, AMD, and others see their names featured in the headlines, it's highly likely that much of the chips bought in these transactions will be produced by Taiwan Semi.

I think 2026 will serve as the beginning of the AI infrastructure era. As more deals come to light, investors should begin to better understand Taiwan Semi's role in the AI landscape and digest just how much demand the company is witnessing. As such, the company's revenue and profit base could be poised for exponential acceleration.

Is Taiwan Semi stock a buy?

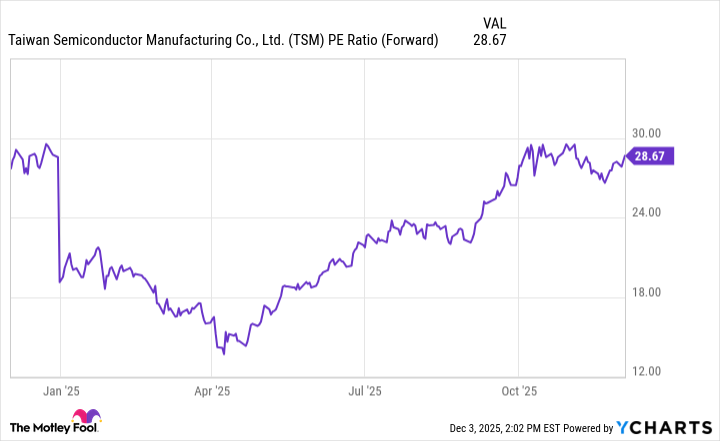

Taiwan Semi's valuation multiples have expanded dramatically over the past year. With that said, I think these dynamics have less to do with the underlying business performance and more so with the company's perception.

TSM PE Ratio (Forward) data by YCharts

Investors have been worrying about TSMC potentially vulnerability to broader geopolitical tensions between China and Taiwan. However, Taiwan Semi appears to have mitigated these concerns -- thanks in large part to the company's expansion efforts in Arizona, Germany, and Japan.

While the stock now boasts a premium compared to its lows back in April, I think shares of Taiwan Semi are still worth a look. The AI infrastructure opportunity remains in early stages, and the current pace of deal flow suggests that TSMC is going to have its hands full for quite some time.

I think Taiwan Semi's next breakout could feature prolonged share price increases as investors come to further appreciate the company's influence in the broader AI market and the reasons for its booming business results.

For these reasons, I think TSMC stock could follow a similar trajectory to that of Nvidia -- making it a compelling long-term buy right now.