2025 isn't in the books just yet, but it's been another wild year for Tesla (TSLA 4.12%).

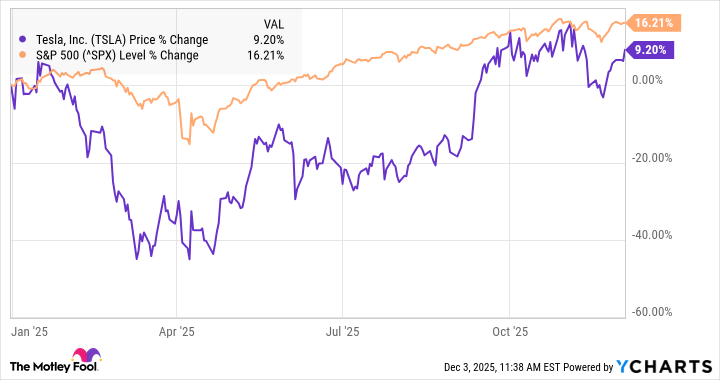

Through Dec. 3, the electric vehicle (EV) maker that's now angling to be a physical artificial intelligence (AI) powerhouse is up 9%, putting it just slightly behind the S&P 500, which has gained 16% so far.

However, it hasn't been a smooth ride for Tesla shareholders. As the chart below shows, the stock lost nearly 50% of its value early in the year due in part to backlash against the company because of CEO Elon Musk's work with the initiative known as the Department of Government Efficiency (DOGE), as well as weakening vehicle sales.

Tesla recouped some of those losses in the spring as Musk stepped down from DOGE, and as the broad market recovered after the crash on President Donald Trump's "Liberation Day" tariffs. The stock also jumped in the fall as third-quarter deliveries were strong and Musk bought $1 billion worth of the stock.

Looking ahead to 2026, Tesla is still facing many of the same questions that have dogged it for much of 2025. EV sales continue to be disappointing. While the company has launched its robotaxi service, first in Austin and then in the Bay Area, it only appears to have a handful of robotaxis on the road currently. Finally, Musk continues to shift investor focus to Tesla's future as an AI company, rather than as a carmaker, indicating a fundamental shift in the business.

So is Tesla a buy heading into 2026? Let's take a closer look.

Image source: Tesla.

Tesla is the same battleground stock

Tesla has long been a lightning rod for controversy as well as a battleground stock, and that will continue in 2026. Investors like Cathie Wood and Dan Ives continue to hype the stock up as a big AI winner, while The Big Short's Michael Burry said Tesla was "ridiculously overvalued." Burry noted Tesla's excessive rate of share-based compensation and dilution, and called out Musk's $1 trillion incentive package.

Indeed, Tesla is distinct from other "Magnificent Seven" stocks as its valuation is much higher than its peers. It has a market cap of $1.5 trillion but just $5 billion in generally accepted accounting principles (GAAP) net income over the last four quarters, giving it a price-to-earnings ratio of roughly 300.

That valuation might make sense if the business were growing rapidly, but it's actually shrinking at the moment. Though revenue rose 12% in the third quarter to $28.1 billion, both GAAP and adjusted earnings per share fell sharply in the quarter, down 37% and 29%, respectively, which was due to increased spending on research and development (R&D) and other areas as it develops its Optimus robot and seeks to expand its robotaxi network.

NASDAQ: TSLA

Key Data Points

Is Tesla a buy for 2026?

Tesla enters 2026 much like it did in 2025, with a high valuation, plateauing sales, and big promises from Musk.

The company's vehicle sales have continued to underwhelm, as the third-quarter results were boosted by the end of the EV tax credit, which is likely to negatively impact subsequent quarters' sales. However, the company is delivering strong growth in its energy generation and storage business, as well as services, which include its Supercharger network and software add-on features.

Increasingly, Tesla stock seems driven more by narrative than performance, and that narrative is largely shaped by Musk. Musk has shown time and again his ability to give the stock a boost by promising something new or touting Tesla's future.

Eventually, he will have to deliver on that promise, and at its current valuation, Tesla seems like it will need to make a significant advance in Optimus or a large expansion in its robotaxi network in order to drive the stock higher next year.

Alternatively, management is aware that the business is beholden to the larger economy, and weakness in consumer spending could put further pressure on the stock. At this point, the valuation seems too rich for the reality facing the company. Investors are better off waiting for a more attractive entry point right now.