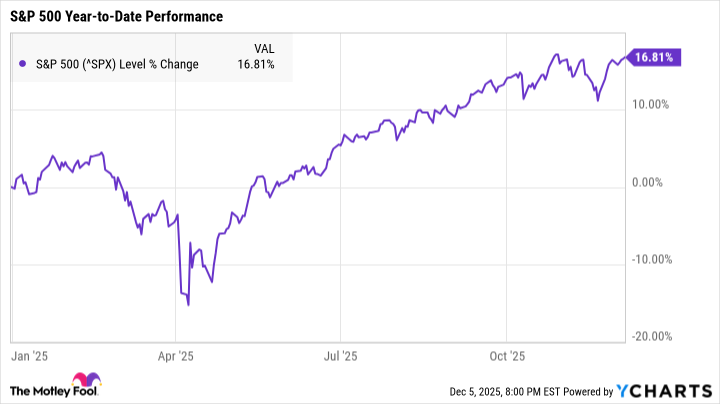

This has been an unusual year for the stock market in many ways. After tumbling into correction territory earlier this year, the S&P 500 (^GSPC 0.06%) is now closing in on a new all-time high.

Many investors, though, are concerned that this stock market surge won't last much longer. A whopping 80% of Americans are at least slightly concerned about an upcoming recession, according to a December 2025 survey from financial association MDRT.

To be clear, nobody knows when or if a recession or bear market is coming. But it's wise to prepare your investments just in case. If a major downturn is looming, this is the biggest investing mistake you can make.

Image source: Getty Images.

This sneaky move could cost you

If the market takes a turn for the worse in 2026, it can be tempting to sell your investments at the first sign of trouble. After all, if you can get out of the market before prices fall further, that could theoretically save you a lot of money.

The market isn't that predictable, though, and selling your stocks can be incredibly costly. There's always a chance prices could rebound quickly, so if you sell off your investments immediately, you might miss out on those gains. At the same time, though, if you wait to sell until prices have fallen substantially and it's clear we're headed for a bear market, you risk locking in steep losses.

For example, say you sold your investments in early April of this year. The S&P 500 had plunged by close to 19% between February and April, and it may have been tempting to get out of the market immediately if you were worried stocks had much further to fall.

Within a few weeks, though, the S&P 500 was climbing its way back up. In this case, selling in April would have been the worst-case scenario. Not only would you have risked selling your stocks for less than you paid for them, but you'd also have missed out on the lucrative recovery period.

A safer -- and more profitable -- approach

While it's often easier said than done, one of the best investing moves you can make during a market downturn is to simply wait it out. It's natural to want to take action to protect your portfolio, and watching your account balance dwindle during a bear market can be disconcerting for even experienced investors.

Keep in mind, though, that losing value is not the same as losing money. If stock prices sink, your portfolio could lose value in the short term. But once the market eventually recovers, your portfolio will likely bounce back and regain the value it lost. As long as you stay invested and avoid selling, you shouldn't lose any money.

The key, however, is to ensure you're investing in quality stocks that are likely to withstand a bear market or recession. The best stocks are those with strong business fundamentals. If a company is sitting on a healthy foundation, it's far more likely to survive even severe economic turbulence.

Where should you invest right now?

The right investment for you will depend on your risk tolerance, goals, and investing preferences. Some investors enjoy building a highly personalized portfolio full of individual stocks, while others would rather stick to low-cost index funds or ETFs.

If you're looking for a surefire investment that is all but guaranteed to survive a market downturn, an S&P 500 ETF or similar broad market fund -- like the Vanguard S&P 500 ETF (VOO 0.08%) or the Vanguard Total Stock Market ETF (VTI 0.06%) can be a great option.

NYSEMKT: VTI

Key Data Points

The market has a proven track record of recovering from periods of volatility. In fact, analysis from Crestmont Research found that throughout the S&P 500's history, it's ended every single 20-year period with positive total returns. Because broad market ETFs follow the performance of the market, it's incredibly likely these investments will see positive returns over time.

Nobody knows where the market will be in six months or a year, but that doesn't mean you can't take steps to prepare. By investing in quality stocks or funds and holding them for as long as you can, your portfolio is far more likely to survive whatever the market throws at it.