Meta Platforms (META +1.72%) shares popped 3.4% on Thursday despite a mere 0.22% increase in the Nasdaq Composite on reports that the company was cutting metaverse spending in favor of artificial intelligence (AI) and smart glasses.

Here's why Meta's capital is better used on non-metaverse projects and why the growth stock is a great buy in December.

Image source: Getty Images.

The harsh reality of Reality Labs

Facebook changed its name in October 2021 to Meta Platforms to better capture the company's expansion beyond its flagship social media app. A name change was the right move, as Instagram is arguably more valuable than Facebook. Along with WhatsApp and Messenger, the four apps are known as Meta's Family of Apps.

The name change to Meta Platforms reflected an increased emphasis on engaging through virtual worlds -- a far more ambitious digital frontier than the desktop and mobile silos the Family of Apps resides in. The name change was followed by a sharp decline in Meta's stock price, which fell 64.2% in 2022 compared to a 33.1% decrease in the Nasdaq.

The sell-off was due to a decline in Meta's Family of Apps operating income and losses on metaverse, augmented reality, and virtual reality spending, which is under the company's research and development arm, Reality Labs.

Meta's losses at Reality Labs have continued to increase. But its Family of Apps have been the saving grace, as operating income from that segment is more than offsetting mounting losses at Reality Labs.

|

Income (Loss) From Operations |

2021 |

2022 |

2023 |

2024 |

2025 (Nine Months Ended Sept. 30) |

|---|---|---|---|---|---|

|

Family of Apps (billions) |

$56.95 |

$42.66 |

$62.87 |

$87.11 |

$71.7 |

|

Reality Labs (billions) |

($10.19) |

($13.72) |

($16.12) |

($17.73) |

($13.27) |

Data source: Meta Platforms.

Family of Apps is more than absorbing Reality Labs' losses

Since the start of 2023, Meta's stock price is up a mind-numbing 450% compared to a 124.6% gain in the Nasdaq as investors have given Meta the benefit of the doubt due to excellent growth from the Family of Apps.

Yet despite that increase, Meta's profits are increasing at such a torrid rate that it's still the cheapest "Magnificent Seven" stock, a group of tech-focused companies that includes Meta, Nvidia, Apple, Alphabet, Microsoft, Amazon, and Tesla.

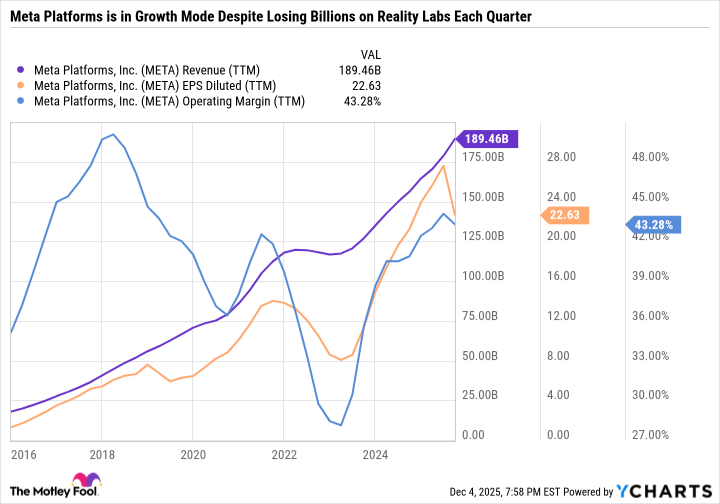

As you can see in the following chart, Meta's revenue and earnings have exploded higher in recent years. And even when factoring in Reality Labs losses, Meta's operating margins are still sky high at 43.3%.

META Revenue (TTM) data by YCharts

Looking at the nine months ended Sept. 30, Meta generated $139.8 billion in Family of Apps revenue and $71.7 billion in Family of Apps operating income. This means that without the Reality Labs drag on profitability, Meta's advertising revenue operating margin would be 51.3%.

For context, Nvidia, which is an ultra-profitable company with customers lining up out the door for its graphics processing units, has trailing 12-month operating margins of 58.8%. This goes to show just how much of a cash cow Family of Apps is.

NASDAQ: META

Key Data Points

Meta's investment thesis just got even better

Meta's decision to cut back on metaverse spending in favor of AI and its Family of Apps is excellent news for long-term investors, especially value investors who are interested in Meta for its high free cash flow, impeccable balance sheet, and growing dividend. Before getting too excited about the news, investors may want to hear commentary directly from CEO Mark Zuckerberg and the rest of the Meta management team to ensure that the strategic shift is lasting and not a temporary change of heart.

The social media giant is investing heavily in AI by building its own data centers, refining its search algorithm to better align content with user interests and connect advertisers with relevant buyers, and developing its Llama large language model to power its Meta AI assistant, among other initiatives. With such a massive opportunity in AI, there's less reason for Meta to continue flooding Reality Labs with capital with no return on investment in sight.

Meta was already one of my highest conviction growth stocks to buy in 2026. This news only makes the investment thesis more attractive, making Meta a screaming buy now.