MP Materials (MP +5.75%) is a mining company that occupies a critical place in the White House's plan to rebuild a domestic supply of rare earth elements.

Indeed, as the only owner and operator of a scalable rare earth mine in the U.S. -- the Mountain Pass mine in California -- it's no wonder the Department of Defense (DOD) invested $400 million in the company to help it expand its magnet factories.

After that investment, the company's stock jumped. In October, shares were trading for as much as $100 a pop.

NYSE: MP

Key Data Points

Since then, shares have dropped below $60. So is this pullback a chance to buy?

Why 2026 could be transformational

MP Materials is heading into 2026 with several tailwinds. Not only does it have backing from the DOD and Apple (AAPL +0.28%) but it's shifting into the national rare-earth supplier that investors have hoped for.

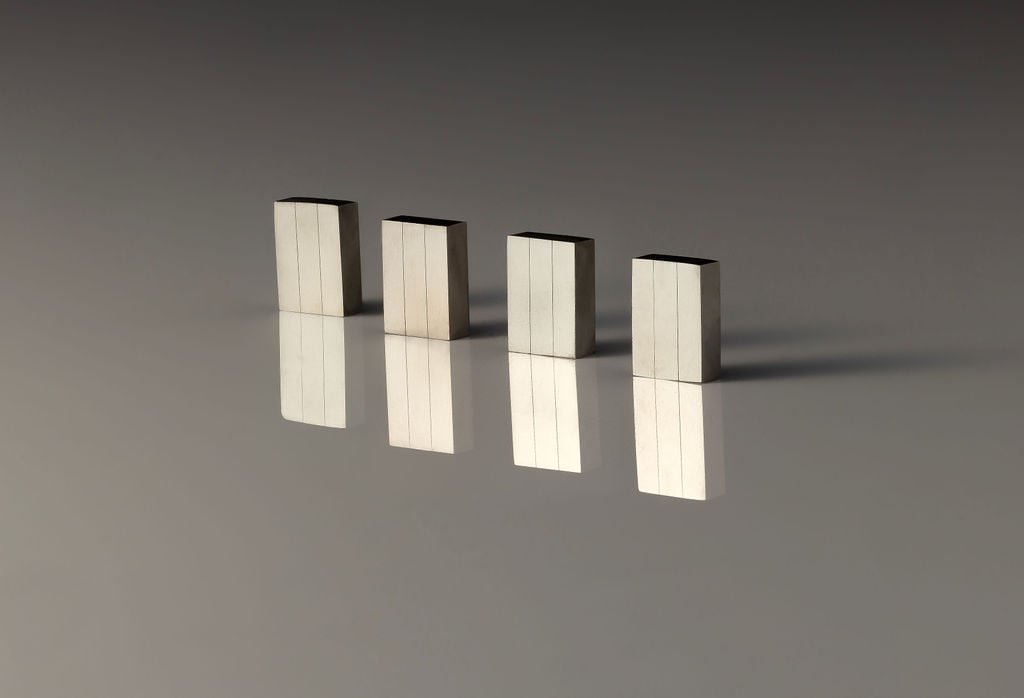

MP expects its Fort Worth magnet facility to begin shipping U.S.-made NdFeB permanent magnets by year-end, with a fuller ramp-up through 2026. Considering that China has dominated every step of the magnet supply chain for decades, this is a major shift for an American company.

NdFeB magnets produced by MP Materials. Image source: MP Materials.

Early signs of revenue growth are also encouraging. Last quarter, MP surprised Wall Street with a smaller-than-expected loss. It also posted record NdPr-oxide output and nearly $22 million in magnet precursor revenue.

More transformation is likely coming. In mid-2026, MP plans to commission its heavy rare-earth separation facility. This will let it produce metals like dysprosium (Dy) and terbium (Tb), which are essential for preventing high-performance magnets from overheating.

An investment in MP isn't risk-free. The company must expand its magnet factories, which will apply pressure to bottom-line growth. Although the company is now expecting to turn a profit next quarter, it's hard to imagine substantial growth without increasing its magnet manufacturing capacity.

If MP hits its milestones, however, and continues to get White House support, buying under $65 could end up being an early entry into a company paving America's rare-earth future.