While many tech giants are taking a breather, Broadcom (AVGO +1.50%) just posted its best month in an already spectacular year. Simply put, Broadcom has been crushing the market for years, and somehow it's still accelerating.

Where is the chip and software giant going next -- and is it too late to benefit from this stellar growth stock?

Image source: Getty Images.

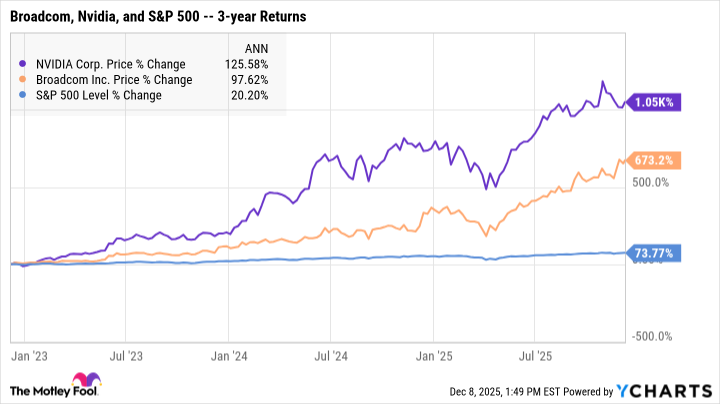

Broadcom's incredible returns

Let's start with Broadcom's multiyear returns. The company hasn't quite kept up with artificial intelligence (AI) chip king Nvidia (NVDA 0.65%) in the last three years, but it earned a seat in the trillion-dollar market cap club with some fantastic returns. It ain't easy to double your stock price three years in a row:

AVGO data by YCharts

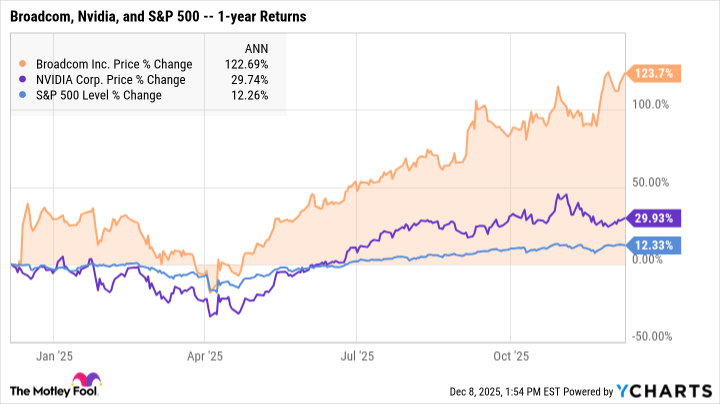

So Broadcom's growth stock credentials are crystal clear. But the growth story intensified more recently. Broadcom's stock more than quadrupled Nvidia's market-beating (and market-defining!) returns over the last 52 weeks (as of this writing on Dec. 8):

How Broadcom got here

Nvidia is far from the only maker of high-powered AI accelerator chips. Many alternative AI chip designers have partnered up with Broadcom.

For example, Alphabet (GOOG +1.57%) (GOOGL +1.60%) runs its own large language models (LLMs) on a proprietary design called Tensor Processing Units (TPUs). Alphabet's Google Cloud team has enough chip-designing expertise to design AI accelerators that meet the company's specific performance requirements. Broadcom steps in with the SerDes system interconnect technology and decades of experience with chip packaging. The final design is sent to manufacturing specialists such as Taiwan Semiconductor (TSM 0.65%) or Samsung (SSNL.F +56.02%), who turn the plans into physical chips.

Alphabet is reportedly selling TPUs to Meta Platforms these days, making the Facebook and Instagram parent an indirect Broadcom customer. And in a hot-off-the-presses moment, Broadcom is talking to Microsoft about an Alphabet-style AI processor collaboration.

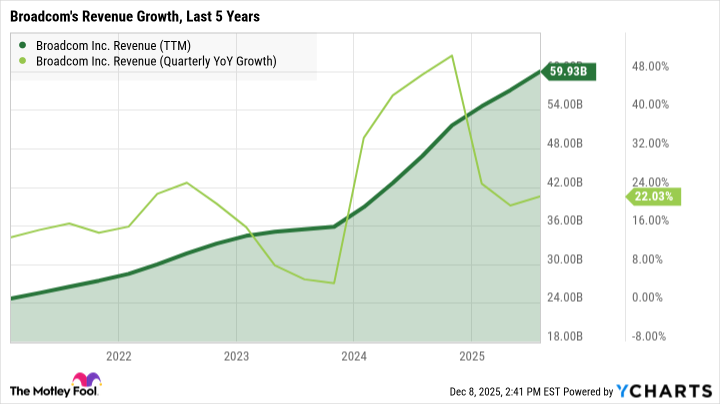

These partnerships have hurled Broadcom's top-line sales growth into a new orbit:

AVGO Revenue (TTM) data by YCharts

Can Broadcom's stock keep rising?

I can come up with both bullish and bearish chapters for Broadcom's upcoming market action.

The bull case

In a perfect world (for Broadcom investors, that is), Broadcom sticks to the first-place position in everybody else's "black book" of Nvidia alternatives.

This position of leadership is in line with the default projection in current Wall Street estimates. Broadcom's trailing sales of $59.9 billion represent a 28% increase year over year. The average analyst firm expects a 23% revenue jump in the next fiscal year, followed by a 36% increase in fiscal 2027. That's not just keeping the pedal to the metal -- it's a whiplash-inducing acceleration.

The stock is likely to keep soaring if the analyst community turns out to be right.

Broadcom's stock is pricey today, trading at 100 times trailing earnings (P/E) and 31 times sales (P/S). That's about twice Nvidia's valuation ratios in both cases. But if you include the Street's five-year growth targets, Nvidia looks reasonably valued with a PEG ratio of 1.0, while Broadcom looks cheap at 0.6.

The bear case

Anyone who claims to know what will happen in five years is trying to sell you something, and the warranty on that gadget will probably expire in four years.

Many things could go wrong before the year 2030. Broadcom's much-vaunted clients and partners could eventually go it alone, removing Broadcom's billions of AI dollars from their chip-production costs. And what if Nvidia turns the tables on Broadcom, pushing out SerDes with its NVLink and InfiniBand interconnect technologies?

And of course, no company is immune to missteps and the occasional poor decision. It doesn't take many of those to send stock prices crashing down from a triple-digit P/E ratio and $1.9 trillion market cap.

It's windy up there in Wall Street's stratosphere.

NASDAQ: AVGO

Key Data Points

Is Broadcom still a buy for 2026?

Broadcom has been crushing the market for years, and the data suggests it's not done yet. While the easy money has been made, the company's position as the Switzerland of the AI chip wars -- neutral, essential, and profitable no matter who wins -- makes it a compelling growth story even at these heights.

Just don't expect a smooth ride; at these valuations and with several potential threats lurking around the corner, crushing the market comes with plenty of white-knuckle moments.