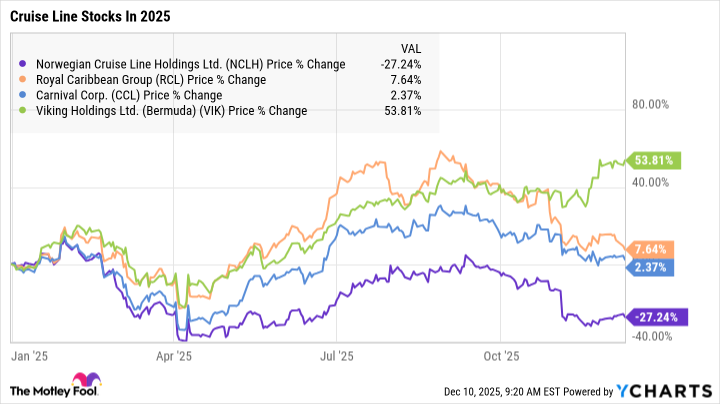

There's an old saying that a rising tide lifts all ships. Ironically enough, the adage doesn't apply to cruise line stocks. Norwegian Cruise Line (NCLH +0.53%) is once again the worst-performing investment in the industry, trading 27% lower in 2025. At the other end of the performance spectrum you have Viking Holdings (VIK 1.64%). The leading river cruise operator has risen 54% this year.

Royal Caribbean (RCL +0.20%) and Carnival (CCL +0.21%) -- the country's most valuable cruise line operator and the largest, respectively -- are splitting the difference. They are clocking in with modest single-digit gains this year.

The disparity is wide between NCL and Viking. It's even a sizable distance of water between NCL and its two larger mainstream rivals. One can argue that it shouldn't be that way, since the industry is at the mercy of healthy booking trends that rely largely on economic trends and geopolitical stability. The chart disagrees.

If one cruise line company is faring poorly -- as NCL is right now -- shouldn't the entire industry be taking on water? If one operator is crushing the market -- that's you, Viking -- why isn't everyone else coasting in this bullish regatta? I have answers. If you're a Norwegian Cruise Line investor, you're not going to like them.

Image source: Getty Images.

Reasons for NCL's underperformance

The easy comparisons coming out of the pandemic are over for the industry. The "revenge travel" surge that followed the natural pent-up demand for a travel niche that was unavailable for more than a year due to the COVID-19 crisis has stabilized.

Carnival, Royal Caribbean, and NCL posted revenue growth between 3% and 5% in their most recent quarterly update. It's the weakest jump since the operators resumed sailings after the pandemic-related interruption. This doesn't mean that the party is over. Analysts see all three companies growing their top lines by 4% to 11% in 2026, and -- plot twist -- NCL is the one at the high end of the three traditional operators on that front.

However, there are other factors that have been holding NCL back compared to its peers. As the smallest player, it lacks the scalability of its peers. Carnival stock's fleet is the largest, affording it marketing and volume advantages. Royal Caribbean has historically posted the strongest growth and the healthiest margins. It's not a surprise to find that Royal Caribbean is the only one that has resumed paying dividends.

Bookings for future sailings are healthy for the industry right now, but NCL would be the most vulnerable if there were an economic setback. The market prices that in, and it's pretty much been that way for years. Even over the past three years -- a time when Royal Caribbean stock has more than quadrupled and Carnival has nearly tripled -- NCL is losing to the market with its 22% gain. This year's slide isn't a fluke. It's a genetic defect.

NYSE: NCLH

Key Data Points

Reasons for Viking's outperformance

Viking's monster run this year also doesn't come as a surprise. It's a specialist in luxury river cruises. It has a large fleet of ships, but they have much lower capacity than NCL's ships. A Viking cruise is also an entirely different vibe.

It's not a nonstop party on Viking. There are no kid day care clubs, because children aren't allowed on the more intimate boats. It's also a luxury brand stock, offering a more expensive adventure than a traditional cruise voyage. The demographics are older and wealthier, making it less vulnerable to an economic or employment slump.

Remember the 3% to 5% revenue growth posted in the latest quarter of the three ocean cruisers? Viking came through with a 19% increase in the third quarter. It's different, and investors are willing to pay a premium for that when it means stronger growth and a heartier moat.

NYSE: VIK

Key Data Points

Passing ships

The contrasts between the two extremes came to light on Tuesday when Goldman Sachs made a pair of guidance changes. The firm downgraded NCL from a buy to a neutral rating, reducing its price target on the stock from $23 to $21. Goldman Sachs is cautious about supply outstripping demand in NCL's Caribbean hotbed in 2026.

Goldman analyst Lizzie Dove also upgraded Viking -- from neutral to buy -- boosting her price target on the shares from $66 to $78. You don't see river cruises on the Caribbean market, which the firm finds vulnerable in the near term. Viking's differentiated experience is giving it an acceleration in pricing advantages.

Value investors may argue that NCL is too cheap, now trading at 7 times next year's profit target. Viking is at the higher end of the valuation range, currently fetching a forward P/E of 21. Royal Caribbean and Carnival -- like their stocks over the past year -- are splitting the difference with forward profit multiples of 13 and 11, respectively.

The moral of the story here is that just like a Viking cruise itself, investors have to pay a premium for a premium experience.