Motley Fool co-founder and CEO Tom Gardner and analyst Seth Jason recently talked with Rocket Lab founder and CEO Peter Beck about business, engineering, and entrepreneurship.

To catch full episodes of all The Motley Fool's free podcasts, check out our podcast center. When you're ready to invest, check out this top 10 list of stocks to buy.

A full transcript is below.

This podcast was recorded on Nov.30, 2025.

Peter Beck: It is a raging cauldron of hell and conflict sometimes in my head because I'm half entrepreneur who wants to take extreme risk, and then half engineer who, by nature, is extremely conservative.

Mac Greer: That was Rocket Lab Founder and CEO Peter Beck. I'm Motley Fool Producer Mac Greer. Now, Rocket Lab is an aerospace company with a launch business and a space systems business, and it has become a big business. Motley Fool Co-Founder and CEO Tom Gardner and Motley Fool analyst Seth Jayson recently talked with Peter Beck about the business of Rocket Lab.

Tom Gardner: We're so pleased to be spending this time with Sir Peter Beck, the Founder and CEO of Rocket Lab. Before going into our conversation, I'll just share, I don't know how familiar you are with The Motley Fool, but when we recommend companies and often put our own skin in the game with our members, we do so with a five-year minimum holding period, generally, and ideally multi-decade holding period. We like to assess the long-term vision and mission strategy and performance of the business. Obviously, we don't want to put you in a position where you're having to give any forward-looking statements. Just deny any of our long-term questions that you can answer, but just letting you know that we really are most interested in the very long term and our greatest investments, which is not unusual for people throughout their lives, are the ones that they held for the longest period of time. I love my low cost basis of $25 a share right around there for Rocket Lab, but Seth Jayson, who's here and Lou Whiteman, who can't be here today, both recommended the stock and owned the stock since it was below five dollars a share. A lot of our Motley Fool members have gotten in some early low positions with the business, but I think, Peter, we love to hear you just outline the main components of Rocket Lab, maybe beginning with space systems since it's easy to overlook the segment or may view Rocket Lab as a launch company. Can you use a walking tour of the business, please.

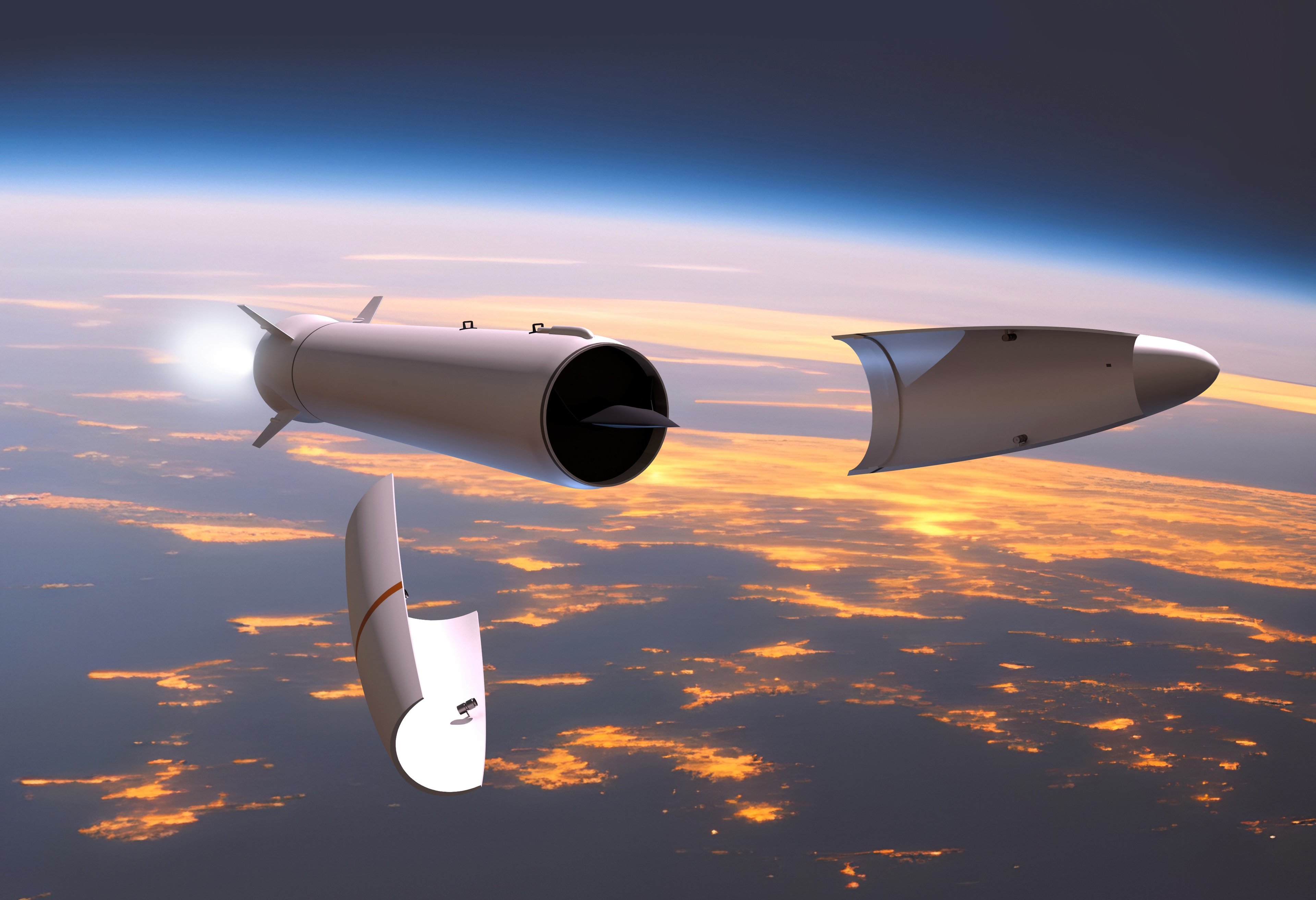

Peter Beck: Totally. I always like to talk about Rocket Lab as an end-to-end space company because it's almost bisected into two parts. There's launch, which is the big roaring stick in the sky, which everybody gets excited about, and then the space systems, which is less visually glamorous, but, of course, a huge part of the business. Both of these elements are necessary to deliver on the key goal here and the key mission of being end to end, and I think ultimately, deploying infrastructure or services on orbit. If you're talking about the long term, it's my view that the biggest space companies in the future, it's going to be a little bit blurry about are they a space company or are they something else? Just take our friends over at SpaceX. Are they a space company or are they a telecommunications company at this point? It gets a little bit blurry, but I think what is absolutely true is that if you have unfettered rapid and reliable access to space and you can build whatever spacecraft you want to build, then your ability to deploy infrastructure or services from orbit is going to be way better than somebody else who doesn't have those capabilities. We're just methodically going about making sure we have all those elements to ultimately deliver on that twin space company goal. I know you want to talk about space systems, but I think it's always good to wrap it in the context of why space systems even exists. Space systems was really started very early on in the company's life. I often hear people saying launch wasn't big enough, so Rocket Lab pivoted to building spacecraft. That's just simply not true. In fact, the second electron vehicle that we ever flew had a whole all of the recesses pre-cut into the kick stage for solar panels to turn that into a photon, so it's been part of the plan from Day 1. But the thing is the most difficult thing to do, and the most transformational thing you can do is have access to orbit. That's the biggest problem you have to solve in all of this. Spacecraft are difficult, but not nearly as difficult as gaining access to orbit.

That's the real disruptor here; it's not anything else. That's where we started. Then as we started to build our own satellites internally, we placed some orders for some components, and the lead times associated with them and the costs associated with them really took us back. We're like, "How can anybody be disruptive in this industry when it takes 12 months to get just a simple star tracker?" Not surprisingly, that led our first acquisition of Sinclair Interplanetary, and we never looked back from that point. The best way to describe what we've done there is literally lay a spacecraft out or satellite out on the boardroom table and then just systematically point to all the bits that really suck and then go after each one of those and either build that technology internally, or we'll go and buy the best company that currently makes that technology. Not just stopping there but actually doing it at scale. That gives us a really healthy ability to just think of it like a storeroom of parts that you can just go and pull off the shelf to build almost anything you want. Then the next leg of space systems, there's really three internal mandates that I set forward when we started space systems officially. That was, one, everything that goes to space should have a Rocket Lab logo on it.

Don't care if we built it, don't care if we launched it, but everything that goes to space should have a Rocket Lab logo on it, preferably the biggest logo that you can fit on the component. Then, secondly, we want to build spacecraft, but not interested in just building boring spacecraft that lead nowhere. They have to be very strategic spacecraft that ultimately fulfill the end vision. Then the third one is building applications or infrastructure in all but that feeds into. The components bit we're well in hand right now. We're the largest supplier in the world of some things. I think we're the largest base grade solar cell provider and panel provider in the world now. I don't know if we're the largest reaction wheel provider, but we must be getting up there, and we just keep scaling these businesses. Then on the spacecraft side, our first spacecraft was the spacecraft called First Light, which was a little Photon. Then we skipped about a decade and went straight to the moon with the next Photon. Then because we were able to successfully build that spacecraft for NASA to go to the moon, we won the ESCAPADE missions to Mars, which are about to launch. Then because we executed those really well, we were able to secure a contract with MDA Globalstar on a quite a [inaudible] big comms platform. Then we're able to win, as a prime contractor to SDA, a whole bunch of national security spacecraft. Then along the way, interesting stuff that's very strategic like the Varda reentry spacecraft and Lockset and a whole bunch of other stuff that all feeds into the end goal here, and a few years later, there you go, that space system.

Tom Gardner: Can you talk about the interplay as an entrepreneur and an engineer between the importance of creativity and imagination, discovery and experimentation, and how crucial it is to execute down to a layer detail and precision that given the business most people never encounter would ever encounter anything like what it takes to have the conviction when you put something on the launch pad that it's time to go.

Peter Beck: Yes, it is a raging cauldron of hell and conflict sometimes in my head because I'm half entrepreneur who wants to take extreme risk, and then half engineer who by nature is extremely conservative. So, to your point finding the balance of putting stuff on the pad that actually works, but moving quickly and being innovative is a fine line to walk. I think it's something that I think it's also a part of the magic of the company. I think if you're just 100% entrepreneur and you've seen that with maybe other space companies and no engineer, the results are just real bad, and then if you're 100% engineer and then no entrepreneur, then I think you would never ever put anything on the pad because you would be unable to take any risk. So I think you have to get that balance right, and I think it's probably some of the magic of Rocket Labs knowing where to be entrepreneurial and take risk and knowing where just to not take risk.

Tom Gardner: It feels to me like most of our questions will weave between engineering and entrepreneurship. So perhaps you can continue to blend those by telling us the process of making acquisitions to be a payload provider on the payload, why that's significant, and how far you are in that process, how complicated it is to assemble that and why it matters.

Peter Beck: So, we've basically got all the bits and pieces of the satellite. There's a few bits there that we haven't quite got, but we've pretty much got everything that we need there, and you really quickly learn that people don't buy satellites for great reaction wheels and solar panels. People buy satellites for the payload and what it does, and you're never going to scale to a giant company if you just provide buses, and you really have to provide the end to end solution. So you've seen us start to dip our toe into payloads now, and Eletroptical is the first piece of that, and if you think about how many providers in the world are there of these deeply complex electro optical infrared payloads, you can count them on one hand. So being able to provide that payload to other people's spacecraft is one thing. But when you turn up all of a sudden to a customer and you can provide the thing that they actually want to do being the payload, and by the way, all of the bus, all of the operation systems, all the ground segment, and we can launch it for you, it's just a totally different proposition. So you'll see us acquire more of those payload elements because I think that's the last piece in the puzzle.

Seth Jayson: Something along similar lines, I cover a lot of our AI stocks here, and sovereign AI has become a thing for various reasons right now, and it sounds a little bit to hear some of the recent space talk that sovereign space launch is shifting in a similar direction, and I know I think that your recent acquisitions may be nodding at that, and so, how do you think about those kinds of markets going forward between Europe, Asia, the US, obviously, you'll never serve. But is that part of the strategic thinking going forward?

Peter Beck: Yeah, so, look, every nation is and I would say, there's been a recent retrenchment in the fact that nations have with various world events have decided that actually we need our own stuff, and so there's definitely certainly a strong desire there. We've always seen it a lot from launch because any emerging space nation always wants their own rocket because it's just super cool and very visible. So we've always been approached a lot with, can you come to our country and build a launch site, and it's like, I don't want to build another launch site ever. So why would I do that? But there's no strategic reason to do it other than a country wants a launch pad, but they have to service that launchpad and that demand with their own sovereign spacecraft, and maybe that will happen, or maybe that won't. But certainly, yes, we're definitely seeing a lot of sovereigns looking to create their own capability, and to your point, the menaric acquisition that hopefully we get through in Germany, it's a fantastic product. It's a laser terminal. It's incredibly needed across air platforms and many others. So in its own right, it's a great acquisition. But also, it really is our first step into Europe, and we're not stopping it just becoming large in the United States. We want to service the globe and the countries that we can work in. So that's the first step into Europe.

Tom Gardner: Just a succinct late question for you about investors in Rocket Lab. If an investor today wanted to align their time horizon with your time horizon as an investor, how long should they be thinking about holding the stock? There's so much of a transactional dynamic in the public markets with a lot of information. One of the biggest challenges we face at the The Motley Fool is to teach the importance of finding something that you want to be honor and the benefits of that. So the dream is to align with the CEO's time horizon. Now, some CEOs are very transactional themselves so everybody's at a different pace with a different time horizon on their vision. What's the proper time horizon to align with your vision?

Peter Beck: Well, I'm not going to provide financial advice here, that's for sure. Darn. But look, I'm trying to build the biggest space company in the world, and I would have hoped to have done it by now. Everything always takes too long, but you have my commitment that's my goal, and my shoulder is down, and I'm running as hard as I can to do that, and so is everybody in the company. How long that takes is how long that takes. But you can see we consistently keep growing and scaling the company, and everything just consistently moves up into the right, and hopefully people see the methodical path that we're trying to walk here. It's like, as I mentioned, right at the beginning of the call, there's like $20 billion opportunity in launch, a $30 billion opportunity in spacecraft and a 350 whatever billion dollar opportunity in applications and services, and the faster you can get there with something that's really disruptive, then, the bigger space company you can actually build.

Tom Gardner: And in that [inaudible] can you talk a little bit about the culture at Rocket Lab? A company that's squeezing years of hours into a month, yet also trying to build something that will succeed for generations. How do you align the work, not burn out in the process and match it with something that's designed to sustain as an independent company for decades?

Peter Beck: Look, it's fair to say if you want work life balance, don't come here, and if you look at our competitors, they don't have work life balance either. So if you think you can compete with your competitors and not work as hard, then that's going to be a bad surprise. So we absolutely push hard, and I would say the culture here is we have a number of really non negotiable elements, and right at the top is we build beautiful things. I just absolutely believe that if you build a beautiful thing, it generally works when you give someone the freedom to build a beautiful thing, they take so much pride in it and they look well past their work and other people's work, and you can go and look at any Rocket Lab, spacecraft, any Rocket Lab component, any Rocket Lab rocket, and they're almost so beautiful, they're artistic, and that's the way it should be, and whether it's a piece of code, a piece of software, a boardroom, table, whatever it is, it needs to be beautiful. I think where a lot of space companies have gone wrong as they try and see how crappy they can build stuff and get away with it, whereas we're the opposite of that. The number one thing that must be always true first in space is it has to work. Everything else behind that it has to be second. So making sure that everything is beautiful is something that everybody is really focused on, and it's a self fulfilling prophecy, as well, because you attract people that want to build beautiful things that work, and people who want to take shortcuts and not present the best work that they can do don't survive. They either realize that it's not the environment for them or their peers around them don't accept their. So it's self fulfilling, and if you look at the launch companies over the last call it five or 10 years, it's not a good bet. Generally, they all fail, and I'm always asked, Well, why did Rocket Labs succeed and all these others fail, and it comes down to really two things. It comes down to building beautiful things, and it comes down to hustle. When I say hustle, I mean when you're greeted with a barrier, you have two options. Is you can either just throw your arms up and go, Well, I don't know what to do, and this seems impenetrable and can't solve it. Or you try and climb it, and if you can't climb it, you try and go around it. If you can't go around it, you get out your spade, and you just start digging until you get under it. That's the Rocket Lab mentality. So where many others would have reached points in both technical or otherwise and given up, I think we just have more tenacity than others.

Tom Gardner: Sir Peter Beck, the founder and CEO of Rocket Lab to resemble RKLB naturally will be a very volatile stack. Many of the greatest companies have very viable stacks as they bring something into the world that others try and figure out how consequential it will be, what risks they will need to endure as a shareholder, and so we're excited to be on that journey with you and your team and your company, and we wish you the very best and thank you for 60 minutes of your time.

Peter Beck: No, thanks very much guys, it's been fun.

Mac Greer: As always, people on the program may have interest in the stocks they talk about, and the Motley Fool may have formal recommendations for or against. So don't buy or sell stocks based solely on what you hear. All personal finance content follows Motley Fool editorial standards and is not approved by advertisers. Advertisements are sponsored content and provided for informational purposes only. To see our full advertising disclosure, please check out our show notes. For the Motley Fool Money Team, I'm Mac Greer. Thanks for listening, and we will see you tomorrow.