Investors generally are unanimous about the following: Warren Buffett is an investor to watch during any market environment. This is because the billionaire has delivered a track record of success that spans nearly 60 years. As chairman and chief executive of Berkshire Hathaway, Buffett has helped generate a compounded annual gain of nearly 20%. This largely beats the S&P 500's 10% compounded increase over that time period.

Buffett is now approaching retirement, with plans to hand over his CEO role to Greg Abel, currently the company's vice-chairman of non-insurance operations, at the end of the year. But this expert investor has remained active in his final months and quarters of leadership. And that means we can take a look at what Buffett's latest portfolio moves say about the market...

Image source: The Motley Fool.

Good news for Buffett fans

First, though, here's some good news for all of you Buffett-watchers: Buffett still will be around as chairman, will go into the Berkshire Hathaway office to share ideas with the team, and he's promised to continue communications through an annual Thanksgiving message. So we may hear about Buffett's thoughts on key subjects well into the future.

Now, let's consider Buffett's general investment strategy over time and the moves he's made in recent quarters. Buffett is known for choosing quality companies with solid competitive advantages, or moats, and investing in them for the long term. The billionaire won't jump into the latest trend even if everyone else is doing so -- and even if it's delivering big returns fast. Buffett prefers companies he can count on over time, and this strategy has been a successful one.

SNPINDEX: ^GSPC

Key Data Points

One extremely important point is that Buffett favors value stocks, meaning he aims to buy stocks trading for less than what they truly are worth. The idea is that the rest of the investment community eventually will recognize the strengths of these particular companies and buy the shares -- and these stocks then will rise.

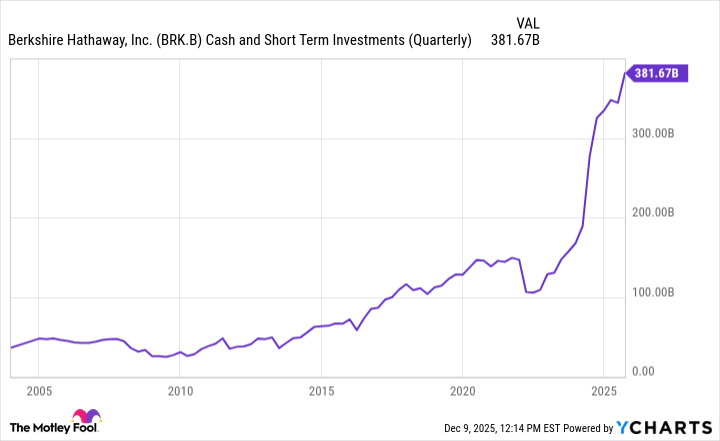

So, what has Buffett been doing lately? The billionaire's moves have been very clear: Over the past 12 quarters, he's been a net seller of stocks, and he's built up Berkshire Hathaway's cash position to reach record levels.

BRK.B Cash and Short Term Investments (Quarterly) data by YCharts

Meanwhile, in his 2024 letter to shareholders, Buffett wrote that it's rare to be "knee-deep" in buying opportunities.

Buffett's moves suggest one thing...

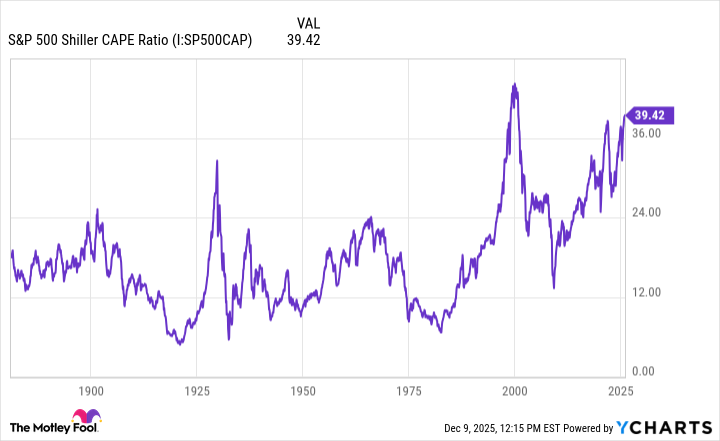

This, along with Buffett's focus on value, says something very clear about the market today -- and a key market metric supports this. The S&P 500 Shiller CAPE ratio, a view of stock price in relation to earnings over 10 years, recently reached beyond 39, a level it's only surpassed once before.

S&P 500 Shiller CAPE Ratio data by YCharts

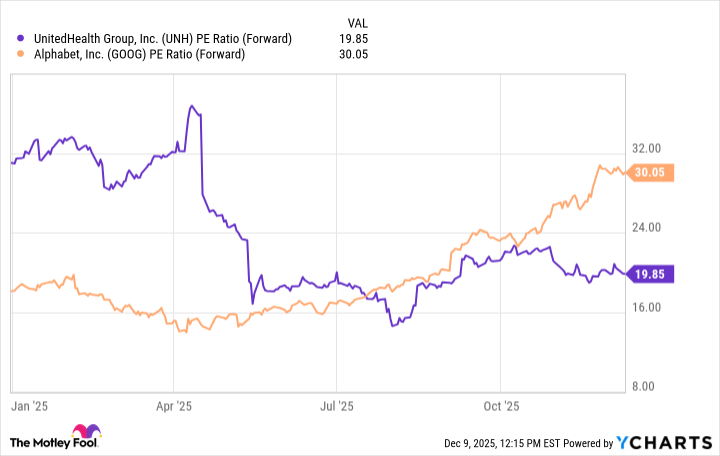

Buffett's actions, supported by this valuation metric, suggest the stock market is expensive and has been so for a while. But, before you make any abrupt investing decisions based on this, it's important to take a deeper look into Buffett's moves. The Oracle of Omaha, as he's often called, hasn't stopped investing. He's still found opportunities -- for example, he picked up shares of UnitedHealth Group in the second quarter and shares of Alphabet in the third quarter.

Both of these stocks were inexpensive at the time, and they continue to be reasonably priced. This shows us that, even if the overall stock market is pricey, investors still may find interesting opportunities.

UNH PE Ratio (Forward) data by YCharts

Now, looking specifically at the Alphabet purchase, we can draw an additional conclusion. Though technology and artificial intelligence (AI) stocks have climbed over the past few years, this doesn't mean that every AI player is expensive. It's important to consider each company individually -- if you don't, you might miss out on a deal today that may become a winner down the road.

So, Buffett's moves over the past several quarters -- from his selling activity to his accumulation of cash -- suggest that today's market is expensive. And the Shiller CAPE ratio confirms this. But Buffett doesn't recommend staying away. Instead, his investing principles ring true in any market environment, including today's: Look for value, and when you find it, buy and hold for the long term.