Tech giant International Business Machines (IBM 0.76%) has been investing in artificial intelligence (AI) for decades, and now, these efforts are paying off. Its stock has soared over 40% year to date.

To further expand its AI technology, IBM has turned to acquisitions -- and one of its next ones will be Cognitus. On the surface, this deal might not seem to be related to AI, since Cognitus specializes in enterprise resource planning systems, specifically within the SAP ecosystem.

But when you dig into the details, it becomes clear that Cognitus really can help IBM with its AI efforts.

Image source: Getty Images.

How Cognitus can help IBM

To understand how the Cognitus acquisition bolsters IBM's AI offerings, a bit of background is required. Across Big Blue's storied history, it has served consumer, corporate, and government customers. With the advents of artificial intelligence and cloud computing, the conglomerate shifted its focus to the last two customer segments and realigned its offerings accordingly.

For example, IBM now specializes in hybrid cloud services. This model blends the cost efficiency of public clouds, which share infrastructure among various organizations, with the enhanced security and privacy of a private cloud dedicated to a single business. The hybrid setup suits many IBM clients, allowing them to use public clouds for standard functions like website hosting, while maintaining a private cloud for confidential assets such as financial and customer data.

This is where Cognitus comes in. Its specialization in enterprise resource planning led the company to construct AI tools that can meet the strict security, privacy, and regulatory requirements of customers such as governments, financial institutions, and healthcare providers.

Cognitus' AI tools offer capabilities -- including compliance monitoring in real time -- that should prove compelling to many of IBM's customers. These features are in addition to Cognitus' core expertise in SAP implementations, which will complement and strengthen IBM's existing SAP offerings.

According to IBM's press release announcing the deal, "This helps organizations in complex and regulated industries simplify operations and achieve greater consistency with a single provider."

NYSE: IBM

Key Data Points

Other factors bolstering IBM's business

With organizations around the world adopting AI, facilitating the integration of artificial intelligence into their enterprise resource planning platforms through Cognitus could bolster IBM's success. In the third quarter, sales from IBM's software division, which encompasses its AI offerings, grew 10% year over year to $7.2 billion.

Moreover, Cognitus will contribute to another key component of Big Blue's business: its consulting arm. The company generated $5.3 billion of its $16.3 billion in Q3 revenue from consulting. Consulting services can come into play when an organization implements enterprise resource planning.

The addition of Cognitus alone won't be a game changer for Big Blue's AI business. It will, however, complement IBM's pending acquisition of Confluent, announced on Dec. 8, which bolsters its real-time data capabilities. Wedbush analysts praised that deal, calling it a "strong move."

With the introduction of Confluent into the mix, IBM's tech stack will become markedly stronger. Artificial intelligence requires mountains of data to perform tasks with accuracy. Since the data feeding AI comes from many sources, it can be a mess to work with. Confluent turns that mess into usable data, feeding into Cognitus and the other platforms that comprise Big Blue's tech stack.

The tech giant also recently initiated a partnership with AI start-up Anthropic. IBM will incorporate Anthropic's AI models into its software.

To buy or not to buy IBM stock

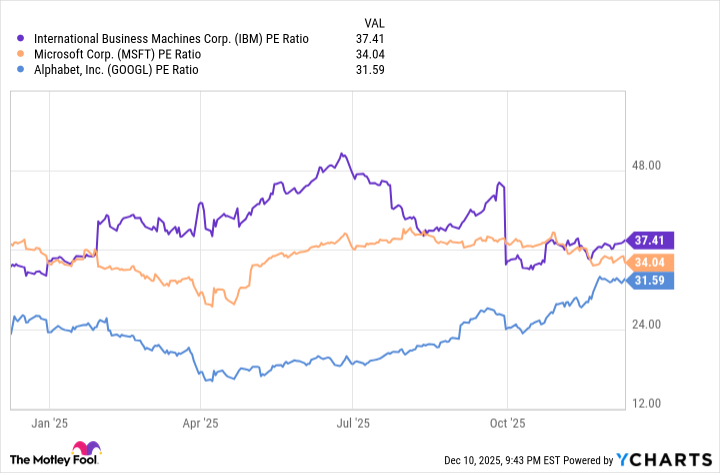

So IBM is continuing to build up its AI arsenal -- but is now an opportune time to invest in its shares? Answering that question requires assessing its stock valuation. This can be done by taking a look at IBM's price-to-earnings ratio (P/E), which measures how much investors are willing to pay for each dollar of the company's earnings over the past 12 months, and comparing it to major rivals in the AI and cloud sectors, Microsoft and Alphabet.

Data by YCharts.

IBM's P/E multiple has been elevated for most of 2025, although it dropped in recent months. Even so, it remains higher than for Microsoft and Alphabet. This suggests IBM shares are not cheap.

Overall, Big Blue has some solid factors, and it's bringing together many compelling capabilities through acquisitions such as Cognitus and Confluent. And its dividend yield of more than 2% at the current share price is hefty for an AI-focused tech company.

But given its elevated valuation, the prudent approach would be to wait for the stock price to drop before buying IBM shares.