Few stocks have had as good a second half of 2025 as Alphabet (GOOG 0.09%) (GOOGL 0.14%). Alphabet has received almost all positive headlines in the second half of 2025, and this has led to incredible performance. The stock has risen over 80% since July 1, and there appears to be no signs of its slowing down.

I think investors should look to Alphabet as the company that can lead the stock market higher in 2026, as it has several growth paths that look to be panning out.

Image source: Getty Images.

Alphabet has several ways to becoming the world's largest company

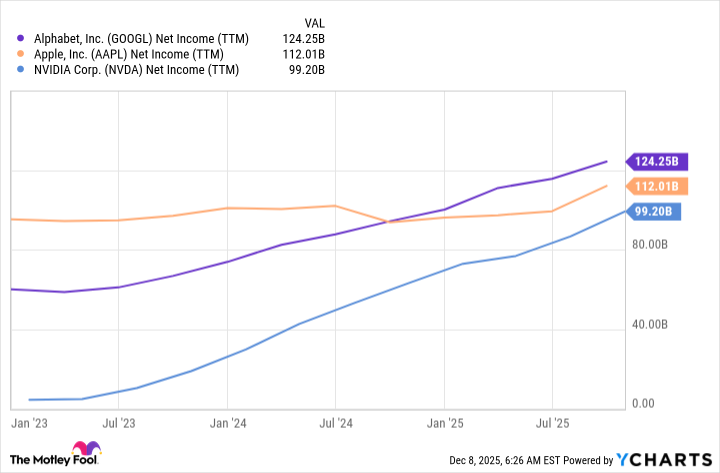

Currently, Nvidia (NVDA 0.16%) is the world's largest company, and Apple (AAPL +0.79%) isn't far behind at a $4.44 trillion and $4.14 trillion market cap, respectively. Alphabet holds a $3.9 trillion market cap, so it's close. And if investors were giving each stock the same valuation based on the company's bottom line, Alphabet would be the largest company in the world because it produces the most net income.

GOOGL Net Income (TTM) data by YCharts

For Alphabet to keep gaining, it's going to need to continue growing earnings at a rapid pace. Fortunately, it has several ways to do that.

Alphabet's primary business is its Google Search engine, which gets its revenue from ads. Advertising is strong right now, and even a legacy business like Google Search delivered 15% growth during Q3. Google Search was the target of a monopoly case earlier this year, but it received a resolution in September that kept it from being broken up, which ignited a huge rally. While Google Search isn't going to deliver blazing fast growth, solid, mid- to double-digit growth is all investors want.

Another area where Alphabet is seeing success is its generative AI offering. While Alphabet was a bit of a laughingstock in the artificial intelligence arms race at the start, it has since made up ground and has reportedly caused OpenAI, the maker of ChatGPT and the current industry leader, to declare "code red" because Alphabet is threatening to take over its lead. That's a big deal and shows that Alphabet's Gemini model may be the best horse to back in this race.

NASDAQ: GOOGL

Key Data Points

Powering Alphabet's AI workloads and others is its cloud computing division, Google Cloud. Cloud computing has benefited massively from AI buildouts, as few companies have the resources necessary to build out their own AI-focused data centers. Instead, tech giants like Alphabet build excess capacity and rent it to cloud computing clients. Google Cloud has been a huge boost to Alphabet's growth rate, with its revenue rising 34% year over year in Q3. Additionally, its profitability is improving, with its operating margin increased from 17% in last year's Q3 to 24% this year. The cloud computing industry is expected to rapidly expand for several years, powered by AI and non-AI workloads alike.

These are all existing business units that are thriving, but Alphabet may have more up its sleeve.

Alphabet's computing products could be a new division

Alphabet has its own computing chips that it uses in-house: Tensor Processing Units (TPUs). These computing units are not intended to replace graphics processing units (GPUs) from Nvidia (NVDA 0.16%), but they do supplement them. TPUs excel when the workload is properly configured. In these instances, a TPU reportedly outperforms Nvidia's GPUs at a lower price point. The only way for clients to access these units was to rent them through Google Cloud, but that could be changing.

Alphabet and Meta Platforms (META +10.28%) are reportedly in talks to sell TPUs to Meta, which could launch a brand-new revenue stream for Alphabet that could help push its stock price up.

Alphabet is also heavily investing in the future of advanced computing through its quantum computing endeavors. While we're likely still several years away from useful quantum computing, Alphabet is already making waves in the industry by running the first verifiable algorithm on its Willow chip. That's a big deal, and it could secure Alphabet's place in the computing market of the future.

Alphabet is excelling on all fronts and makes for an exciting AI investment. If these results carry into 2026 and beyond, I have no doubt that Alphabet could continue leading the market higher.