The "Magnificent Seven" stocks have dominated the market and the financial news cycle for several years. These large tech companies, which generate tremendous free cash flow and profits, are also viewed as the largest potential beneficiaries of artificial intelligence (AI), a new technology that some experts believe will revolutionize everything.

All of these stocks now have market caps exceeding $1 trillion and collectively account for over a third of the broader benchmark S&P 500 index. While there are many other impressive AI stocks, this group garners the majority of investor interest. Here are the Magnificent Seven winners and losers in 2025, and which are well positioned heading into next year.

Image source: Getty Images.

Winners and losers of 2025

Regardless of their AI capabilities and capital expenditures (capex), all companies in the Magnificent Seven were taken aback when President Donald Trump announced strikingly high tariffs on most of the country's major trading partners. The market initially tanked but then quickly recovered after being able to digest some of the tariff news and because inflation hasn't surged as many had expected, at least not yet.

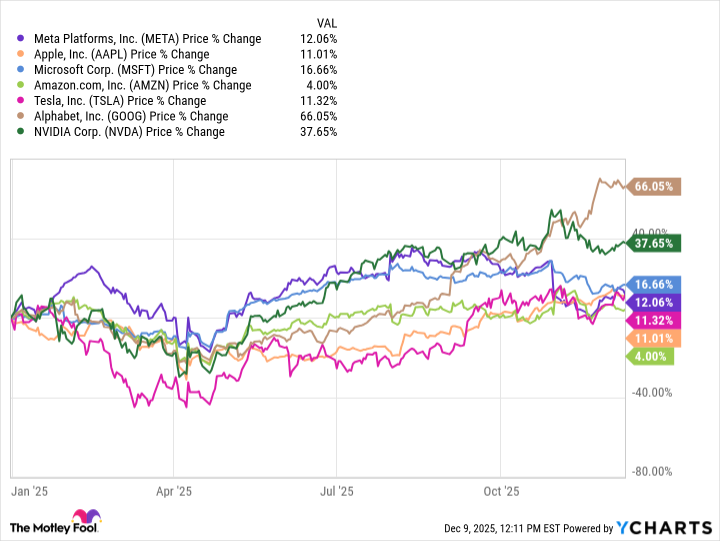

The market is poised to post another strong year of returns, but a closer look at the year-to-date performance of the Magnificent Seven below suggests that tariffs may still be weighing on some members of this group. Apple (AAPL +0.62%) and Amazon (AMZN 1.02%) have underperformed, and both are heavily impacted by tariffs.

Apple manufactures many of its popular consumer products, such as the iPhone, in China, although it has started to shift more of its production to India and Vietnam. Many of Amazon's products are sourced from abroad, and several of its third-party sellers are based there.

Meanwhile, Alphabet (GOOG 0.02%)(GOOGL 0.05%) and Nvidia (NVDA 0.72%) have outperformed this year. Investors have broadly viewed Alphabet as the value play in the group. The company operates many strong business lines, but for several years has failed to unlock much of the value that shareholders and analysts believed possible.

Alphabet also faced pressure due to the U.S. Department of Justice's blockbuster lawsuit, which alleged that the company employed monopolistic practices in its core search and digital advertising business.

A federal judge sided with the Justice Department, but he failed to impose the harsh punishments that would have significantly harmed the company, such as requiring Alphabet to divest its Chrome business, which the Justice Department had requested.

Alphabet has also shaken off concerns about AI chatbots like OpenAI's ChatGPT, which many feared would take a significant share of the search market. While ChatGPT remains a threat, investors are more confident about Google's position following the release of several AI features.

Tariffs also challenged Nvidia, as did export restrictions imposed by the U.S. government, hurting the company's business in China. However, strong earnings and indications of AI demand, coupled with easing geopolitical tensions and the Trump administration's willingness to work with the company, have contributed to the stock's rebound.

Which are in a good position for 2026?

It's certainly possible that all stocks in the Magnificent Seven live and die in 2026 by how investor sentiment toward AI shapes up. Many of these names have seen their stocks surge due to the technology and have also planned to invest tens of billions, if not hundreds, into capex for AI infrastructure.

However, individually, I think Apple may be attractive for several reasons. Investors have criticized the company for not having a strong enough AI strategy, but in recent months, this has turned into an advantage of sorts, as investors have questioned all of the AI capex, which management hasn't been nearly as aggressive with.

NASDAQ: AAPL

Key Data Points

Therefore, the stock can potentially perform well if AI sentiment sours, because it has less to lose. However, analysts expect Apple to potentially invest further into AI, so if this happens, the stock could also gain if investors see an improved strategic road map.

Others that are somewhat well positioned include Microsoft (MSFT 0.83%), Amazon, Alphabet, and Meta Platforms (META 2.95%). These are slightly safer AI stocks, since they operate many other successful businesses in addition to ones that are AI related. If there is a deep sell-off in AI, I still expect these companies to be able to navigate the difficult environment and maintain dominant positions in future decades.

I view Nvidia as a bit of a boom-or-bust proposition in 2026, depending on AI sentiment. If it is strong, the stock will likely outperform, but it could also have the most to lose if sentiment sours.

Lastly, I would avoid Tesla (TSLA +3.38%), which, in my view, trades at far too rich a valuation, because the risk-reward proposition is no longer favorable.