Nasdaq-listed stocks tend to be tech-focused and have risen to become the largest companies in the world. Eight of the 10 largest are listed on the Nasdaq, and it's a great place to look for stocks that are primed for outperformance.

The new year is nearly here, and I have three Nasdaq stocks that look primed to soar: Alphabet (GOOG 0.02%) (GOOGL 0.05%), Meta Platforms (META 2.96%), and Nvidia (NVDA 0.72%).

Image source: Getty Images.

Alphabet

Alphabet has caught fire in the second half of 2025. Since July 1, the stock has risen more than 75%.

Its strength is due to multiple factors, including winning a court case claiming it is a monopoly, launching an industry-leading generative artificial intelligence (AI) model, and potentially selling its custom AI computing unit on the open market. All of these are significant developments and position Alphabet well for 2026, despite its strong performance in 2025.

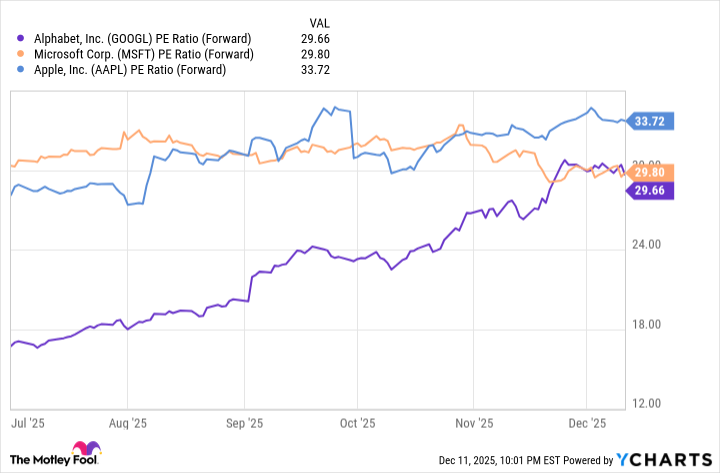

Before this rise, Alphabet was consistently the cheapest big tech stock. However, its valuation has risen, and it now trades for 30 times forward earnings.

GOOGL PE Ratio (Forward) data by YCharts; PE = price to earnings.

That is a bit pricey for Alphabet's stock, but it's about the same price you would pay to own Microsoft or Apple. Alphabet's results have been better than those of both companies, so it's not a premium over its peers; it's just trading at higher levels than it previously has.

Next year looks promising for Alphabet as its leading generative AI model begins to be integrated into various products and platforms. We'll see what effect this has on its finances, but I think it is well-positioned to maintain its dominance in 2026, making it a great Nasdaq stock to buy now.

Meta Platforms

If you liked Alphabet's third-quarter results (with revenue up 16%), then you'll love Meta's. Its revenue rose an outstanding 26% year over year, thanks to AI integration on its platforms, which caused users to spend more time on its various social media apps like Facebook, Instagram, and Threads.

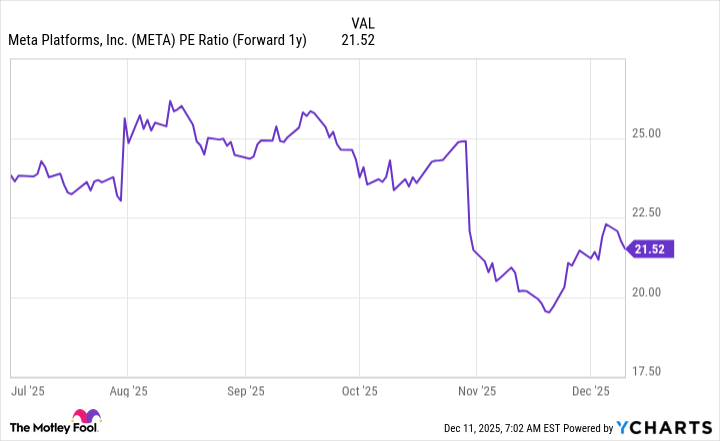

However, its capital expenditure (capex) guidance for 2026 spooked investors, causing several to head for the exits. The stock is about 20% down from its all-time high as a result, but it appears to be a huge bargain at these levels.

After its tumble, it now trades for 21.5 times 2026 earnings.

META PE Ratio (Forward 1y) data by YCharts.

That's a far cheaper price than you'll pay for many of the AI hyperscalers listed on the Nasdaq, making it nearly a value play at this point. I think Meta is in a good position for the future, and patient investors can buy this beaten-down stock in expectation of a solid 2026.

Nvidia

Nvidia has been one of the best-performing Nasdaq stocks for multiple years in a row, thanks to the AI boom. The company provides leading graphics processing units (GPUs) and a technology stack to support them. Nvidia's revenue growth has been nothing short of huge, and 2026 looks to bring more of the same.

For fiscal year 2026 (ending next month), Wall Street analysts expect Nvidia's revenue to rise about 63%. For fiscal 2027 (ending January 2027), they expect another round of 48% growth.

NASDAQ: NVDA

Key Data Points

That's unbelievable considering the company's size, but it could be just another year in a series of similar growth rates. Management expects global data center capex to rise to $3 trillion to $4 trillion by 2030, up from $600 billion in 2025.

That indicates strength over the next few years, and 2026 could mark the beginning of an even more significant rise for the stock. The AI spending spree isn't slowing down anytime soon, so investors need to ensure they have a healthy amount of Nvidia stock in their portfolio to capitalize on one of the biggest technological shifts we've ever seen.